Tirupur, the crown jewel of India’s apparel manufacturing, is bouncing back after a tough FY ’24. The textile hub faced an 11 per cent dip in exports, driven by a 10-month slump from April to January. The exports fell by 11 per cent to Rs. 30,690 crore (US $ 3.62 billion) from Rs. 34,350 crore ((US $ 4.05 billion) in FY ’23 due to external factors such as the Ukraine war, economic troubles in Europe and the US and trade disruptions. However, FY ’25 has brought in strong recovery.

Accounting for 55 per cent of India’s knitwear exports, Tirupur posted 13 per cent growth in the first five months of FY ’25 as exports grew to Rs. 14,679 crore (US $ 1.73 billion), up from Rs. 12,995 crore (US $ 1.53 billion) during the same time last year, with August alone recording a 22 per cent rise to Rs. 3,114 crore (US $ 367 million)—the highest in over two years. The exports are projected to reach Rs. 40,000 crore (US $ 4.72 billion) in FY ’25.

The region’s 5000 MSMEs including 15 vertically integrated companies are operating at 95 per cent capacity, compared to just 60 per cent – 65 per cent a few months ago. Trade bodies credited an uptick in orders from the US and the UK as well as political unrest in Bangladesh for the recent growth in exports. Beyond exports, Tirupur also serves as the domestic market which generates Rs. 25,000 crore (US $ 3.1 billion) in revenue. To keep up the momentum and offset price pressure from buyers, local entrepreneurs are exploring new markets, diversifying product offerings, increasing their focus on man-made fibres and sustainability.

Tapping into the US Market

Talking about the growing importance of the US market, Logu, MD, AKR Industries, with an annual production capacity of 2.5 million kidswear garments, mentioned, “We used to have our products in almost all stores across the EU. Now, I’m very optimistic about the opportunities in the US as this market offers large orders. Developments like the China-plus-one policy and similar trends are expected to benefit us.”

The company whose clients includes Tommy Hilfiger, H&M, Timberland, Lee Cooper and Landmark Group, is shifting from offering value products to focusing on high-volume products. Logu sees this as a positive move since larger orders come with the volume segment. Although the profit margin is lower in volume business, it will be partly offset by improved production efficiency as volume increases.

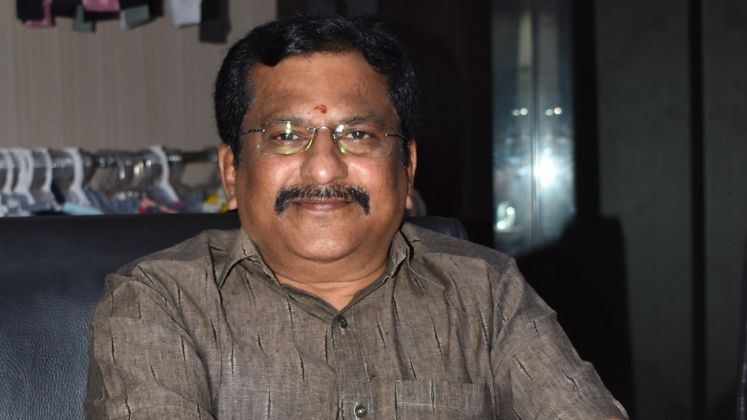

Similarly, P. Moghan, MD, Anugraha Fashion Mill, a vertically integrated garment manufacturer with an annual turnover of Rs. 400 crore (US $ 50 million) and a capacity of 100,000 pieces in a day, has also cast an eye on the US market. “US market can be an additional market area to focus on in near future,” he said and informed that the company is enhancing its production capacity by 30 per cent in Tamil Nadu.

Best Corporation, a leading textile company with an annual turnover of Rs. 1600 crore (US $ 200 million), was one of the first in Tirupur to recognise the potential of the US market, which now accounts for 60 per cent of its revenue.

“Europe is a fragmented market with smaller order sizes compared to the US. Right now, the focus is on expanding capacity to meet the opportunities available with our existing clients and markets,” said Rajkumar Ramasamy, MD, Best Corporation. He also noted that other markets are smaller and more mature, offering limited growth potential for companies like theirs.

The players are also negotiating strongly for a better price. “Earlier, we committed to a low price and the priority was to run the factories. Now almost all the exporters are negotiating with buyers and prioritising to work with good brands. The good thing is that more and more buyers are willing to pay higher prices than before and they are also increasing their orders,” emphasised KM Subramanian, President, Tirupur Exporters Association (TEA), a group of more than 1300 knitwear exporters and allied companies. Subramanian is also the Founder of KM Knitwear, a vertically integrated garment manufacturer. He also underlined that the cluster is putting more effort into getting business from the US, as Europe is now almost the same size in market for Tirupur. Earlier, Europe had a larger share, around 40 per cent, while the US had about 30 per cent. Now, big US companies like Costco, which didn’t give much attention to Tirupur before, are increasing their orders from here.

Though Subramanian clarified that US-based clients still prefer to work with only a few selected companies. However, as their focus on Tirupur grows, there will be more opportunities for other exporters to receive orders as well.

| We used to have our products in almost all stores across the EU. Now, I’m very optimistic about the opportunities in the US as this market offers large orders. Developments like the China-plus-one policy and similar trends are expected to benefit us. – Logu, MD, AKR Industries |

MMF takes the spotlight

The global move towards MMF (man-made fibres) is clear, as 50 per cent of US $ 953 billion in apparel exports worldwide were made from MMF in 2022, 37 per cent were made from cotton and the rest came from other fibres.

