Global awareness about sustainability is growing, and although progress is slow, it is steadily gaining momentum. The textile industry, as a major polluter with its entire supply chain, is now leading the way in prioritising sustainability—adopting eco-friendly materials, reducing waste and minimising carbon footprint. This progress is particularly crucial as around 70 per cent of fashion industry emissions stem from upstream activities like material production and processing. These efforts are transforming production practices and reshaping both consumer expectations and market trends.

As the industry steps up its efforts, the government is also stepping in to offer support through policies that encourage sustainable practices.

After years of talk without follow-through, the Centre is now taking concrete steps by preparing a framework on sustainability for the textile industry with clear deliverables. This framework, being prepared in consultation with the industry, will set short-term and long-term sustainability targets for the sector.

The development comes as western nations’ such as the US, UK and European countries’ have enacted multiple laws on sustainability. For example, the European Union has already introduced its ‘EU Strategy for Sustainable and Circular Textiles’, which encourages all textile products sold across the EU’s 27 member countries to be durable, repairable, recyclable, largely made from recycled fibres, free of hazardous substances and produced in ways that respect social rights and the environment.

Turning Waste into Value

With the textile industry responsible for 1.2 billion tonnes of greenhouse gas emissions and US $ 500 billion in losses from under-recycled clothing each year, experts argue that adopting sustainability measures could unlock a US $ 500 billion market and create significant value.

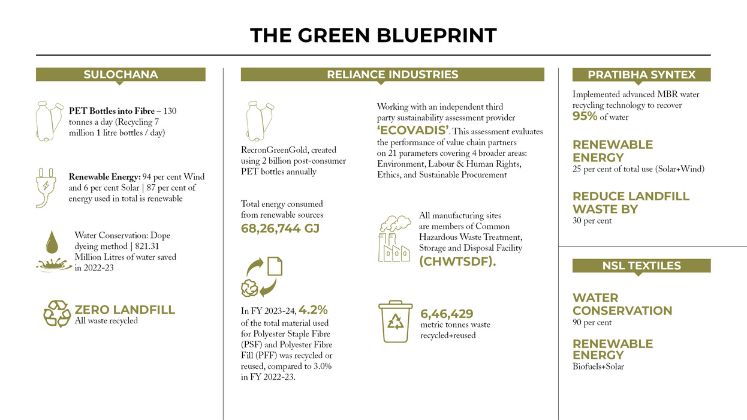

“We have already scaled our recycled fibre capacities. Currently we produce 130 tonnes of recycled polyester fibre and 8 tonnes of recycled cotton fibre,” revealed R. Sabhari Girish, Head of Sustainability, Sulochana Cotton Spinning Mills. The company claims to be the largest producer of melange/marl yarn in India with an installed capacity of 120,000 spindles and 50 tonnes of melange yarn per day. It claims to use GRS-certified Recycled Yarn and all its products are made using 100 per cent post-consumer PET bottles, but since the caps are made of polypropylene, which can’t be turned into fibre, they are instead processed into pellets. These pellets are then supplied to industries that make plastic products. Similarly, labels made from PVC (polyvinyl chloride) are removed and sent to the cement industry, where they are used to generate electricity.

According to Girish, “Recycled yarn is typically made using Open End Spinning. However, six years ago, Sulochana conducted research and development to spin recycled yarn using Ring Spinning, resulting in better hand-feel and greater pilling resistance. Currently, we are able to spin up to 34s with 100 per cent sustainable material (60 per cent Recycled Cotton/40 per cent Recycled Polyester). Our latest achievement is that our initial bulk production has proven we can now spin up to 40s with 100 per cent recycled material.”

He explained that the company mainly works with brands to turn their post-industrial waste into yarn, fabric or garments, based on the brands’ needs. The brands connect them with their vendor factories to collect the waste and they train the factories’ cutting rooms to sort the waste by colour and quality. This way, most of the waste (about 98 per cent) is already sorted when it arrives. The brands also have a good idea of what waste will be available, almost a season in advance, which helps them plan their styles early. For example, for Spring/Summer 2025, they use waste from Fall/Winter 2024. This process helps create a circular story for the brands, as they bring their own waste back into their supply chain.

