According to a McKinsey report ‘The State of Fashion 2020’, more than 70 per cent of European and US consumers expect to cut back spending on apparel compared to a 40-50 per cent drop in global discretionary spending. Sadly, India’s top 10 markets – US, UAE, UK, Germany, Spain, France, Netherlands, Italy, Saudi Arabia and Canada – which contribute around 75 per cent to Indian export market are among the severely hit regions. It is common knowledge that overseas buyers and buying houses were either cancelling or postponing confirmed export orders indefinitely till the third week of April 2020. However, the situation seems to have improved to a large extent after the appeal of Hon’ble Minister of Textiles requesting buyers/brands to do ‘Commerce with Compassion’. What are the ground realities today? How are the brands or buyers treating Indian manufacturers? More so, is the domestic market also looking to stand shoulder to shoulder with manufacturers to revive their incomes?

It is time to work hand in hand!

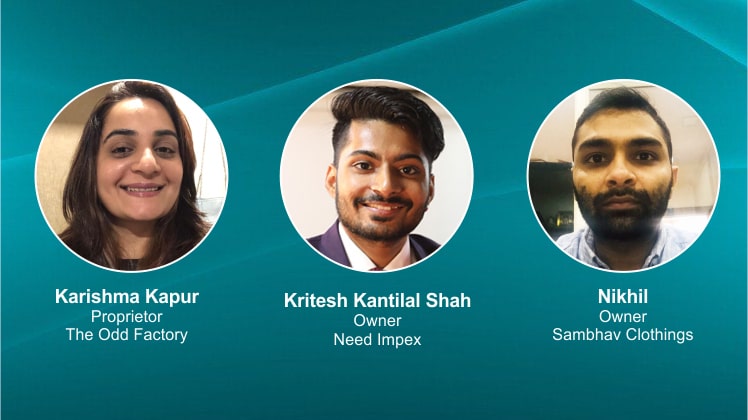

“A drop in export orders was the inevitable truth that we had to face during the initial days of the lockdown. It was like a two-way sword for us. On the one hand, we had to face pile-ups owing to the cancellations, and on the other hand, we had to shut shop and still arrange for funds to pay our workers and keep up with the other payments. However, we did not lose hope and the Government was timely in responding to the crisis. The markets have started opening up and as our action plan in order to combat the tough times, we started to shift our attention to the domestic orders,” Kritesh Kantilal Shah, Owner, Need Impex, mentions.

Also Read: Embracing sustainability: Looking closely at the thrift clothing marketspace in India

Belting in over 38 years of textile industry experience, Need Impex is a known name within the menswear category and the company exports fibres and fabrics for men’s shirtings & suitings all across the world. When asked about compensations coming from buyers and companies abroad, Kritesh says, “Now is not the time to really demand anything from anyone. We understand that the brands who had their shutters down did not have any option but to delay payments and orders. Our client relations are built on trust and we do not want to break that owing to the pandemic or its repercussions. We were lucky to start getting orders from the domestic market and this is the festive market pull that we are sure to improve all our conditions. Not only in India, but all across the world, the festivities will definitely bring up the impetus of buying, and thus, will see improvement within the market. In fact, our buyers have promised to work competitive in terms of order volumes and margins until we have a healthy work and cash flow. This does assure us of brighter days and is enough of a compensation for us.”

A proof that the situation is better now is evident in the apparel exports figures that have logged a double-digit growth in September, which indicates the segment is on course to a V-shaped recovery. Significantly, this is the first time that the exports rose in this fiscal and it is a steep recovery from 90 per cent fall in April to 10 per cent rise last month.

Also Read: Plant-based fabrics: How is the industry looking at this domain?

Domestic market to the rescue

“We can clearly see that the domestic market has become extremely responsive. The ‘unlock’ phase is actually helping us recover. We had to keep orders waiting in our warehouses, as there was no buy or sell through retail fronts during the lockdown. However, I feel everyone has, with time, understood their responsibilities towards each other, and the retailers and brands within India are also working towards pushing the held-in orders and the more they sell, the better for us,” avers Nikhil, Owner, Sambhav Clothings, Bengaluru.

What started 12 years back as a humble production unit is a big set-up today that boasts of overseas clients. The Odd Factory’s core work is exports, and in terms of ratio, they manufacture 70 per cent for clients in the US, Australia, Singapore, Saudi and UK, and 30 per cent for domestic clients.

Talking about the pre-COVID market, Karishma Kapur, Proprietor, The Odd Factory, mentions that those were the days when order input and output were very balanced. She continues by sharing her thoughts on the lockdown stage, “Since the lockdown was so sudden with no prior planning or notice, at first, it just seemed like a break, but then it became worrisome, as we had orders on schedule that had come to a standstill. So all of our production was severely affected… we had raw materials under process that had to be stopped midway… we had purchases that were made with vendors and goods that were going to be received… all of this got held. Workers were naturally without work and couldn’t even go back for a long time. As an ethical manufacturer, we paid 25 per cent salaries to our workers during the lockdown months in order for them to buy their essentials and make provisions to go home. Our production orders got cancelled, and post lockdown, we were left with a lot of raw material that was already in process but technically is of no use since orders got cancelled. Because this was a worldwide issue, sales for everyone got affected and some of our clients were unable to continue with the orders they had placed, whereas other clients reduced the order quantities by 50 per cent. Overall, we lost close to 70 per cent in terms of our earning capacity due to the lockdown.”

“We have had to completely re-structure our way of work in order to suit the circumstances. Unfortunately, we still cannot pay our workers the same salaries that they were getting pre-COVID. We had to let go of staff with a heavy heart after carefully scrutinising efficiency levels… it involved tough decisions, but we have had to re-structure in order to survive. The scale of work has reduced, so the scale of operations must reduce as well. By mid-April, we received cancellations. But there’s no compensation as such; brands are trying to generate small orders to be on the safer side, whereas smaller brands that mainly depend on retail sales have shut work altogether and will probably resume in few months,” Karishma comments.

Further, she says that in order to be able to recover and regenerate revenue, it will take another year. In order to survive these testing times, she is exploring newer opportunities, and even those clients that do not come with a promise of repeat orders or have very small sampling to be done are also welcome at the moment as long as Karishma knows that her team can fulfill such orders. She is waiting to see her unit get work up to their full capacity, and that she admits will take time.

Also Read: Time to understand fabric sampling for your business more closely