The demand for woven products has failed to match that of the knit offerings during the pandemic period. As per data from Bangladesh’s Export Promotion Bureau (EPB), export earnings from knitwear in July-November of FY ’22 increased by 25.91 per cent to US $ 8.98 billion compared to that of US $ 7.13 billion in the same period of FY ’21 while earnings from woven garments export in the five months of FY ’22 increased by 19.32 per cent to US $ 6.87 billion compared to US $ 5.75 billion in the same period of FY ’21.

An integral part of the woven category, did denim suffer the same fate or witnessed a decreased demand?

Market dynamics in favour of Bangladesh!

“…I have not heard if denim is not doing well,” says Arshad Jamal Dipu, Chairman of Tusuka Jeans Limited, speaking to Apparel Resources (AR) while underling denim manufacturers in Bangladesh may have taken a hit on the chin, but that is primarily due to reasons other than the dwindling demand for ‘Made in Bangladesh’ denims.

Despite the fact that the industry and the market both underwent major shake ups on account of the pandemic, the demand for denim products from Bangladesh remained intact or shall we say increased.

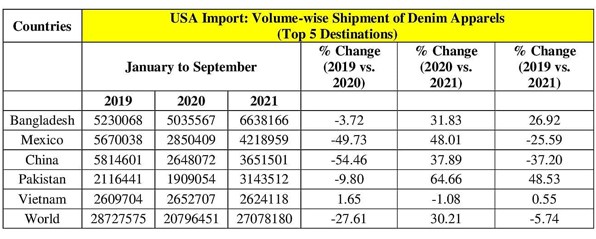

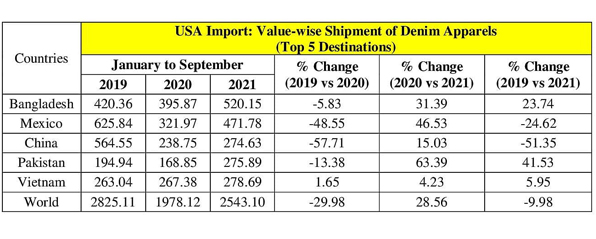

Take for example USA, which is the top garment importer globally. Even if USA’s overall denim apparel import has declined by around 10 per cent in value and 5.74 per cent in quantity with denim buyers changing their sourcing preferences and looking for cheaper destinations — as per data analysis by AR data analysis team, in Jan.-Sep. ’19, unit prices per dozen of the imported denim apparels by USA were US $ 98.26, which shrunk to US $ 95.10 in the same period of 2020 and prices further reduced to US $ 93.95 in the 9-month period of 2021.

This decline of 4.38 per cent in two-year period signals towards the fact that US buyers are now sourcing more of basic jeans and searching for low cost destinations — it has apparently benefited Bangladesh more.

Sample this; Bangladesh, which was way behind Mexico in 2019, has now moved past the Latin American nation in 2021. Mexico, which ships high-fashion denim to USA, witnessed its export declining by around 24.62 per cent in 2021 over 2019, even if at the same time, Bangladesh has seen significant increase of 23.74 per cent in 2021’s first 9-month period, compared to the corresponding period of 2019.

Table 1(All quantities are in dozen)

Source: OTEXACompiled by: Apparel Resources

Table 2 (All values are in US $ million)

Source: OTEXA Compiled by: Apparel Resources

Profitability negates the demand aspect…

Positive market dynamics and export statistics perhaps don’t always portray the correct picture. We can say this at least with respect to Bangladesh, which has not been able to make much of a business gain despite the increased demand for ‘Made in Bangladesh’ denims!

“The increase in cotton prices in the global market has impacted us significantly. Plus there has been a gas price hike by 50 per cent while freight charges have also gone up significantly,” rues the Chairman of Tusuka, indicating towards the fact that even if demand for ‘Made in Bangladesh’ denim jeans has increased, it hasn’t translated into equal business profitability, thanks to faltering profit margins.

The issue of price points is however not restricted to denim makers only and spans across the sector.

“We are receiving adequate number of work orders but there is a fear of the resurgence of the crisis in the supply chain,” stated BGMEA President Faruque Hassan while adding the buyers are paying higher prices because of a hike in raw material prices and freight charges, but the latter have gone up to such an extent that the percentage increase per unit paid by the buyers is not adequate to offset the higher production cost and enable garment makers to make a profit.

For instance, yarn prices increased by 60 per cent, container freight charge from 350 per cent to 500 per cent over the past year, dyes and chemical prices by 40 per cent and electricity by 13 per cent, stated the BGMEA President about increased overhead and operating costs to prove his point.

It’s a different story though that spinners are doing decent business compared to the denim jeans makers as they have reportedly hiked the prices of yarn keeping with the cotton price hike in the international markets.

As per reports, many yarn makers posted a maximum 1000 per cent growth in profit in the 2020-21 financial year even if the profit of Metro Spinning Limited of Maksons Group and Square Textile Limited of Square Group, which are counted amongst the major players in the Bangladesh spinning sector, reportedly increased by 1,100 per cent.

On the other hand, Envoy Textile Limited, which is one of the largest denim manufacturers in Bangladesh, has reportedly lost around 66 per cent of its revenue in the last fiscal year while Evince Textile, another leader in denim manufacturing, has lost 100 per cent of its revenue.

Europe hopes for future growth

Even though latest, authentic data as to how denim from Bangladesh is performing in Europe is yet to come in, industry feelers point towards better days ahead for ‘Made in Bangladesh’ denims in the European market.

The demand for denim products is gradually increasing in European countries, claimed Director of Envoy Textile Tanvir Ahmed. Sharing his viewpoint on the issue of the so-called loss of the Bangladesh denim makers, he further maintained after the Coronavirus-induced shutdowns, spinners were doing business while denim makers’ are waiting to make a strong turn around.

To summarise the views as expressed by the stakeholders, one thing become clear, despite the increasing demand of ‘Made in Bangladesh’ denims, profitability remained a major concern for the denim manufacturers and, all eyes are focused on how things would pan out in the coming days, with focus being on Europe now!