The 37 per cent tariff slapped on Bangladesh’s exports by the Trump administration felt more like a punch to the RMG industry’s gut. While the 90-day reprieve softened the blow, a baseline 10 per cent tariff remains in place, similar to other countries. The big question now is: Will the sector face irreparable damage or will it adapt and thrive in this new era of tariff wars?

During the 90-day window, more than 75 countries, including Bangladesh, reached out to the White House to try and negotiate. But the ongoing trade war between the US and China has shown that once these disputes start, they often spread and smaller countries like Bangladesh can get caught in the middle. Being part of global supply chains means even small shifts in trade policy can have a big impact.

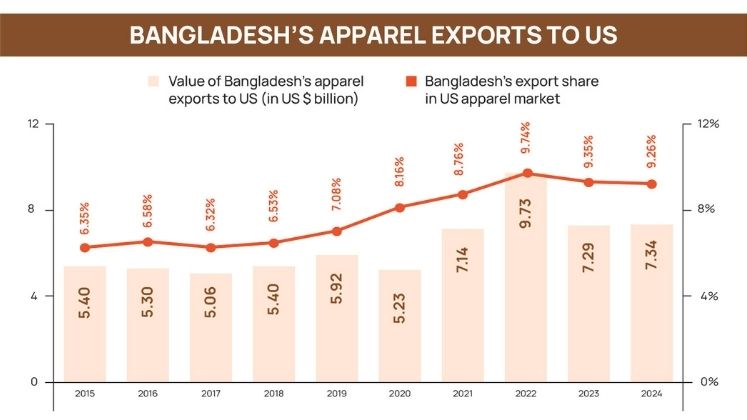

Over the past 10 years, exports to the US have steadily grown, making Bangladesh a key player in the market. In 2024, Bangladesh exported US $ 38.48 billion worth of garments overall. Out of that, US $ 7.34 billion went to the US, making it the third-largest apparel exporter to America, after China and Vietnam.

Despite being a Least Developed Country (LDC), Bangladesh hasn’t had duty-free, quota-free (DFQF) access to the US market for garments since 2013. This is because it doesn’t benefit from the Generalised System of Preferences (GSP). As a result, it’s been paying steep tariffs, an average of 15.2 per cent, with knitwear facing 18.7 per cent and woven garments 15.8 per cent. On the flip side, US goods sent to Bangladesh are taxed much less, only around 1.6 per cent in 2023-24.

The country has made multiple attempts to regain duty-free access to the US, fulfilling 16 conditions for the reinstatement of GSP benefits and submitting progress reports to the United States Trade Representative twice. Yet, the US has repeatedly stated that Bangladesh needs to do more. Finance Adviser Salehuddin Ahmed pointed out that the US has raised ‘labour-related concerns’. Many in the industry worry that once the 90-day window ends, tariffs might go up again, making Bangladeshi garments more expensive in the US. That could push American buyers to look elsewhere like countries with lower trade barriers. If that happens, it could mean job losses and less funds for improving skills, sustainability and innovation in Bangladesh.

On top of that, China, which is facing tariffs as high as 245 per cent, might start selling more to other markets like Europe and Japan. Vietnam could do the same. That means more competition and lower prices in those regions, which could squeeze Bangladesh’s market share even further.

All of this might eventually lead to higher prices in the US, which could hurt demand and, in turn, affect Bangladeshi suppliers.

To understand the way forward, we spoke with industry leaders about their views and strategies.

90-day Window to Reposition and Trigger a Wake-up Jolt

Experts say that Bangladesh must work together, not just at the factory level but also at the national level. Addressing the challenges will require more than just the 90-day reprieve. It will take long-term efforts, with the tariff shock serving as a wake-up call for the industry to become more responsive and resilient.

“We need to build strong relationships with US buyers and reassure them that we can continue supplying without any problems, while also offering more affordable products,” said Abrar Sayem, Director, Sayem Group and President of BAYLA (Bangladesh Apparel Youth Leaders Association).

| We need to build strong relationships with US buyers. If inflation rises in the US because of high tariffs, history shows that low-cost, fast-fashion items sell well during hard economic times and that is where Bangladesh’s strength lies. Abrar Sayem Director, Sayem Group and President-BAYLA |

Sayem Group is a leading sweater manufacturing company, running export-focused factories like Sayem Fashions Ltd., and Radiant Sweater Industries Ltd. The group’s products are competitively priced, with FOB prices ranging from US $ 4 to US $ 25. It manufactures around 2,80,000 to 300,000 pieces of both basic and fashionable sweaters every month, using gauges from 3gg to 12gg.