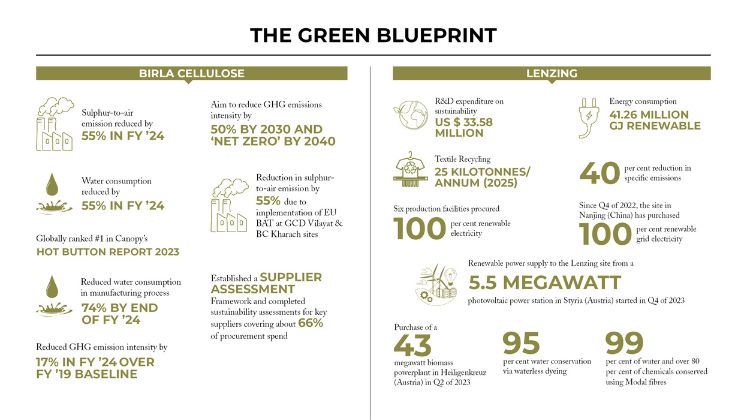

“Innovation has always been the core of Birla Cellulose and we have proved our mark with launch of new innovative fibres like Livaeco, Liva Reviva, functional viscose fibres like Birla SaFR and Birla Intellicolor viscose. Liva Reviva brand overarches our circular fibre product basket and it has been a special innovation as it focuses on utilising textile waste back as feed stock and in the process, there are several other resources’ reduction. We started with 20 per cent waste, we have now launched the fibre with 30 per cent textile waste,” said ManMohan Singh, CMO – Birla Cellulose, Grasim Industries Ltd.

He also stressed that over 110 brands and over 2000 value chain collaborators worldwide are currently using Birla Cellulose’s GreenTrack™ traceability platform which leverages blockchain technology to provide brands with real-time insights into the journey of raw materials from forest to retail store.

Echoing similar sentiment, Rakesh Bali, Sr. VP and Head of Marketing – PetChem Business, Reliance Industries, the largest producer of polyester fibre and yarn in the world, with a capacity of 2.5 million tonnes per annum, shared, “We currently recycle over 2 billion post-consumer PET bottles annually and aim to more than double this to over 5 billion bottles. This initiative produces Recron GreenGold, one of the world’s most sustainable fibres, used in manufacturing R|Elan GreenGold fabrics.”

Sharing his thoughts, Bhavik Shah, BDM – Brands and Corporate, Perfect Filaments Limited conveyed, “There’s an abundant supply of raw materials, thanks to years of accumulated recyclables — materials that were once discarded but can now be repurposed and reused.” Perfect Filaments is a vertically integrated manufacturing facility, specialising in the production of polyester textured yarns, from chips to textured yarn, with colour doping capabilities on 100 per cent POY lines and Special Double Density DTY machines.

The company also uses CiCLO technology, a sustainable textiles ingredient in the form of an additive that is combined with polyester and nylon during melt extrusion at the very beginning of the fibre making process. CiCLO additive creates countless biodegradable spots in the matrix of the plastic, where microbes that naturally exist in certain environments can break down the materials just like they do with natural fibres. The chemistry used to create CiCLO fibres is ECO PASSPORT certified by OEKO-TEX.

Similarly, NSL Textiles, part of the US $ 1 billion conglomerate NSL Group with interests in seeds, infrastructure, power, sugar and textiles, is charting a course for a closed-loop and circular production system to minimise waste.

“We focus on recycling textile waste generated during manufacturing, including fabric scraps, off-cuts and post-consumer waste. Over the next three years, we aim to increase our recycling efforts, targeting a 20 per cent to 30 per cent reduction in waste. This will be achieved by expanding recycling capabilities and improving sorting technologies,” commented Pritam Das, Sr. Executive Compliance, NSL Textiles Ltd. The parent company, Nuzeevidu Seeds Limited, is the largest seed company in India.

