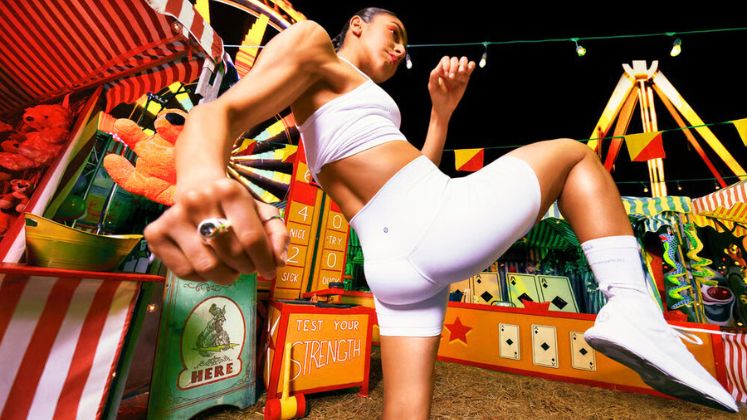

Lululemon Athletica shares fell as much as 21 per cent on Friday after the athleisure behemoth warned that increased tariffs and declining consumer demand in North America and China will compress profits this year. The steep fall placed the stock on course for its biggest single-day decline since the pandemic’s early stages in March 2020, erasing close to US $ 8 billion in market capitalisation.

The Canadian retailer, famous for its cult-status Align yoga pants, said it will roll out modest price increases on a limited number of products while adding promotional activity across much of its line to offset weakening demand.

Even as it has introduced new models of sports bras and performance jackets, Lululemon has been unable to keep up with a fast-changing marketplace, losing ground to cheaper, fashion-conscious rivals in key markets. “Even as demand in the Americas has softened, management remains product innovation-focused and committed to the Chinese expansion—potentially at the cost of mitigating back-off from core consumers,” Jefferies analyst Randal Konik wrote, labeling the company’s strategy as “misaligned.”

The prognosis worsened as Lululemon cut its 2025 profit estimate, attributing anticipated margin declines to planned US tariffs that will target products from large manufacturing hubs in Vietnam, Cambodia, and Sri Lanka. The policy uncertainty—following unresolved trade tensions that began during Donald Trump’s presidency—added to anxieties of an economy-wide slowdown.