“If inflation rises in the US because of high tariffs, history shows that low-cost, fast-fashion items sell well during hard economic times and that is where Bangladesh’s strength lies,” he added.

At the same time, buyers are being careful and are mostly making short-term orders because they worry tariffs might go up again after the current pause. To deal with this, some manufacturers are taking the opportunity to offer higher-margin, value-added products like outerwear, athleisure and technical garments, where higher FOB prices can help absorb any future tariff increases.

“We see this pause as a window to stabilise, not a signal to let our guard down. We’re not rushing into price renegotiations, but we are carefully reviewing our pricing and margin structures to ensure we are protected if conditions change again,” said Usama Maqsood, Group Director, Experience Group, a leading family-owned apparel conglomerate that produces over 23 million garments annually across more than 80 production lines, supported by a workforce of 12,000.

| When garments made at US $ 3-US $ 4 FOB sell for US $ 35 at retail, does it make sense to expect manufacturers alone to absorb tariff shocks? We’re having frank discussions with our partners and we’re aligned on the need for fair cost-sharing. Buyers now understand that squeezing factories is not a sustainable solution. Usama Maqsood Group Director, Experience Group |

While the US $ 3 – US $ 4 FOB pricing model still dominates much of the industry, stakeholders are increasingly questioning the fairness of expecting manufacturers to solely bear the impact of tariff adjustments. Usama elaborated, “When garments made at US $ 3-US $ 4 FOB sell for US $ 35 at retail, does it make sense to expect manufacturers alone to absorb tariff shocks? This has to be a shared conversation. We operate on razor-thin margins. If the tariff burden falls entirely on the manufacturer, it destabilises the entire supply chain. We’re having frank discussions with our partners and we’re aligned on the need for fair cost-sharing. Buyers now understand that squeezing factories is not a sustainable solution.”

Echoing similar sentiments, Luthmela Farid, Director, Pacific Jeans, highlighted, “The best scenario is for the price increase to be shared by everyone in the value chain, including the end consumer, to protect all parties. But how much each party absorbs depends on each customer’s business strategy.” Pacific Jeans, one of Bangladesh’s top apparel exporters, produces over 40 million denim garments annually and employs more than 35,000 workers across 13 factories. The company aims to reach US $ 1 billion in exports by 2028.

| The best scenario is for the price increase to be shared by everyone in the value chain, including the end-consumer, to protect all parties. But how much each party absorbs depends on each customer’s business strategy. Luthmela Farid Director, Pacific Jeans |

However, a study by the Fair Wear Foundation found that up to 39 per cent of Bangladeshi garment exporters accept prices below production costs, often in hope of maintaining long-term relationships with international buyers.

This pricing imbalance benefits international brands, which often sell Bangladeshi-made garments at a markup of up to 400 per cent.

No wonder, Faruque Hassan, MD, Giant Group and former president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), pointed out that buyers are asking suppliers to share the cost burden of the 10 per cent universal tariff.

To fight this, sellers need to come together and refuse to lower their prices to cover the tariff. The industry association should keep a close eye on any price changes and take action against those who don’t follow the agreement.

“Bangladesh mainly exports low-and mid-priced clothes to the US, which are bought by lower-income shoppers. US retailers don’t usually want to raise prices for these items. That’s why it’s important to talk to buyers and brands and involve them in high-level discussions,” said M Masrur Reaz, Chairman and CEO, Policy Exchange Bangladesh (PEB).

| Given the likelihood of intensified competition in non-US markets, Bangladesh should develop early warning systems to track trade diversion, particularly from China. Coordinated outreach to key EU buyers, flexible pricing strategies and industry-level cooperation will be vital to minimising disruptions. M. Masrur Reaz Chairman and CEO, Policy Exchange Bangladesh |

“If we can work out a fair way to share the cost of the tariff, then even if the US keeps the higher tariff for a long time, the damage to Bangladesh can be reduced,” he explained.

