The industry seems to be obsessed with the word ‘Industry 4.0’, whether or not they really understand what it implies. In fact, many feel that it makes them appear updated and ready for the future. Practically, every technology supplier has now adopted the term ‘Industry 4.0’ in their catalogue and/or promotional material, with most having no idea what is it all about!

While some are just playing with words that are trending like ‘Textile 4.0’, ‘Apparel 4.0’ ‘Fashion 4.0’, some players have actually gone deep to integrate the true concept of ‘Industry 4.0’ with HR, with sustainability, with lean and all forms of operational excellence. A country obsessed with MBAs obviously loves playing with jargons and it is not surprising that newer jargons sprung up without much substance. Some even have started toying with ‘Industry 5.0’ to stay ahead of the competition.

The fact is that organisations started departments and job descriptions around ‘Industry 4.0’, acknowledging the omnipresence of the concept and sometimes for a show off or feed-good factor. Acknowledging the importance of the same, Shahi Exports, India’s largest apparel manufacturer took concrete step by setting up Industry chair at NIFT, Delhi during the year 2019 with clear emphasis to conduct research on the emerging technologies that are likely to disrupt the apparel manufacturing industry. While such research output will explore the ‘Industry 4.0’ applications and will create a roadmap for the industry in short and medium term, NIFT has also geared up by including ‘smart factory’ specialisations in its Master’s program to produce trained manpower to serve the organisations looking forward to ‘Industry 4.0’ solutions.

‘Industry 4.0’ or the fourth industrial revolution was first introduced by a team of scientists developing a high-tech strategy for the German government. It involves automation and data exchange in manufacturing technologies, including cyber-physical systems, the Internet of things, cloud computing and cognitive computing, additive manufacturing, augmented & virtual reality and creating the smart factory.

Going deep into what really constitutes a movement into ‘Industry 4.0’, Dr. Prabir Jana, Shahi Chair Professor, ‘Industry 4.0’, discusses about the technological challenges that are likely to be faced in short and medium term by the early adopters of smart factory in South East Asian countries. Let’s take a stock of technologies that will play vital role in implementing ‘Industry 4.0’ solutions in apparel manufacturing. We need to acknowledge the fact that readymade off-the-self ‘Industry 4.0’ solutions for apparel manufacturing will take another 5-7 years to debut. Till then all the solutions will be driven by in-house R&D by large manufacturing organisations, or technology consulting companies or new start-ups.

According to industry estimates, the ’Industry 4.0’ market is projected to grow from US $ 64.9 billion in 2021 to US $ 165.5 billion by 2026, i.e. at a CAGR of 20.6 per cent. Another estimate puts the smart factory market size at US $ 134.9 billion by 2026 at a CAGR of 11.0 per cent. Although ‘Industry 4.0’ and Smart Factory are often used interchangeably, the former’s potential is undoubtedly brighter. It is difficult to predict how much of these market will be sized by apparel manufacturing, but according to adoption rate of ‘Industry 4.0’ by different industries, textile and apparel does figure in top 10 industries. The data also shows that North America and Europe are leading ‘Industry 4.0’ in terms of geographies but unfortunately the bulk of global apparel manufacturing happens in Asia. Therefore adoption is likely to be slow.

The fact that as many as 1260 persons were registered for Joachim Hench’s webinar on Smart Factory – Smarter Leaders, is testimony to the hype and excitement about ‘Industry 4.0’ or smart factory among the apparel industry enthusiasts across the world.

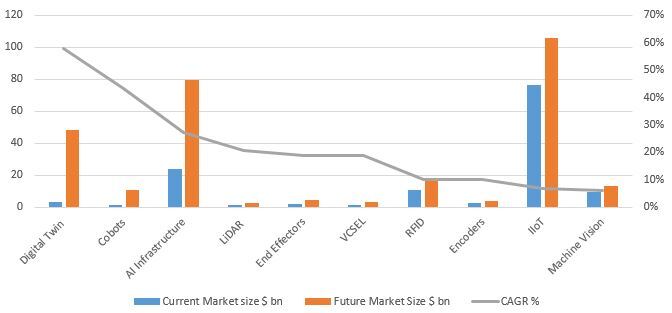

The basic blocks for creating ‘Industry 4.0’ solutions are AI Infrastructure, IIoTs, Machine Vision systems, Encoders, Cobots, End Effectors and Digital Twin. If we look at the market projections of these individual technologies in next 5 years, it is interesting to see how important are these and where we stand.