In line with this trend, representatives from the TEA recently visited Surat. The purpose of the visit was to find ways to combine Surat’s expertise in MMF production with Tirupur’s strong garment manufacturing capabilities. The group is also sharing ideas about MMF with experts from countries like Taiwan and Korea.

Taking the next step in the MMF segment, Best Corporation is setting up a synthetic fabric facility that is expected to start in the next few months. The plant, with an initial capacity of around 10 tonnes per day, will outsource yarn and develop fabric with circular and warp knitting machines. “We will focus on producing different types of manmade fabric here”, said Rajkumar Ramasamy, who is seeking professional help from Taiwan for this plant.

This thrust is also seen by companies that usually focus on cotton, like Anugraha Fashion Mill.

“After Covid, exporters stepped out of their comfort zone and sped up product diversification. Fluctuations in cotton prices also pushed them to focus more on MMF,” said Raja M Shanmugam, MD, Warsaw International and past President, TEA. The company, with a focus on men’s apparel, works exclusively with a German premium casual brand and sells each garment for € 20.

TEA is closely working with its members to help them transition to MMF-based garments. The goal is for MMF garment exports to make up 30 per cent of total exports by 2030. Leading domestic brands like Technosport are guiding exporters in this shift. “Motivated by opportunities in MMF, my factory has started a separate dyeing division for 100 per cent polyester,” said KM Subramanian.

| Earlier, we committed to a low price and the priority was to run the factories. Now almost all the exporters are negotiating with buyers and prioritising to work with good brands. The good thing is that more and more buyers are willing to pay higher prices than before and they are also increasing their orders. – KM Subramanian, President, TEA |

Tirupur’s push for sustainability

Tirupur is often touted as India’s most sustainable apparel manufacturing hub. Thanks to the collective efforts of the apparel manufacturers, state and central government along with civil society, the cluster has established itself as a water treatment capital.

One of its key initiatives is the Zero Liquid Discharge (ZLD) system, which recycles 120 million litres of water every day. The area has also invested heavily in renewable energy, using wind and solar power, which provides five times more energy than it needs.

For instance, AKR Industries is using 100 per cent recycled polyester and recycled cotton in a major way. Similarly, Anugraha Fashion Mill, which has a LEED-certified (Gold) facility, is also focusing on making its production process more sustainable. The company has achieved the Certification of Sustainable Textile Production (STeP) and is eligible for Made in Green (MIG). Anugraha has also decided that all its new facilities will be green-certified. The company generates 60 per cent of its energy through its own power and claims its thrust on sustainability is not due to buyers’ pressure.

However, Milton Ambrose John, MD, Cotton Blossom, another vertically integrated manufacturer underlined, “If the costs and requirements for certifications are reduced, more companies, especially smaller ones, will be able to focus on sustainability and work towards it.” The company has a capacity to produce 30 million garments per year and is certified with The Cradle to Cradle (C2C) Gold Level Certification.

KM Subramanian mentioned, “We are in discussion with the Government to establish a separate HSN code for truly sustainable garments.” TEA has even formed a dedicated committee for sustainability, working to raise awareness and support the cluster’s apparel manufacturers. KM Subramanian further added that KM Knitwear aims to become 90 per cent carbon-neutral and to become carbon zero by 2027.

Manufacturers explore new markets

Experts are also optimistic about the future. For example, AKR Industries expects to make around US $ 65 to US $ 70 million in turnover this year and believes it will reach over US $ 100 million in the next financial year. The company is looking for partnerships with Korean firms that have strong connections with American buyers and good control over design. Its in-house team of software engineers are working on their own ERP system, with plans to offer it to other apparel manufacturers in the future.

Tirupur-based companies are also exploring other parts of India to expand their manufacturing operations, attracted by various states offering generous subsidies. The availability of local labour in emerging hubs is another key factor, as Tirupur heavily relies on migratory workers and frequently faces labour shortages. Recently Madhya Pradesh’s CM Mohan Yadav also visited Tirupur and had a meeting with apparel exporters.

Best Corporation, which already has a manufacturing unit in Kenya, plans to transform the company’s RMG unit in Madhya Pradesh into a vertically integrated unit mainly because of subsidies on capital, interest and employment offered by the state. The company has also developed its own ERP system and is now using it commercially. “Our goal is to provide the best quality and service to our clients while staying cost-competitive. To do this, we keep looking for new manufacturing locations, both in India and internationally,” said Rajkumar.

Warsaw International has also started making wool-based garments, something uncommon in Tirupur. It is currently importing wool from China but is also exploring sourcing options from other regions, including India.

KM Subramanian mentioned that business from the UAE and other regions is also growing. Orders from Australia have increased significantly, with companies like Woolworths, Target and Big W now placing orders in Tirupur, instead of Bangladesh. Similarly, buyers from Tesco, Next, Decathlon, Mothercare and C&A are also increasing their orders from Tirupur. Buyers and brands have now slowly started their compliance audit through third party agency which shows their interest in placing more orders in future.

The cluster is also trying to crack the Japanese market.

(With inputs from Dheeraj Tagra)