Things that seem picture-perfect on the surface, most of the time are not. The same holds true for running a fashion brand in India. On the surface, everything seems rosy, be it latest collections dropping every month, fresh silhouettes, rising revenues, growing store counts and a constant buzz on social media… but behind the scenes, lies a constant hustle that most never talk about.

For instance, sourcing and production are a constant headache due to broken and highly fragmented supply chains. This makes it hard to predict inventory needs or even deliver on time. Demand is another unpredictable beast. What’s selling like crazy one month can flop the next. Logistics in smaller cities like Tier-2, Tier-3 and Tier-4 is especially tough. While these markets represent huge volume opportunities, the infrastructure is slow and unreliable, making delivery a challenge.

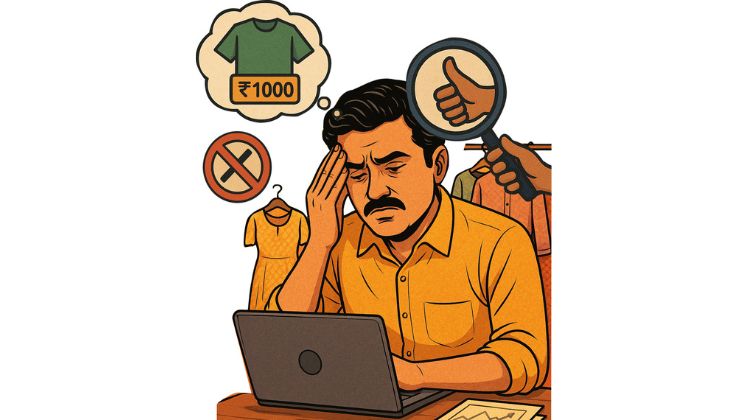

Then, there’s the struggle to find quality retail space, especially for emerging brands trying to establish themselves. On the digital front, online fashion still faces a lot of skepticism in the form of sizing issues, quality concerns and Cash on Delivery (COD) rejections. Returns are another big headache as they add to shipping costs, mess with inventory and slow down cash flow.

Technology implementation brings its own set of challenges. First, technology can be expensive to set up and then also, the brands have to constantly spend on the upgradation of the technology. Managing every aspect of supply chain with tech is also hard because it involves tracking everything from production to delivery in real-time. Many smaller brands struggle with manufacturers due to delivery delays, poor quality, poor tech support for tracking orders and high minimum order requirements.

To make matters worse, customer loyalty is more fickle than ever. Price wars and constant discounting can sometimes build short-term sales but don’t help in creating lasting relationships with the customer.

Regional preferences also create complexity. For instance, what works in one part of the country might not work in another, adding another layer of difficulty in targeting the right markets.

Then, there are the challenges of maintaining smooth relationships with vendors. To add to the pain, operational costs are continually rising, putting pressure on already thin margins. And with sustainability fast becoming a major factor in consumer purchasing decisions, sustainable brands are feeling the heat to invest in greener practices without always seeing immediate returns.

And if that wasn’t enough, brands also have to jump through all kinds of bureaucratic hoops to get approvals and certifications. Moreover, funding options are often difficult to access.

Finding and retaining good talent, especially in smaller cities, is another hurdle. On top of all these challenges, brands have to react to macro challenges. For example, with ongoing tariff wars, the global economy is in a tight spot and a slowing economy has made consumers more cautious about their spending.

In order to truly understand what goes into building a fashion brand in India, we reached out to industry leaders to understand more about the fires they’re fighting and the unspoken truths behind running brands.

Their stories offer a raw, unfiltered look at the ups and downs of running a fashion business in India. The challenges are real and so is the creativity, hustle and determination driving the industry forward. Read on…

“SERVING FASHION LOVERS IN SMALL CITIES IS HARDER THAN IT LOOKS”

Harsh Somaiya, Co-founder, The Bear House

One of the biggest challenges I face in running my brand is the limited infrastructure, especially in Tier-2 and Tier-3 cities. It’s tough to deliver orders within 24 to 48 hours in these areas, which is what customers expect nowadays.