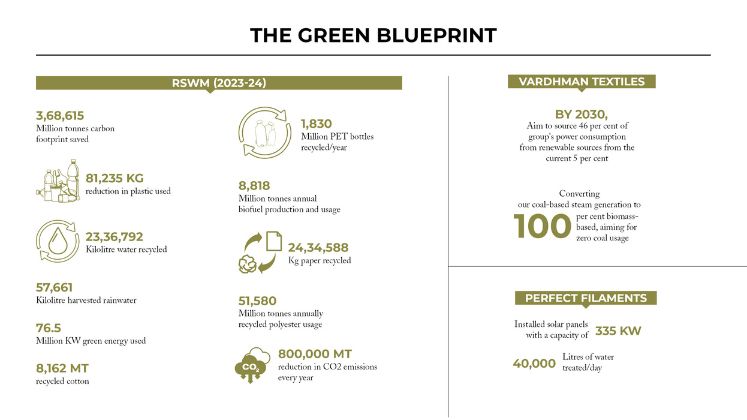

Addressing the plastic waste crisis, RSWM, the flagship company of LNJ Bhilwara Group with a net worth of US $ 1.2 billion and one of the leading manufacturers and exporters of synthetic, cotton and blended spun yarns in India, recycles approximately 1,830 million PET bottles each year, converting them into 51850 MT of recycled polyester fibre. This helps save 368,615.88 MT of carbon emissions.

Fibre green® by RSWM, made from recycled PET bottles, offers a sustainable solution through recycled polyester fibre, which closely resembles virgin polyester. This product can be blended with various fibres to create yarns for consumer-grade fabrics.

| Since 2023, we have partnered with Swedish pulp producer Södra to develop recycling of textile waste on an industrial scale, contributing our knowhow in REFIRBA™ technology to enable a variety of complex, coloured textiles.S. Jayaraman VP of Global Sales Textiles, Lenzing |

“From decisions on whether to discard or reuse, we strive to embed sustainability into every aspect of our business. Allocating dedicated budgets for sustainability within our annual plans is a priority for us,” declared BM Sharma, Jt. MD, RSWM Ltd. The company annually produces 1,21,000 MT Greige Yarn, 24,000 MT Melange yarn, 32,000 MT Dyed yarn, 32 Metres Denim Fabric, 9000+ MT Knits Fabric and 43,000 MT Green Fibre.

“Our closed-loop production in spinning integrates textile waste back into our products, reducing landfill waste by approximately 30 per cent,” claimed Mukesh Matta, Head of ESG and Sustainability Initiatives, Pratibha Syntex. The company has four verticals including farming, yarn, fabric and garmenting.

The REFIBRA™ technology from Lenzing focuses on increasing the recycled content in fibres by upcycling cotton scraps from pre- and post-consumer textile waste. These scraps are converted into recycled pulp, with 30 per cent blended with wood pulp to create new virgin TENCEL™ Lyocell fibres.

“Since 2023, we have partnered with Swedish pulp producer Södra to develop recycling of textile waste on an industrial scale, contributing our knowhow in REFIRBA™ technology to enable a variety of complex, coloured textiles containing a mixture of cotton, polyester and other components including elastane to be processed and recycled in future,” averred S. Jayaraman, VP of Global Sales Textiles, Lenzing.

Headquartered in Austria, Lenzing group supplies the global textile and nonwoven industry with man-made cellulose fibres manufactured from sustainable sources such as wood and wood pulp.

The company also applies closed-loop production techniques. For example, Lenzing’s Lyocell process recovers 99.8 per cent of the NMMO solvent required, which is then fed back into the process. In another case, where valuable raw materials are extracted from wood for pulp production, the rest of the materials can be used to generate bio-refinery products such as acetic acid, thermal energy and electricity. Thanks to this process, the company’s plants in Paskov (Czech Republic) and Indianópolis (Brazil) hardly require the additional purchase of energy for pulp production.

Vardhman has established Vardhman ReNova, a cotton recycling facility with a six TPD production capacity. “This project takes a significant stride in this direction by recycling both pre- and post-consumer waste into high-quality yarn,” said Mukesh Bansal, Head (Fabric Marketing), Vardhman Textiles Limited, a leading vertically integrated textile producer with a production capacity of 670 metric tonnes of yarn per day, 180 million metres of fabric per year and 22,000 metric tonnes of fibre annually.

Green Energy, Water Conservation and Blocking Toxins

Industry leaders are embracing renewable energy by cutting down on fossil fuels and investing in sustainable power sources. Many companies are giving extra thrust to harness wind power and adopting biofuels such as rice husk, maize shank and biomass to power their operations.

For instance, Perfect Filaments has installed solar panels with a capacity of 335 KW and is planning to install ore.

At Sulochana’s main plant, 100 per cent of the energy used comes from renewable sources, with 94 per cent from wind and 6 per cent from solar. The solar panels are also manufactured on-site. Across all their units, approximately 87 per cent of the energy consumed is from renewable sources.

