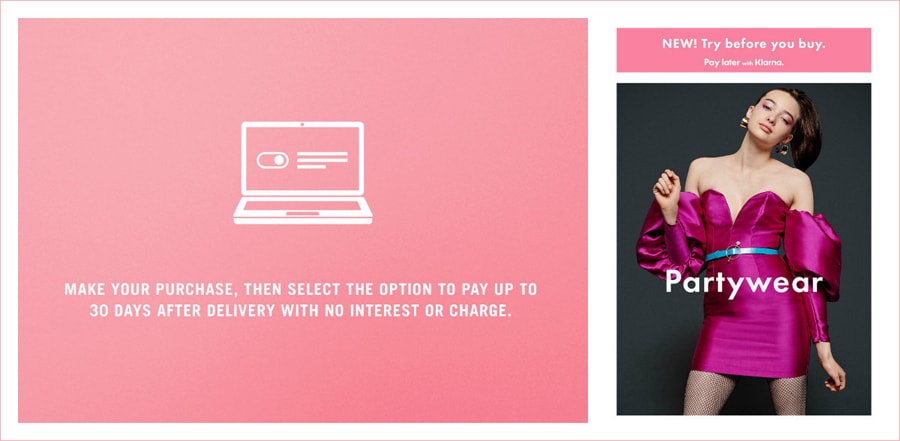

Welcome to no credit agreements, no interest charges and no hidden fees – ‘Try Now Pay Later’ is the latest buzz in the industry.

Retailers like Amazon and Arcadia signed up to a similar service earlier this year, and the latest to jump on the bandwagon with Klarna include ASOS, Topshop, Miss Selfridge, Dorothy Perkins and Topman, to name a few.

The rise of e-commerce has got major companies and brands thinking about what to offer next; how to engage more consumers; and how to keep them hooked… Among the hiatus, emerges a concept called ‘Try Now Pay Later’ that has been in business for the past 10 years and is now giving credit card companies a run for their money.

Stockholm-based Klarna is a unique digital payment method that allows you to buy now and pay later, and an increasing number of fashion e-commerce sites are adopting the strategy owing to the ease of access and success rates involved.

The payment service works on a simple principle wherein the consumer gets 30 days to decide on an item they have purchased and return the unwanted items by using a slew of options such as Visa, PayPal or Amex.

Klarna aims to dismantle the one-click purchase experience Amazon has become famous for and introduce it to other retailers. The service cuts down on the checkout process by requiring minimum information; consumers only need to provide their e-mail and zip code, and voila! – the purchase is complete.

In a world where the consumer is spoilt for choice and offers lure you from every side, it is a challenge to attract and keep a customer loyal. Not being able to try on items before purchasing them has long been a challenge faced by the world of e-commerce and services such as the ones offered by Amazon and Klarna aim to change just that.

Online retailers are required to allow up to 14 days for a customer to change his/her mind, return items and make a full refund. This triggers a relationship with the customers wherein mutual trust is evoked.

The best scenarios this service addresses are when a consumer is confused between two sizes or colour combinations, wherein the 30-day grace period serves as an ample time frame for the consumer to make his/her decision.

Not having to pay for products right away could urge consumers to spend more time browsing through clothes they might not have considered and in turn encourage them to order more without having to worry to foot hefty bills, which relatively increase the chances of them keeping the product once it arrives.

The idea that you can buy clothes, try them on in the comfort of your home and still return them without paying anything is a shopaholic’s dream come true.