In metro cities, high demand and numerous delivery partners make quick deliveries easier.

But when it comes to smaller cities, the demand is limited, even though people there are very interested in fashion and do place orders. The problem is that these cities often don’t have airports and the train network isn’t strong either. That means we have to rely on road transport. And that only works when there are enough parcels. If there are just 3 or 5 orders, we often have to wait until we can club them with a larger shipment. This slows everything down – sometimes it takes 72 to 80 hours to deliver.

To solve this, we’re planning to open more EBOs directly in Tier-2 and Tier- 3 cities. We’ve already planned 14 stores by the end of the year.

Another issue we face is with courier partners. We often get complaints from customers saying they received damaged items or even products from other brands. Unfortunately, there have been cases where couriers open packages and things go missing.

It’s a serious problem that hurts trust and customer experience. Returns and COD are another big pain point. A lot of consumers order but then don’t accept the delivery which increases costs and messes with our inventory planning. If we can fix these issues, I believe our business will grow much faster.

“DEMAND IS HARD TO PREDICT”

Siddharth R Dungarwal, CEO, Snitch

Getting the right fabric on time is difficult due to regional production strengths. For example, a delay in importing fabric for our summer resort collection pushed our launch back by three weeks, costing us 15 per cent in expected revenue. Customer preferences in India also change quickly, influenced by both global and local trends. This makes predicting demand hard. For instance, a sudden 40 per cent jump in demand for ethnic-style fusionwear during the festive season caught us off guard, leading to missed sales. To tackle these challenges, we’ve invested in data analytics and trend forecasting, helping us optimise inventory and reduce unsold stock by 30 per cent.

“WHAT SELLS IN HYDERABAD FAILS IN CHANDIGARH”

Satyen Momaya, CEO, Celio India

One challenge rarely mentioned is the complexity of local consumer preferences. India’s diversity means what works in one region may not in another. For instance, in Hyderabad, people prefer skinny, ankle-length jeans, while in Chandigarh, straight and loose fits are more popular.

Another challenge is balancing global appeal with local adaptation. While there’s growing interest in international fashion, Indian consumers still value traditional craftsmanship, colours and local influences. This balance requires constant adjustment.

“OPENING STORES IN SMALL CITY IS A TOUGH NUT TO CRACK”

Most brands highlighted how expanding into offline retail is easier said than done. “As a first-time offline brand, it’s difficult to get good retail space. Big national brands usually get first preference in prime locations. We often end up with whatever is left,” lamented Harsh Somaiya.

Echoing similar sentiments, Rishi Behal, VP-Sourcing, The Souled Store too pointed out that getting a premium location in any city is tough. Established brands have already taken up the best spots for their flagship stores and they rarely vacate it even after years.

“We have to look for newer malls, ones that are still developing and work on creating our own identity. Inflation is also rising, which makes it even harder to secure these spots,” stated Rishi.

Meanwhile, Siddharth R. Dungarwal shared his strategies for ensuring retail visibility. “Our biggest lesson came during our Mumbai expansion, where high operational costs forced us to adopt a strategic approach to stand out. We focus on experiential retail, creating immersive store experiences and using hyper-localised marketing strategies to drive footfall and customer loyalty.”

“INVENTORY MISSTEPS CAN BREAK A FASHION BRAND”

Vipul Mathur, CBO, Raymond (Ex-Nykaa)

In the branded apparel business, inventory can make or break your profitability. Most offline retail brands typically operate with inventory turns of 2.5 to 3 times a year. But for D2C e-commerce brands, we have to work much faster, with 5 to 6 inventory turns annually, because our margins are much thinner.

That means the inventory we make needs to turn into cash within 2 to 3 months. And the only way to make that happen is by knowing exactly what the consumer wants. But in an overcrowded and fast-changing e-commerce market, that’s nearly impossible to predict accurately.

