Unification of disparate retail channels is the need of the hour in fashion business as managing and maintaining data separately across channels (online, offline) is difficult and time-consuming. This unification allows brands to combine operations such as order fulfilment, inventory management, customer relationship management and others across their e-commerce, m-commerce and offline stores and helps them get rid of internal channels that operate in their own siloes.

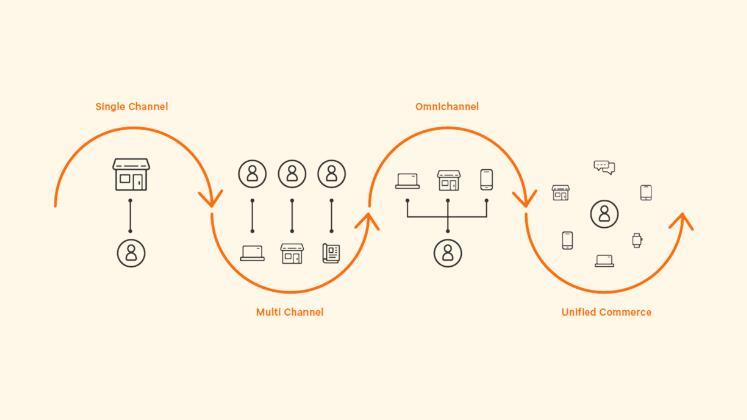

However, as the concept is evolving, it is important to understand the fine difference between ‘omnichannel’ and ‘unified commerce’ that are being used by the industry interchangeably. Unified commerce is a much-advanced concept compared to omnichannel because it integrates all retail channels into a single, cohesive system. Unlike omnichannel, where channels may operate independently, unified commerce synchronises data and operations, providing a seamless customer experience.

For example, when a customer adds an item to their cart online and later visits a physical store, they can pick up from where they left. Unified commerce goes beyond simply offering multiple channels; it unifies inventory, customer data and processes. This allows for real-time visibility and greater convenience, making it a more advanced and customer-centric approach.

| Unified commerce enhances the ability to personalise and improve customer interactions by providing a holistic view of each customer’s history and preferences across all touchpoints. For example, a customer who frequently shops online might receive personalised recommendations when they visit a physical store. This leads to improved customer loyalty and increased sales. |

According to Digvijay Ghosh, Partner (Business Consulting), EY India, unified commerce comes to the picture of retailing when brands start looking at channels that are directly and indirectly controlled by themselves. Amazon, AJIO and Myntra, amongst others, are the third-party marketplaces that are on indirect business mode, but a brand’s own website is direct mode of business for them.

“The brand’s goal today is to unify all these channels from consumers’ experience standpoint or supply chain standpoint. This mode comes with some advantages, however, some sort of complexities are also prevalent which need to be dealt with,” mentioned Digvijay.

| ‘‘The concept of unified commerce comes with some advantages, however, some sort of complexities are also prevalent which need to be dealt with.” Digvijay Ghosh Partner (Business Consulting), EY India |

How does unified commerce work? POV of fashion brands and retailers!

Fashion brands face several challenges when managing data separately across retail channels. This separation can lead to discrepancies in inventory, pricing and customer information. For instance, if a product is out of stock online but available in a physical store, it can frustrate customers. Such data disparities also hinder decision-making and marketing efforts, affecting overall operations and customer satisfaction.

Unified commerce brings in collaboration between different departments or channels within an organisation by breaking down internal silos. For example, sales data from physical stores can inform about online marketing strategies and vice versa. This synergy streamlines operations, improves inventory management and enables consistent branding and customer experience across all touchpoints. This leads to cost savings and minimisation of order cancellations.

| Crucial technologies and tools for unified commerce in the fashion industry include a unified point-of-sale (POS) system, inventory management software and a customer relationship management (CRM) system. Fashion brands should select solutions that integrate seamlessly and can scale with their business needs. |

Varun Rajwade, Vice President of Product and Digital CX at ABFRL, emphasises on the importance of adapting technology and process solutions to the specific context of a business problem. He points out that the method of unification should be flexible and responsive to changes in that context. To illustrate, during the Covid pandemic when physical stores struggled to attract customers, revenues were generated by digital channels. However, in today’s landscape, both physical stores and online channels are drawing foot traffic, indicating a shift in context.