Likewise, NSL Textiles aims to transition to 100 per cent solar energy for all common energy needs across its operations within the next five years. It also uses biofuels made from 100 per cent rice husk in its operations and is exploring the use of maize shank as an additional biofuel source to further diversify its energy supply.

RSWM has also installed Solar Power Plants at its various manufacturing locations including Kanyakheri, Mandpam, Gulabpura, Kharigram, Mordi, Ringas and Rishabdev.

Lenzing is tapping into bioenergy through the acquisition of a 43-megawatt biomass power plant in Austria, which would help replace 50 per cent of natural gas used at its Lyocell plant, reducing CO2 emissions of the plant by around 50,000 tonnes per year.

“We have been expanding our green electricity mix in our fibre and pulp production. At the Lenzing site in Austria, we have been producing solar energy and making purchase agreements to source more renewable electricity,” said Krishna Manda, VP, Corporate Sustainability, Lenzing.

With the garment and textile industry consuming about 79 trillion litres of water each year — enough to meet the needs of 27 per cent of the global population according to WHO standards — significant efforts are also underway to reduce this high level of water usage. Manufacturers are leveraging technology to develop innovative ways to save water.

For example, NSL Textiles’ Air-Dye® technology uses compressed air and heat instead of water to transfer dye onto fabric. This process eliminates the need for large quantities of water.

As a leading viscose manufacturer, Birla Cellulose claims their water consumption in making 1 kg of viscose fibre is lowest and it also benefits in lowering carbon footprint.

“Our EcoD utilises an eco-friendly dyeing process in which colour is integrated directly into the polymer, eliminating the need for traditional water-intensive dyeing methods. EcoD also consumes only one-tenth of the energy required for conventional dyeing and avoids Class-A pollutant dyestuffs,” remarked Rakesh Bali.

The industry players are also using low-temperature dyeing processes, which require less energy and fewer harsh chemicals, resulting in both reduced chemical waste and water usage. They also prioritise the use of natural dyes and eco-friendly chemical alternatives.

With the introduction of dope-dyed fibres with Indigo Colour technology, Lenzing has significantly reduced water consumption by over 99 per cent. This technology incorporates indigo pigment directly into TENCEL™ branded modal fibres through a one-step spun-dyeing process, helping ensure water conservation throughout the entire product lifecycle.

The company has also partnered with Exponent Envirotech to implement waterless dyeing technology for cellulose fibres, specifically for Cobalt Fashion’s knitwear collection. This method saves up to 95 per cent water, reduces dyestuff and energy use and eliminates salt, helping to address the industry’s ongoing issue of high salinity in wastewater.

Industry players also ask their suppliers to follow ZDHC Manufacturing Restricted Substance List (MRSL) in their process.

Sustainability’s Roadblocks: The Path Isn’t Easy

As organisations strive to balance growth with environmental responsibility, they face significant challenges along the way. Rakesh Bali pointed out that to begin with, the domestic textile industry faced significant challenges due to an oversupply of fabrics and apparel imported from China amidst lower export demand from key markets like the US and EU. These imports, often undervalued and misdeclared, disrupted the domestic textile supply chain and affected profit margins. As a result, the polyester industry operated at less than 70 per cent capacity.

Significant capital and technical expertise are required for the downstream textile value chain to invest in new technologies aimed at enhancing production efficiency and reducing environmental impact. Skills shortage is another big challenge. Equally important is to educate consumers about the benefits of sustainable products and to dispell misconceptions to drive demand and encourage responsible consumption.

“Although the demand of sustainable viscose fibre has seen growth season after season, but the volumes are very small as brands are unable to pass the cost. With consumer awareness towards sustainable offering ,we expect that, over time, demand of sustainable viscose fibre will increase resulting in higher adoption of such material by value chain partners including circular fibre Liva Reviva,” expressed ManMohan Singh.

Some manufacturers are also facing capacity challenges, for instance, NSL Textiles Ltd., has certainly seen a strong interest in 100 per cent organic cotton. While this material is in high demand due to its eco-friendly properties, they are still facing some capacity challenges.

“The key challenge comes from the higher price point of organic cotton compared to conventional cotton, which can make it more difficult to scale production quickly. The cost is driven by factors like lower yields per acre, the need for specialised farming practices and the certification process that ensures it’s truly organic,” noted Pritam Das.

