India’s ethnicwear market is quietly reshaping everyday fashion, as more consumers turn to traditional styles that feel both familiar and refreshingly modern. It also holds the largest pie — US $ 22 billion—of the nation’s overall garment industry, valued at US $ 102 billion in FY ’24.

By FY’ 26, the Indian ethnicwear market is expected to reach US $ 26.9 billion with a CAGR of about 10.6%.

Industry experts put the unorganised share of the ethnicwear market at 80-85%. Yet, the organised segment, which accounts for 15-20% of the overall market today (around Rs. 28,000 to Rs. 37,000 crore), is growing at an impressive 20% each year as Indians increasingly turn to ethnic apparel for various occasions. Of the organised segment, 40% of the market belongs to mid and value brands, while 30% each belongs to premium and luxury brands, according to reports.

“The ethnicwear market is evolving towards global standards, with growing demand for styles that are both rooted and relatable. Indianwear today isn’t just for occasions—it’s becoming a part of everyday fashion,” said Sidhant Keshwani, Founder and CEO, Libas.

Adding to this, Vinay Chatlani, Co-founder and CEO, Soch, stated, “Ethnicwear is no longer reserved just for festivals or special occasions, it’s becoming a part of everyday style. This shift is paving the way for fusionwear to take centre stage, with contemporary silhouettes like shararas, kaftans and corset blouses gaining significant popularity.”

The market is booming for both D2C and retailers. For instance, numerous D2C brands have emerged of late such as Tjori, Berrylush, Suta, Koskii, Bunaai, Okhai, Taneira, Fashor, House of Chikankari, Kalki Fashion and Karagiri.