Hence, the best approach is to produce in small batches, observe how it performs and then scale up based on what’s actually selling. Of course, this comes with its own set of challenges— managing the supply chain, logistics, pricing and quality which can be incredibly complex. At Nykaa Fashion, especially for ethnic women’s brands, here’s how we tackled it:

A. Make – Sell – Learn – Make Model

We first took positions on certain fabrics and designed multiple garments from them. Then we’d choose what we believe would work and manufactured in small batches using sampling units. We observed sales over two months and then decided whether to scale production. This model accounted for about 50 per cent of our business.

B. Vendor-Managed Inventory Model

We used the same small-batch logic but kept the inventory at the manufacturer’s end. We created a manual system to share forecasts, top trends and bestsellers with our vendors through a dedicated team called the ‘Novelty Engine’. This model made up around 25 per cent of our business.

C. Boutique and Export Sourcing

A senior designer-led team sourced exclusive, high-fashion pieces from small boutiques and exporters who served premium clients. These were expensive, niche and high in visual appeal. Though the quantities were small, these items provided trend insights and helped shape our broader collections. This model contributed to the remaining 25 per cent of the business.

In my view, any e-commerce brand working in high fashion must adopt one or more of these models to create inventory that sells.

| “ETHICAL FACTORIES ARE FEW AND FAR BETWEEN”

For many emerging fashion brands, offering sustainable products at the right price is a constant balancing act as every step, from sourcing to production, involves trade-offs between ethics and economics. “Even though India is a huge producer of organic cotton, finding eco-friendly fabrics is still tough,” shared Kriti Tule, Founder, Doodlage, further stating, “And when we do find them, they cost much more. We’re trying to make sustainable fashion affordable, but we end up competing with fast fashion brands that sell at half the price.” The problem doesn’t end with sourcing. Amar Nagaram, Co-founder and CEO, VIRGIO, added, “There are very few ethical factories that follow the right standards — cruelty-free, PETA-certified, Sedex, Fair Trade. And the ones that do exist often don’t work with small brands like us.” To overcome this, VIRGIO took the hard route. “We built personal relationships with responsible factories and convinced them to take small batch orders. But it comes with delays and unpredictable costs.” Another roadblock? “Many shoppers in India still choose fashion based on trends and price,” Kriti explained. Government support is also lacking. “There are hardly any policies or incentives to support green brands,” said Kriti. Despite all odds, Amar said, “We’ve priced most of our styles between Rs. 1,000 and Rs. 3,000. “That’s half of what many sustainable brands charge. But maintaining these prices while staying ethical is a constant balancing act.” |

“BUILDING TRUST FOR ONLINE BRANDS IS HARD”

Rishi Behal, VP-Sourcing, The Souled Store

When we first started, consumers didn’t trust online fashion. They were used to shopping from places like Amazon, where they often felt disappointed. For example, when they saw a product online priced at Rs 500, which looked like a Rs 1,000 product, they got excited. But when the product didn’t meet their expectations, they felt cheated and that gave D2C brands a bad reputation.

This made things difficult for us. Sometimes, even a small design feature on a garment was mistaken for a defect. People would post online claiming the product was faulty when it was actually meant to look that way. To address this, we started educating our customers better, clarifying on our website and in photos that certain design features were intentional and not defects.

As trust began to build, we expanded our product range. But with every new launch, we encountered fresh comparisons. For example, when we released our first range of lifestyle sneakers at Rs. 2,000, customers compared them to Rs. 10,000 Nike shoes. While the products were completely different, these comparisons kept coming. As a digital-first brand, every opinion mattered, and people expected perfection, even at budget prices.To meet these expectations, we built a strong team that rigorously checks and tests every product. We made sure nothing left the warehouse unless we all agreed it met the standard. Building trust as an online fashion brand has been one of our toughest but most crucial challenges.