“You have to have the following things right in place – processes, policies and technologies. Most importantly, a brand needs to have good use case for consumers to adopt it,” shared Varun mentioning that ABFRL has introduced concepts like local delivery, BOSS (Buy Online Ship-to-Store) and BORIS (Buy Online Return In-Store). While the brand has experimented with BOPIS (Buy Online Pay In Store) in India, this concept thrives more successfully abroad, as Indian consumers prefer having their online orders delivered to their homes rather than visiting a store solely for pickup. Varun highlights the necessity of adjusting use cases to fit the prevailing context, as it plays a pivotal role in the success of these initiatives.

| “You have to have the following things right in place – processes, policies and technologies. Most importantly, a brand needs to have good use case for consumers to adopt it.” Varun Rajwade Vice President of Product & Digital CX at ABFRL |

“Indian consumers do not want to go to store just for pick up as they want product to come to their home if they have placed orders online. So, setting up use cases is pivotal here,” added Varun.

On the other hand, Campus Sutra – an online-first brand that forayed into offline retailing also in 2019 – sees this entire scenario of unification from a different perspective. Dhiraj Agarwal, Co-Founder, Campus Sutra, opines that international brands in India are earning no greater than Indian brands and retailers and this calls for integrating channels in a balanced manner so that revenue streams can be rightly looked upon.

“While expanding operations in a market as diverse as India, one of the most significant challenges faced by brands is the underutilisation of technology. For businesses transitioning from online to offline, it becomes essential to establish seamless communication between systems to gain insights into product performance and consumer behaviour. While many companies have access to valuable data, a common issue is the inadequate utilisation of this data, with proper optimisation occurring only 10 per cent of the time,” explained Dhiraj.

| “We recognise that the offline sphere presents challenges in gathering consumer data, making our onlinefirst approach all the more crucial in today’s data-driven landscape.” Niraj Patel SVP (Product and Engineering), DaMensch |

The key certainly is the brands’ commitment to centralising data from every source, involving all product lines and customer interactions. If a brand is deeply rooted in online business such as DaMensch, it is privy to a wealth of customer data collected from various touchpoints, including website, mobile app and online marketplaces. This extensive data pool forms the backbone of their decision-making processes.

“We recognise that the offline sphere presents challenges in gathering consumer data, making our online-first approach all the more crucial in today’s data-driven landscape,” commented Niraj Patel, SVP (Product and Engineering), DaMensch.

Getting tangible benefits out of unified commerce is crucial

Consumers have fairly evolved post-pandemic. Today, every customer knows what kind of trends are gaining traction in the fashion market and they also expect speed of delivery and excellent service, alongside pricing, all of which are possible with unified commerce. According to various reports, 40 per cent of the retail business happens during weekdays, while 60 per cent business happens during weekends. With the advent of unified commerce, retailers have seen the spin where they are generating revenues during weekdays as well.

Sales can be generated in far easier ways and brands like WROGN that were online-first brands now have over 550 retail POS across India – thanks to unified commerce. “For us, gathered data gets converted into information, then into insights and finally into actionable tips,” shared Nishant Poddar, CMO and Head – Retail Experience, WROGN.

The fact of the matter is that, within an organisation, there are different functions and each function looks at consumers’ problems differently and there are functional KPIs also to look at. Brands like ABFRL break down these functional siloes in two ways to get tangible benefits. Firstly, the consumer has a pull and they ask for certain things that help the retailer break down siloes naturally.