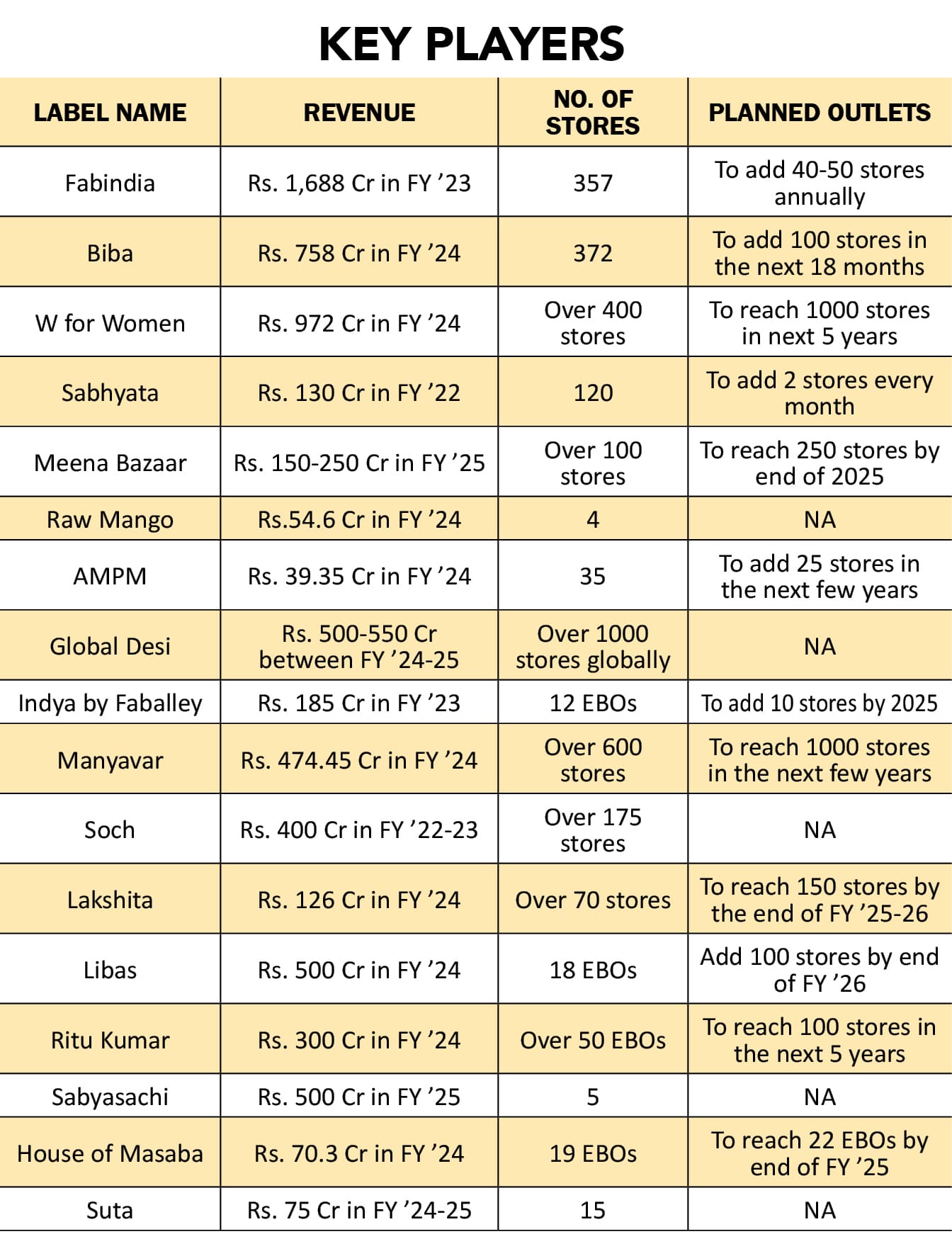

Similarly, top retailers ruling the market include Fabindia, Biba, W for Women, Meena Bazaar, Sabhyata, Global Desi, Manyavar, Soch, Lakshita and Libas. Meanwhile, luxury and high-end brands like Raw Mango, AMPM, Satya Paul, Ritu Kumar, Sabyasachi and House of Masaba, amongst others, are cementing their foothold and are now in expansion phase. Fabindia, which has 357 stores in India, plans to add 40-50 stores annually, focusing on both Indian and international markets, with a mix of company-owned and franchise stores. It also aims to expand its e-commerce presence and omnichannel capabilities.

Biba, on the other hand, is focusing on its value fashion brand, Rangriti. Its goal is to add 40-50 new stores annually, while also adding 100 Rangriti stores in the next 18 months.

W for Women plans to open 1000 exclusive stores across India in the next five years. W’s parent company, TCNS Clothing Company (now acquired by Aditya Birla Fashion and Retail), has also sought financial investments to fuel growth plans, including a planned US $ 100 million raise from private equity funds. Meanwhile, Sabhyata made Rs. 130 crore in revenue during FY ’22 and expects 20% growth year-on-year.

With an annual revenue between Rs. 150 to 250 crore, Meena Bazaar aims to expand its footprint significantly by targeting over 250 exclusive brand outlets (EBOs) by this year.

Manyavar, owned by Vedant Fashions, aims to double retail floor space to 2 million square feet over the next few years and is targeting 1000 exclusive stores. Soch, which has over 175 stores across 68 cities in India, aims to add 25 new stores by the end of this fiscal year.

Lakshita, which reported a revenue of Rs. 130.36 crore in FY ’24, plans to double its revenue by the 2028 financial year, fuelled by bricks-and-mortar retail expansion. The New Delhi-based brand also aims to open a total of 100 EBOs in India by the end of FY ’26.

Libas that touched Rs, 500 crore milestone in FY ’24, has a goal to continue growing at 60-70% in the new fiscal year. Currently, operating 18 EBOs, the label plans to open around 100 EBOs by the end of FY ’26. On similar lines, premium ethnicwear label House of Masaba has a target of reaching Rs. 500 crore revenue in the next five years and plans to expand from 19 to 22 EBOs by the end of this fiscal year.

Ethnicwear brands are also eyeing international expansion, given the huge presence of South Asian diaspora in foreign markets. For instance, Manyavar plans to open 15 international stores in countries like the US, UK, UAE and Canada. Similarly, Soch recently opened its first international store in Brampton, Canada and plans to launch two more stores this year in either Malaysia, Singapore or the US. In the first phase of its global expansion, the brand aims to open 4–5 stores in Indonesia, Mauritius, the Middle East and the UK. The ethnicwear players have also caught the attention of investors.

For instance, D2C brand Kalki Fashion bagged Rs. 225 crore (US $ 26.2 million) funding from Lighthouse Funds to ramp up its Indian and global retail expansion and double down on its omnichannel presence. Libas also raised Rs. 150 crore (US $ 18 million) from ICICI Ventures to further accelerate offline expansion across geographies and enhance its exclusive brand and retail outlets across key metros and Tier-1, Tier-2 and Tier-3 cities. Bengaluru-based Koskii secured Rs. 61 crore (US $ 7 million) from Baring Private Equity in 2023. Similarly, Fashor raised US $ 5 million funding from Blume Ventures to enhance its brand and supply chain in 2024, while New Delhi-based artisanal-led brand House of Chikankari raised Rs. 4 crore (US $ 466,872) in its seed round from angel investors and micro-VC funds this year.

Other Trends

1. 2025 Trends: Silver Generation Set To Rule Fashion

2. 2025 Trends: Product discovery and customer service to power growth

3. 2025 Trends: Bharat Retail To Go Compact, Lean: Anant Tanted, Founder and CEO, The Indian Garage Co.