AI Infrastructure

This technology can be divided into hardware and software. The hardware segment can be sub-segmented into processor, memory, storage and networking (switches, routers and other equipment used to link servers in the cloud and connect edge devices). While NVIDIA (US), Intel (US), Micron (US), Xilinx (US), Google (US), Samsung (South Korea) and Graphcore (UK) are some of the companies that develop hardware needed for AI, software needs will be fulfilled by Google, Microsoft, Amazon Web Services, IBM, etc. Consultants and system integrators will combine the hardware and software based on technology types (Machine learning, deep learning), functions (Training, Inference) and deployment types (On-Premises, Cloud) to complete their offerings. AI infrastructure market is expected to grow from US $ 23.7 billion in 2021 to US $ 79.3 billion by 2026, at a CAGR of 27.3 per cent.

Industrial Internet of Things (IIoT)

This is one of the blue-eyed technology components of ‘Industry 4.0’ and probably holds the highest potential in smart factory applications. IIoT can help in Quality Control, Inventory Management, Predictive Maintenance, More Safety in Operations, Smart Metering and Smart Packaging. IIoT building blocks consist of perception layer, transport layer, processing layer and application layer. While the perception layer is mainly the hardware part, the other three layers consist of the software component. The perception layer consists of ‘smart things’ like sensors that collect and convert analog signals into digital data and vice versa. The connectivity layer transfers data from the physical layer to the cloud and vice versa via networks and gateways. The processing layer employs IoT platforms to accumulate and manage all data streams and the application layer delivers solutions like analytics, reporting and device control to end users. Major players in the market are Huawei (China), Cisco (US), GE (US), Intel (US), Rockwell Automation (US), ABB (Switzerland), Texas Instruments (US), Honeywell (US), IBM (US), to name a few. The global IIoT market size is expected to grow from US $ 76.7 billion in 2021 to US $ 106.1 billion by 2026, at a CAGR of 6.7 per cent.

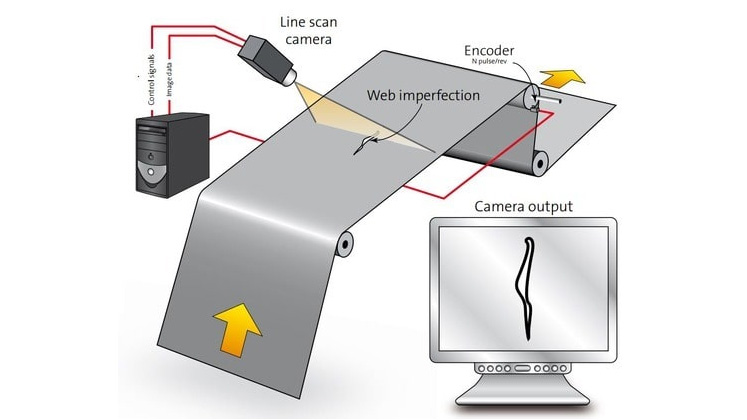

Machine Vision

This is another important technology component in the ‘Industry 4.0’ ecosystem. The major driving factor in the machine vision market is the increasing need for quality inspection and automation. The integration of AI in industrial machine vision software is expected to fuel the growth of the industrial machine vision market for software during the forecasted period as deep learning enables machines to recognise objects. Also, deep learning-based machine vision software helps in minimising human intervention and provides a real-time solution by distinguishing the acceptable variations in products and the defects in manufacturing industries.

Though the PC-based machine vision system is currently holding a major share, smart camera-based machine vision systems are likely to dominate in the next few years due to the advancements in technology like IoT integration and upgradability. Major players in the market are Cognex Corporation (US), Basler AG (Germany), Omron Corporation (Japan), Keyence (Japan), National Instruments (US), Sony Corporation (Japan) and Teledyne Technologies (US) to name a few. The global machine vision market size was valued at US $ 9.6 billion in 2020 and is projected to reach US $ 13.0 billion by 2025; it is expected to grow at a CAGR of 6.1 per cent during the forecast period.

