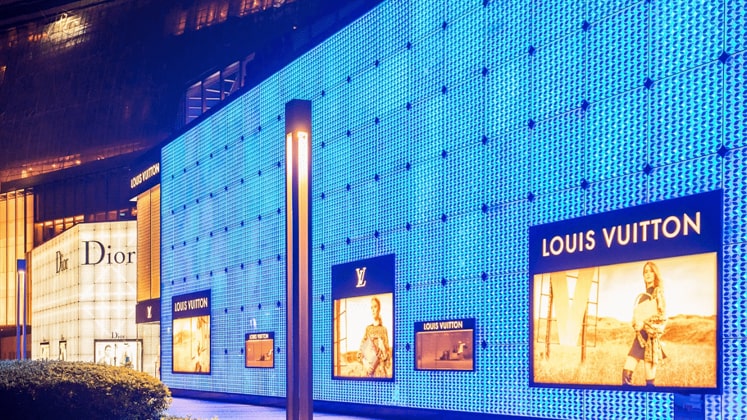

The biggest luxury conglomerate today, LVMH Moët Hennessy Louis Vuitton, is rapidly working towards its mission of expansion in all fields that promise luxury. In a recent announcement, LVMH mentioned its agreement to buy Belmond Ltd, the London-based luxury travel operator for a hefty US $ 2.6 billion amount.

This move signifies LVMH’s presence in the hospitality sector with Belmond being one of the most famous luxury travel chains having Venice Simplon-Orient-Express train and hotels including the Copacabana Palace in Rio de Janeiro under its umbrella.

The French conglomerate will procure Belmond with each class A share for US $ 25.00 which accumulates to an enterprise value of US $ 3.2 billion.

Belmond has its roots in 24 countries and boasts of about 46 luxury hotel, restaurant, train and river cruise properties in its portfolio. In the 12 months preceding September 2018, the 40-year old travel group reported revenue of US $ 572 million and adjusted EBITDA of US $ 140 million.

“Belmond delivers unique experiences to discerning travellers and owns a number of exceptional assets in the most desirable destinations. Its heritage, its innovative services, its excellence in execution and its entrepreneurship resonates well with the values of the group and is complementary to our own Cheval Blanc maisons and the Bulgari hotels activities. This acquisition will significantly increase LVMH’s presence in the ultimate hospitality world.” – Bernard Arnault, Chairman and Chief Executive Officer, LVMH

The decision was tough as per Roland Hernandez, chairman of the board of directors of Belmond, as they received reasonable offers from several real estate and lodging companies, sovereign wealth institutions and financial buyers.

“The board has concluded that this transaction with LVMH provides compelling and certain value for our shareholders as well as an exciting path forward with a group that appreciates Belmond’s irreplaceable assets and strong management team.” – Roland Hernandez, Chairman, Board of Directors, Belmond

The transaction will be completed halfway through 2019 and depends upon Belmond’s shareholders’ approvals along with clearance by the relevant competition authorities.