4. 2025 Trends: Q-Commerce To Fuel Fashion In Small Cities

5. 2025 Trends: Brands Must Speak Bharat

6. 2025 Trends: Buy Now, Pay Later To Ignite Shopping Boom

Market Demographics

Experts say that the primary consumers are working professionals, homemakers and style-conscious millennials who want trendy, high-quality clothes at a fair price. A recent study by Technopak highlights the dominance of the women’s segment in ethnicwear. The category holds 71% of India’s entire womenswear market. This growth is attributed not just to population trends but also to increasing work participation by women. “Millennials and Gen Z women are leading the demand, especially working professionals and students. They’re looking for outfits that blend tradition with functionality— pieces that work from festive gatherings to workspaces,” said Vinay Chatlani, adding that 50% of their customers fall within the 25-35 age group and 65% of the brand’s stores are currently in Tier-1 cities. While biased in favour of women, the men’s ethnicwear category is picking up speed, especially in Tier-2 and Tier-3 cities. Some brands like Tasva, Kalpraag, Andamen, Kisah and Raaya exclusively offer men’s ethnicwear, while other popular labels like Fabindia and Manyavar have both women’s and men’s collections. “We serve customers in Tier1, Tier-2 and Tier-3 cities and most of our customers are from middle-income to upper-middle-income families,” said Vikram and Priyanka Kankaria, Co-founders, Fashor.

Adding to this, Sidhant Keshwani said, “Metro cities like Delhi-NCR, Bengaluru, Hyderabad and Pune remain strongholds. Interestingly, Tier-2 cities like Lucknow, Indore, Udaipur and Kochi are witnessing faster-than expected growth, indicating a widespread appetite for aspirational fashion.”

Moreover, Vinay Chatlani said that Tier-2 and Tier-3 cities are showing accelerated growth, as consumers there seek quality ethnicwear that mirrors urban trends. “Cities like Kanpur, Patna and Rajahmundry are particularly responsive, with a growing fashion consciousness,” he added.

In a similar vein, Srishti Tanwani, Co-founder and CEO, Indo Era, said that ethnicwear growth is strongest in Tier-2 and Tier-3 cities, making up over 60% of online sales. “Surat leads with 15% annual growth, followed by Jaipur (12%), Lucknow (10 %), Indore (9 %) and Coimbatore (8 %). Metro cities like Mumbai, Delhi, Bengaluru and Chennai contribute 35% of the market, mainly for premium and fusion styles. Gujarat and Rajasthan hold 28% market share in traditional wear, while Southern states see a 20% yearly rise in fusion and sustainable ethnic fashion demand,” she explained. Sabhyata is also planning to open two stores every month, with a target on southern and eastern parts of the country particularly Kerala, Chennai and Guwahati for expansion.

There is also a growing kids’ ethnicwear market in India worth Rs. 5630 crore (US $ 1 billion) and it is growing at 10% annually—which constitutes 15% of the total kidswear market. As such, ethnicwear is more popular for girls, making up 23% of the girlswear market (ages 0-19). Brands such as Biba are strengthening their kidswear segment, specifically the Biba Girls segment, with standalone stores and extending offerings to include girls aged 15. Other labels such as Fabindia, Little Muffet, Tiber Taber Kids, The Loom, Westside and Tjori also cater to the kids’ ethnicwear segment.

The Top Trends Set To Redefine Ethnic Fashion

The hybridisation of traditional and western styles will continue to dominate. Think lehenga with crop tops, kurta-shirt hybrids, sarees with jackets or sneakers and draped silhouettes with tailored cuts. Younger consumers, especially Gen Z and millennials, are driving this trend, seeking clothing that reflects both cultural identity and contemporary style.

“There’s been about a 35% jump in demand as people want to mix traditional embroidery with modern cuts. When it comes to silhouettes, styles like Anarkalis, structured jackets and fusion drapes are really taking off, growing by around 30%. Colour-wise, classic reds and golds are giving way to pastels, earthy tones and bold shades like teal and mustard, which have gone up by about 25%,” said Srishti Tanwani.

Echoing similar sentiment, Sidhant Keshwani noted, “While traditional silhouettes remain central during festive and wedding seasons, Indo-Western designs are becoming everyday staples. This hybridisation will deepen as consumers seek culturally rooted yet globally relevant fashion.” Eco-conscious consumers will increasingly demand organic fabrics, natural dyes and artisanal techniques like handloom, khadi, chikankari and block printing. Provenance and transparency will matter—brands that spotlight craft communities and slow fashion will gain loyalty. There will be a strong revival of regional textiles and forgotten techniques—from Telia Rumal of Telangana, Chikankari of Lucknow, Bandhani of Gujarat, Patola of Patan, Kalamkari of Andhra Pradesh, Pochampally Ikat of Telangana to Toda embroidery from the Nilgiris, Kanjeevaram of Tamil Nadu, Phulkari of Punjab, Muga Silk Weaving of Assam, Paithani of Maharashtra and more. Fashion will become a vehicle for cultural education and pride, especially amongst young Indians.

As ethnicwear moves beyond festive dressing, brands will design seasonless staples—like anti-fit kurtas, printed co-ords or statement dupattas—that can be worn to work, brunch or the airport.

Experts highlighted that a key challenge ahead lies in managing the rising expectation of speed—especially as quick commerce redefines delivery timelines. What feels fast today, like one-day delivery, may soon seem slow in a world moving towards hyperlocal, 10-minute fashion drops.