China not losing its global market share anytime soon

Though China’s growing appetite and demand for international luxury is known globally, but what is often overlooked is the fact that many Chinese brands are taking advantage of the country’s advanced manufacturing sector by balancing high production standards with relatively low costs. According to the data released by The Economist, over the past 25 years, China’s share of global manufacturing output has risen from 3 per cent to nearly 25 per cent by value, and if the supply chains that Chinese firms drive across other parts of Asia are taken into account, then the figure rises to nearly 50 per cent. But when it comes to the global fashion manufacturing output, China’s share is even greater. Currently, producing 60 per cent of the world’s shoes and exporting 43 per cent of the world’s clothing, China is indispensable for designers, brands and retailers across the globe from fast fashion to luxury.

Though China’s growing appetite and demand for international luxury is known globally, but what is often overlooked is the fact that many Chinese brands are taking advantage of the country’s advanced manufacturing sector by balancing high production standards with relatively low costs. According to the data released by The Economist, over the past 25 years, China’s share of global manufacturing output has risen from 3 per cent to nearly 25 per cent by value, and if the supply chains that Chinese firms drive across other parts of Asia are taken into account, then the figure rises to nearly 50 per cent. But when it comes to the global fashion manufacturing output, China’s share is even greater. Currently, producing 60 per cent of the world’s shoes and exporting 43 per cent of the world’s clothing, China is indispensable for designers, brands and retailers across the globe from fast fashion to luxury.

Essentials

According to CEIC Analysts, apart from the shock caused by the financial crisis in 2007-08, one reason behind the decline is that after years of the economy sky-rocketing, the wages of Chinese garment workers have doubled, resulting in higher costs of production.

Currently, there is a wealth of local talent whose design labels are being offered by e-tailers such as Shangpin.com, which is the largest luxury and fast-fashion online shopping platform in China, offering collections from almost 80 Chinese brands and is also the first fashion retailer selling authorized in-season designer collection of partner brands in China. The success of the e-tailer is mostly because the designers selling on the site have travelled, explored and studied globally, which has enabled them to evolve at a phenomenally fast pace. Also, it helps to have easy access to the top-quality manufacturers locally meeting international standards and delivering under tight deadlines at affordable prices. Moreover, these designers incorporate subtle or distinctive Chinese elements into their prints, something that the Chinese consumers can identify as a cultural reference.

When local culture is entwined with international standards, the results are powerful, especially when the quality and the right pricing are attractive to local consumers, in comparison to the likes of Gucci or Prada. The local production is an added advantage, not only on price, but on delivery also. Pricing for a special dress or suit, by high-end local designers on Shangpin.com, would typically be anywhere between US $ 300-600, a few having the options of next day delivery as well. Increasingly ‘Made in China’ designers are becoming popular with Chinese fashion-conscious consumers who often look out for standout fashion and with limited number of pieces among these local brands, it leave little room for it being ‘mass’ rather than ‘class’, assuring exclusivity.

When local culture is entwined with international standards, the results are powerful, especially when the quality and the right pricing are attractive to local consumers, in comparison to the likes of Gucci or Prada. The local production is an added advantage, not only on price, but on delivery also. Pricing for a special dress or suit, by high-end local designers on Shangpin.com, would typically be anywhere between US $ 300-600, a few having the options of next day delivery as well. Increasingly ‘Made in China’ designers are becoming popular with Chinese fashion-conscious consumers who often look out for standout fashion and with limited number of pieces among these local brands, it leave little room for it being ‘mass’ rather than ‘class’, assuring exclusivity.

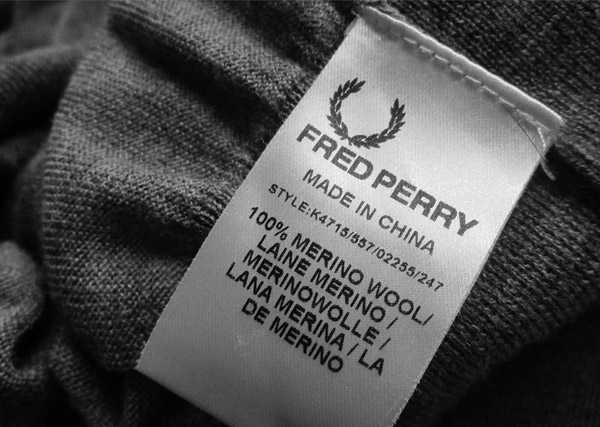

Apart from this local thrust, the ‘Made in China’ label can be found in every American and European’s closet giving impetus to China’s growing wealth. However much the world may want to move away from the country in manufacturing, there are very few options available where the same standards in quality and quantity can be offered. The GDP per capita of China in 2015 was more than 16 times of that in 1980 as China has been producing labour-intensive products and selling them to the rest of the world since the 1970s, and increasingly so in successive decades, gaining market share. Today, luxury brands such as Burberry, Armani, and Prada manufacture in China not just because it is cheap but also because they are still able to get good workmanship for the price. In fact, a lot of international brands still continue to source from China despite increasing prices due to their experiential labour force.

Nevertheless, like other manufacturing sectors, China’s apparel, footwear and textile industry is currently facing challenges such as higher production costs and rising wages as competition from cheaper sourcing hubs in Asia and Africa and a global economic crisis loom over. At a time when the Chinese Government is introducing policies to tilt the economy, from manufacturing to services and creating a tougher regulatory environment, there is no doubt that China’s fashion manufacturing sector is under pressure. According to CEIC Data, some large clothing retailers with global coverage have shifted a portion of their production to Bangladesh and have gradually reduced their use of Chinese factories. In some cases, it is the Chinese contractor who is taking their know-how and partnering with firms elsewhere in order to retain the business of the big international clothing brands. In other cases, international retailers are finding the Bangladesh firms themselves and building new relationships; relationships that for decades united American clothing companies with the Chinese.

Nevertheless, like other manufacturing sectors, China’s apparel, footwear and textile industry is currently facing challenges such as higher production costs and rising wages as competition from cheaper sourcing hubs in Asia and Africa and a global economic crisis loom over. At a time when the Chinese Government is introducing policies to tilt the economy, from manufacturing to services and creating a tougher regulatory environment, there is no doubt that China’s fashion manufacturing sector is under pressure. According to CEIC Data, some large clothing retailers with global coverage have shifted a portion of their production to Bangladesh and have gradually reduced their use of Chinese factories. In some cases, it is the Chinese contractor who is taking their know-how and partnering with firms elsewhere in order to retain the business of the big international clothing brands. In other cases, international retailers are finding the Bangladesh firms themselves and building new relationships; relationships that for decades united American clothing companies with the Chinese.

Essentials

Today, luxury brands such as Burberry, Armani, and Prada manufacture in China not just because it is cheap but also because they are still able to get good workmanship for the price. In fact, a lot of international brands still continue to source from China despite increasing prices due to their experiential labour force.

Meanwhile, even as the Chinese labour force has stepped up on productivity and skill level to compete in other industries, there is a growing push towards other areas apart from fashion manufacturing. This means that better productivity gains and automation in Chinese factories is leading to China gradually shifting its focus from making Nikes and Ralph Lauren polo shirts, to making iPhones and laptops. But nonetheless with a new breed of well-informed designers that are making their foray in the local arena and also the already well-trained labour workforce, it is surely making it irresistible for many retailers to produce in China despite challenges such as increasing manufacturing costs.