“In one of our brands, we have implemented BOSS concept. Consumers want faster delivery; we want faster turnaround. On weekdays, when stores are slightly lull, omnichannel or unification continues to give us revenues. So, BOSS is a key KPI for store and it also incentivises the store to deliver what traditionally is thought to be an online metric, which is you are buying online that a store is fulfilling,” mentioned Varun.

The other way in which siloes have been broken down is through CHATSHOP that ABFRL implemented in Pantaloons which was ‘WhatsApp-based Shopping’. During Covid-19, when malls were shut, stores were still open because some walking was happening. More consumers were using live WhatsApp conversation to look at Pantaloons’ merchandise that ABFRL had in its Pantaloons stores. “At the end of the day, it was a pull from consumers and we got some desired results,” asserted Varun.

| “Sales can be generated in far easier ways and brands like WROGN that were online-first brands now have over 550 retail POS across India – thanks to unified commerce.” Nishant Poddar CMO and Head – Retail Experience, WROGN |

Multi-channel presence needs right management of consumers’ preferences

It’s a fact that consumers’ expectations are different on all retail selling points. One thing that goes with around 44 per cent of consumers is the parity of prices across channels. If they see disparity in prices, chances of them to opt for higher-priced channel are negligible. While large-format retail (LFR) works differently, there should be unification between D2C channels and EBOs where consumer data has to be married.

“I will give you a consumer journey for that matter – we do performance ad for a product or a range of products – consumer sees the ad, clicks on it and adds the product to the basket. Now, let’s say, for any given reason, he forgets to complete the purchase. This data point needs to be captured and not lost so that it can be retargeted whether on D2C channel or EBO,” shared Nishant from WROGN’s perspective.

| Data analytics and insights play a crucial role in the success of unified commerce strategies. Brands leverage data to make informed decisions about inventory management, marketing campaigns and customer preferences. Real-time data analysis ensures that brands can react swiftly to market changes and customer needs. |

The idea here is to help the consumers choose the channel of their liking and go shopping. It becomes easier when channel is owned by the brand – D2C or EBO. The challenge comes when the channel is not owned by the brand and they do not have access to data points as far as LFR or MBO is concerned. In a marketplace model, brands have direct dashboard available where they have access to all data points. Here brands take data-driven decisions such as personalisation where they can target a particular customer with right product or suggestive selling for that matter.

| Mobile commerce (m-commerce) is integral to unified commerce as it influences the customer journey and brand engagement. For instance, fashion brands can offer mobile apps that seamlessly connect online and offline shopping experiences, enabling customers to browse, order and pay through their smartphones. |

Giving a contrasting opinion here, Dhiraj said that while making purchase decision on different platforms, consumers have different mindset. He quoted that an online marketplace may sell over 90 per cent products on discount, while offline stores such as Shoppers Stop, Pantaloons amongst others may have close to 60 per cent products on no discount! Yet if a consumer walks across the store and buys a product on which he wasn’t offered any discount, he definitely has a different mindset which means touch and feel of the product, shopping experience and convenience is more important for them.

“Take example of Primark in Europe, they refused to open any kind of online sales operation until 2022, arguing that the cost involved in going online would require an increase in prices to cover the investment. So, brands need to lay their plans and strategies very carefully by observing consumers’ requirement,” stated Dhiraj.

| Fashion brands might encounter challenges during the transition to unified commerce, such as resistance to change from employees or technical integration issues. Strategies to overcome these obstacles include proper training, clear communication and phased implementation. |

Customer loyalty across channels should also be looked upon

When Indian fashion brands first started implementing omnichannel strategies, they did it separately on online and offline channels and this turned out to be a disaster. So, the need is to have centralised data systems and loyalty programs.

If customer A goes to an offline store to buy something at a particular location and the same customer goes to online channel of the same brand, the brand has to identify both are the same person and accordingly needs to implement not just common loyalty programs, but a common personalisation, marketing strategy as well.

“At ABFRL, this approach has helped us in managing discounts or no-discount disparity on same product in offline and online,” concluded Varun.