Encoders

An encoder is an electro-mechanical feedback device used to give information on position, speed, count or direction in any existing machinery and equipment. It can detect rotation angle or linear displacement. This is an under-reported yet very important device in various smart factory applications. The encoders can be linear or rotary type, can work on Optical, Magnetic or Inductive technology. Encoders provide the critical parameters to the data working in combination with machine vision or IIoT systems. Some of the prominent key players are Sensata Technologies (US), Dynapar Corporation (US), HEIDENHAIN (US). The global Encoder market size is expected to grow from US $ 2.3 billion in 2021 to US $ 3.7 billion by 2026, at a CAGR of 10.0 per cent.

Cobots

Most collaborative robots or Cobots are generally available with payload between 5 kg ~ 15 kg. The hardware consists of robotic arm and end effectors. Cobots are designed to move at the speed of a human arm, which enables them to be deployed safely alongside a human. The average speed of collaborative robots is around 1m/s and they have a reach of upto 1,000 mm. Cobots have to meet certain standards set forth by ANSI, RIA and ISO (ANSI/RIA R15.06-2012 and ISO 10218-1,2:2011), which limit their speed and payload combination to mitigate risk to surrounding workers. The Cobot market is projected to grow from US $ 1.2 billion in 2021 to reach US $ 10.5 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 43.4 per cent and 5-10 kg payload capacity are anticipated to have the fastest growth. Major vendors in the collaborative robot market include Universal Robots (Denmark), ABB (Switzerland), FANUC (Japan), YASKAWA (Japan), Techman Robot (Taiwan), KUKA (Germany), Doosan Robotics (South Korea), Productive Robotics (US), Precise Automation (US), Denso Corporation (Japan).

End Effectors

The importance of this lesser known component of any robot or Cobot is obvious from the fact that its current market size is bigger than Cobots! If robots is equated with the arm of a human being, the end effectors are the fingers, therefore they have a greater significance in an industry segment dealing with soft, tactile dimensionally unstable material like fabric. The end effector market is projected to grow from US $ 1.9 billion in 2021 to US $ 4.4 billion by 2026 at a Compound Annual Growth Rate (CAGR) of 18.8 per cent. Major vendors in the end effector market are Zimmer Group (Germany), Schunk (Germany), Schmalz (Germany), Destaco (US), Festo (Germany), Piab AB (Sweden) Tünkers (Germany), Robotiq (Canada), FIPA (Germany), Wiess Robotics (Germany), ATI (US), Bastian Solutions (US), IPR (Germany), ABB (Switzerland), KUKA (Germany), SMC (Japan), Applied Robotics (Denmark), IAI (Japan), JH Robotics (US), EMI (US), Millibar Robotics (US), RAD (US), Soft Robotics (US), OnRobot (Denmark) and Wyzo (Switzerland).