Meanwhile, others are ramping up their operations to meet growing demand. Lenzing has invested more than € 200 million in its production sites since 2021, converting existing capacity for generic viscose into capacity for specialty fibres. Jayaraman noted, “So far, we have ramped up our Lyocell production capacity by almost 40 per cent and boosted our Modal production by around 30 per cent. In sustainable viscose, we have more than doubled our specialty fibre capacities, making us well-prepared to meet consumer demand.”

Birla Cellulose plans capacity ahead of demand through brownfield projects and debottlenecking opportunities of existing capacity and will continue to maintain the same principle for all their future expansions.

Another challenge manufacturers face is that buyers expect recycled products to match the quality and colour consistency of virgin materials. Bhavik urged manufacturers to establish distinct quality and colour-matching standards specifically for recycled products, aligning with sustainability goals. “For instance, if brands were to allow a slightly higher tolerance for colour variations, we could reduce the need for repeated dyeing processes, thereby conserving natural resources,” he stated.

Girish highlighted that it’s difficult to sort fibres consistently on a large scale, which means that the fibre content in recycled fabrics can vary widely. For example, one section of fabric might contain 70 per cent polyester, 20 per cent cotton, 5 per cent viscose, 3 per cent acrylic and 2 per cent unidentified fibres, but just a few metres later, the blend might shift to 65 per cent polyester, 15 per cent cotton, 15 per cent viscose, 4 per cent acrylic and 1 per cent unidentified fibres.

| The domestic textile industry faced significant challenges due to an oversupply of fabrics and apparel imported from China amidst lower export demand from key markets like the US and EU. These imports, often undervalued and misdeclared, disrupted the domestic textile supply chain and affected profit margins. Rakesh Bali Sr. VP and Head of Marketing, PetChem Business |

This inconsistency makes mechanical recycling of post-consumer textile waste challenging. In contrast, recycling post-industrial waste—mainly the cutoffs from apparel production—is much more straightforward.

Experts also pointed out that buyers are still hesitant to pay the premium for sustainable products.

“As the consumers are becoming more environmentally and sustainability conscious, they are increasingly willing to pay a premium for sustainable products. However, price sensitivity remains a key factor. Brands and retailers must balance premium pricing with the value proposition of sustainability, focusing on quality, performance and ethical sourcing to justify higher costs,” proposed Rakesh Bali.

Reinforcing the viewpoint, Mukesh Bansal asserted, “The willingness of buyers to pay a premium varies across different market segments. We have observed that a significant portion of our customers, especially those in the premium and luxury segments, are willing to invest in sustainable products, recognising the long-term benefits and ethical implications.”

An emerging perspective in the industry suggests that meeting the demand for sustainable products does not stem from a lack of resources or materials—particularly in India, where sustainable dyes, chemicals and fibres are readily available for those dedicated to sourcing them. Instead, the primary challenges often lie in ensuring that every part of the supply chain consistently adopts these sustainable options.

| The Green Revolution in Trims and Accessories

As the conversation around sustainable supply chains picks up, the often-overlooked sector of Indian trims and accessories is quickly making sustainability a top priority. Titan Zip Fastener Industries, for example, has been using pressurised natural gas (PNG) since 2012 and ensures its products are free from conflict minerals like titanium, tin, tungsten and gold. Madeira uses 80 per cent recycled water and incorporates sustainable materials such as recycled polyester and Sensa Green (Lyocell) in its products. Similarly, Telephone Thread is prioritising sustainability through technological upgrades, such as using a gas-based boiler in its dyeing plant, implementing rainwater harvesting and running its Delhi office on solar power and LED lighting. The company also introduced an efficient Swiss-made Thread Winding Machine to boost product efficiency. Vardhman Yarns & Threads Ltd., has launched several innovative sustainable products, including the world’s first anti-counterfeiting, sustainable sewing thread called INTEGRITY, developed in partnership with Applied DNA Sciences. This molecularly tagged thread ensures authenticity and provides a solution for sustainable traceability. Other companies are also making strides in sustainability. For instance, Ketan Buttons Pvt. Ltd., produces eco-friendly buttons made from repurposed horn, corozo (tagua palm seeds) and coconut shells. Kotak Group is exploring the use of high-quality recycled plastic bones. For their Japanese buyers, including Daiso, they are producing hangers made from sustainable materials, utilising patented polymer technology that incorporates TANTEC polymers, which emit fewer emissions when burned. |