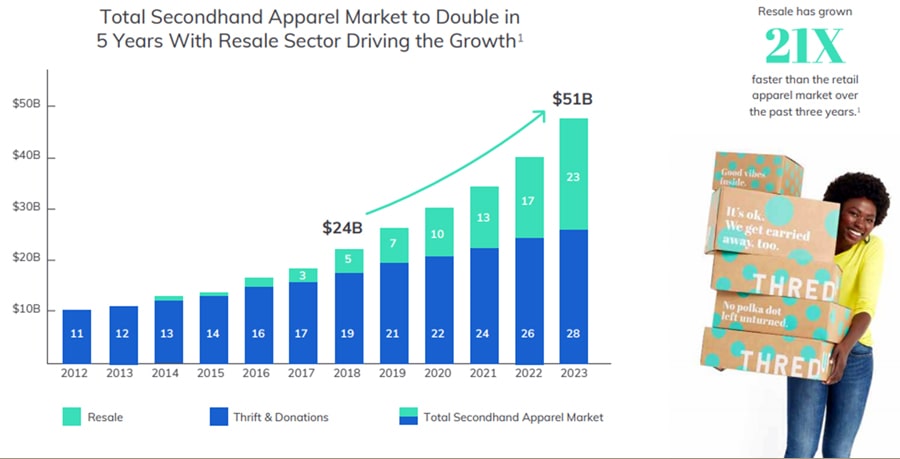

The second-hand apparel retail industry is booming rapidly and is expected to surpass the fast fashion industry in the coming few years. In the present age, when the consumers are seeking variety and value, second-hand, subscription and rental are the top three fastest growing retail categories. A recent report by thredUP, an online resale shopping platform, with the research and data from GlobalData, a third party research and analytics firm, shows that the second-hand industry – currently worth US $ 24 billion – is expected to double in the next five years to US $ 51 billion.

“The resale customer is no longer somebody else’s customer, rather they are everybody’s customer. Mass market or luxury, if people can find a high-quality product at much cheaper rate, they’ll unabashedly choose a used product. As the line between new and used apparel blurs for consumers, a powerful transformation in retail will unfold,” the report claims. The growth in the resale market is majorly from the online resale sector. And while the traditional frugality store market is growing by 8 per cent annually, the online resale market is marching upward more than four times faster at 35 per cent a year, and which is 17 times faster than the broader apparel market overall. Simultaneously, over the past three years, resale has grown 21 times faster than apparel retail. As a result, even traditional retailers have started embracing second-hand apparels.

Marching upward

The resale industry has attracted all the age groups, but millennials and Gen Z thrive the most, especially women over 65 and between 18 and 24 age groups. Both the groups are motivated by the savings but the younger group is almost 2.5 times quicker than other age groups and may be influenced by environmental consciousness while shopping for second-hand clothes. Also, the stigma associated with the used clothes has disappeared and a growing number of shoppers are now enthusiastic to buy second-hand apparels. More than one in every three Gen Z will buy secondhand clothing in 2019. Overall, 64 per cent of women have committed that they’re willing to buy used apparel, shoes and accessories, compared to 45 per cent in 2016.

The report also shows that more than half of these shoppers have shopped second-hand in the past one year and will be shopping in future as well. Over 40 per cent of consumers also confessed that they consider the resale cost of an item before purchasing something new. The shoppers with the highest likelihood to shop secondhand are those with income above US $ 1,25,000. Seventy-seven per cent of thredUP’s customers are working professionals and 71 per cent own their own home. These customers are twice likely to shop second-hand online than opting to buy new products online. Apart from this, there are other reasons for the recent rise of resale apparel business. One is the environmental benefits and the other is the desire for frequent turnover of wardrobes, especially among the Instagram generation. Like thredUP lists 30,000 new items every single day, which are 150 times more than H&M.

“Compared to the overall apparel market, resale’s growth has been phenomenal. As the market uniquely meets consumers’ preference for variety, value and sustainability, we expect the high growth to continue,” stated Neil Saunders, GlobalData Managing Director & Lead Market Analyst for thredUP’s Resale Report.

Second-hand market will reach US $ 51 billion in 5 years

With the robust growth, almost 9 in 10 retail executives desire to get into the resale apparel business by 2020. Over 96 per cent of senior retail executives are willing to advance their company’s circular fashion efforts by the next year. As these senior retail executives believe the market has a great potential to boost revenue, site traffic, along with customer loyalty and sustainability, the customers of the future will look for ways to recycle, resell or upcycle and will be drawn to the incredible value of buying secondhand and brands will need to partner with resale sites and support the circular economy.

The challenges…

Despite the upscale, the challenges are many, as the business promises a lot of uncertainties. The financial statements of a number of secondhand clothes stores are not that attractive. Obviously, the store rents are reasonably high and the quality of products and price points which can get overpriced or underpriced, become a challenge.

The online businesses like thredUp, Material World, TheRealReal, Poshmark and many others, on the other hand, are charming consumers away from many other channels. But the value proposition and experience they offer is more like off-price than any other retail channel; the fun is in the hunt for great stuff at the lowest price. The thredUP report claims that TJ Maxx sells 359 brands, Amazon sells 10,000 brands and thredUp sells 35,000 brands. The value proposition for second-hand is bigger, as the discount from list price is more than in off-price, which for many consumers is highly compelling.”

Growth in off-price would be higher if the off-price retailers would get into the second-hand business. It’s a sensible expansion or acquisition strategy for them as they understand what the customer wants and how to market that to them, but as off now, these companies too have no response to the growth of the second-hand online apparel sales, which will impact their market share.

On the other hand, the online retail leader Amazon also does not have the capacity and system to evaluate each and every garment’s price so as to effectively compete with the sector right now. Even eBay that used to sell second-hand products earlier has now moved away from the segment and almost 80 per cent of the products sold on the site are new.

As the market for online second-hand grows, there will be more companies that are threatened. Macy’s has expanded its effort in off-price and Nordstrom Rack and Neiman’s are putting more effort into it too. As companies in larger number enter the off-price market, they will be affected by the increased competition and the new business models like thredUP that are taking up the market share.