Digital Twin

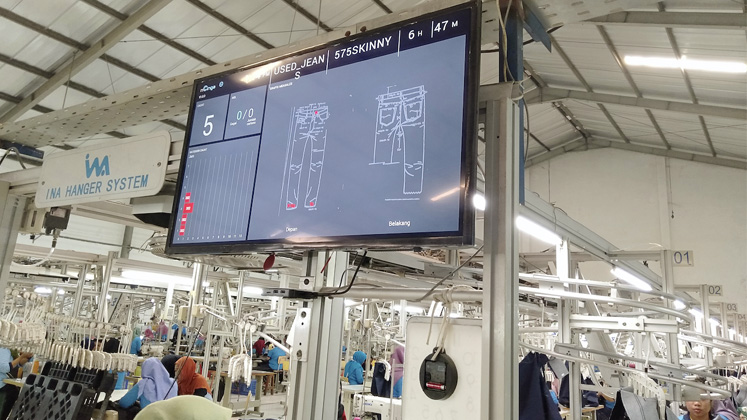

This technology can be applied on products and processes. While Digital Twin of the product (i.e. apparel) is already being adopted by many, the process market is yet to take off. Some of the major players offering solutions on digital twin of product are Tukatech (US), Optitex (Israel), Lectra (France), etc. The Digital Twin process market is currently catered by General Electric (US), IBM (US), PTC (US), Microsoft Corporation (US), Siemens AG (Germany), ANSYS (US), which have a negligible footprint in the apparel industry. Therefore some of the major apparel technology players like Jack Stock (China), Juki (Japan), Brother (Japan), Typical (China), Lectra (France) can play an important role in developing process digital twin market. This market is projected to grow from US $ 3.1 billion in 2020 to US $ 48.2 billion by 2026, at a CAGR of 58 per cent.

Radio Frequency Identification (RFID)

Probably the industry will be able to relate to this technology because of its current use to track merchandise in manufacturing or warehouses. This technology includes tags, readers, softwares and services. The applications are manifold depending on Size, Tag Type (Passive Tags and Active Tags), Frequency, Applications and Form Factor. This market is poised to grow to US $ 17.4 billion by 2026 from US $ 10.7 billion in 2021 at a CAGR of 10.2 per cent. Major players in this market are Avery Dennison (US), Zebra Technologies (US), Honeywell (US), NXP Semiconductors (Netherlands), Impinj (US), HID Global (US), GAO RFID (Canada), Identiv (US), Invengo (China), Nedap (Netherlands) among others.

While the above comprise the key technologies of ‘Industry 4.0’ that will be important for apparel manufacturing applications, few other allied technology segments will also contribute with newer applications imagined in. Some of these are soft-robotics, VCSEL & LiDARS, with significance presence in other industry segments.

Conclusion

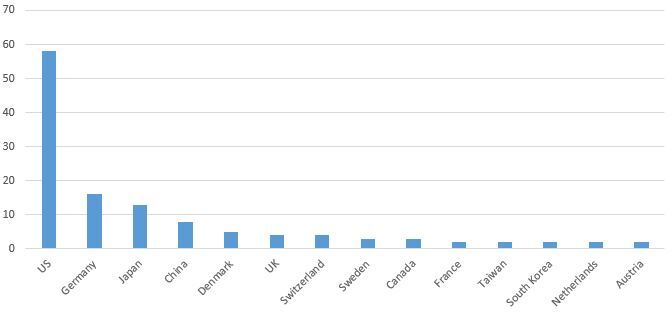

If we look at the global technology suppliers across above technology components, US leads the pack with 47 per cent share followed by Germany (13 per cent) and Japan (10 per cent). Incidentally, China, the current technology leader in apparel technology market stands at a distant 4th position with 6 per cent market share. Although China possesses the capability to replicate any technology, the IP of these new technologies may take some time to begin Asia production. Not to mention, not a single Indian company featured in the list!

Although India’s software prowess is known worldwide (in terms of supplying trained manpower to famed US and Silicon Valley), but still there is no Atmanirbhar software product to boast off. India traditionally is a poor hardware manufacturer, there may be some odd Indian manufacturers that missed the attention, but the picture is clear; our industrial ecosystem is nowhere in a position to technologically support ‘Industry 4.0’ initiative by apparel manufacturers. Secondly the cost of technology will be significantly high for Asian manufacturers, especially the hardware components due to import, duty, installation, support and maintenance.

Thirdly, most of the market survey predicts that APAC will be the next growth driver, that means we will see the return of 1980s . . . US-Europe-Japan will dominate the technology development market and APAC market will remain the consumption market with exception of China becoming the technology assembler.

Last but not the least, if we look at future potential of these technologies, most of these are showing two digit CAGR with maximum up to 58 per cent. IIoT leads the market opportunity followed by AI Infrastructure and Digital Twin. It is high time Government looks into these technologies as high priority sectors and creates some world-class technology companies that will make India truly Atmanirbhar and also bring foreign currency on export.

It is high time Government looks into these ‘Industry 4.0’ technologies as high priority sectors and creates some world-class technology companies that will make India truly Atmanirbhar and also bring foreign currency on export.