Experts also highlighted the importance of diversifying into non-cotton-based products, particularly man-made fibres (MMF), to stay competitive. MMF is essential for creating technical apparel, activewear and other high-value items that offer better profit margins. “As global demand for MMF grows, Bangladesh needs to expand its product range. MMF is key not only for technical garments but also for supporting circular business models due to its recyclability. Encouragingly, the sector has already seen a 20 per cent growth in value-added categories like suits and blazers in recent years,” stressed Luthmela Farid.

Some of the top exportable apparel items from Bangladesh include cotton T-shirts, men’s and boys’ cotton woven trousers, women’s and girls’ cotton woven trousers, cotton jerseys and pullovers, MMF jerseys and pullovers, men’s and boys’ cotton woven shirts, woven cotton knitted trousers and men’s and boys’ cotton knitted shirts and trousers.

Highlighting the challenges faced by the RMG industry, Mohammad Sohel Sadat, Chairman, Shin Shin Group said, “We face real challenges compared to Vietnam’s advancing technology integration, India’s vertical integration capabilities and Indonesia’s growing design sophistication.” Established in 2007, Shin Shin Group operates five production units across Dhaka and Chittagong, with a combined monthly capacity exceeding 1.77 million pieces.

| We face real challenges compared to Vietnam’s advancing technology integration, India’s vertical integration capabilities and Indonesia’s growing design sophistication. We see a growing demand for mid-market quality and compliance capabilities. Mohammad Sohel Sadat Chairman, Shin Shin Group |

To remain competitive, the company is adopting several differentiation strategies. Firstly, it is focusing on specialised product categories where it can build strong expertise, rather than attempting to compete across all segments. Secondly, Shin Shin Group is investing heavily in sustainability practices such as implementing water recycling systems and utilising renewable energy across its production facilities, which are becoming increasingly important in sourcing decisions.

Also, the company is enhancing its quick-response capabilities by integrating digital solutions with buyers, enabling more flexible production planning. Finally, Shin Shin Group is expanding its service offerings beyond traditional manufacturing, including design collaboration, logistics optimisation and inventory management solutions.

Mohammad Sohel reiterated that the success of Bangladesh’s RMG sector won’t come from competing solely on price, which is ultimately unsustainable. Instead, the focus should be on establishing centres of excellence in specific product categories and developing partnership models that create mutual value beyond basic manufacturing.

| 245 per cent

China, which is facing tariffs as high as 245 per cent, might start selling more to other markets like Europe and Japan. Vietnam could do the same. That means more competition and lower prices in those regions, which could squeeze Bangladesh’s market share even further. |

Beyond America: Rebalancing Market Dependency

With the US market still a crucial destination for Bangladesh’s RMG exports, there is a growing push to tap into new and emerging markets. In 2024, exports to non-traditional markets reached US $ 6.33 billion, which accounted for 16.46 per cent of Bangladesh’s total RMG exports. Amongst these markets, Japan leads with US $ 1.12 billion, followed by Australia at US $ 831 million, India at US $ 606 million, Turkey at US $ 426 million and Russia at US $343 million.

The European Union (EU) remains Bangladesh’s largest trading partner, comprising 50.10 per cent of total RMG exports with shipments valued at US $ 13.42 billion in the current fiscal year (FY ’25), according to the EPB.

“Given the likelihood of intensified competition in non-US markets, Bangladesh should develop early warning systems to track trade diversion, particularly from China. Coordinated outreach to key EU buyers, flexible pricing strategies and industry-level cooperation will be vital to minimising disruptions,” mentioned M. Masrur Reaz.

“We’re leveraging preferential trade access through schemes like GSP+ that make our products more competitive in the EU market compared to non-beneficiary countries. We are also strengthening direct relationships with European brands, expanding our product portfolios to meet seasonal trends and investing in market specific certifications and packaging requirements,” said Farzad Islam Antor, Director, FTI Group, a diversified conglomerate that operates Platinum Sourcing & Services Ltd. (PSSL) in the apparel sector, which specialises in sourcing offshore apparel, home textiles, leather goods and jute products.

FTI Group is also targeting growth in Canada, Japan and the Netherlands, with a keen interest in emerging markets across Latin America and Africa. Countries such as Brazil, Mexico, Chile, South Africa, Kenya and Nigeria are now firmly on its roadmap due to their growing middle class, urbanisation and rising consumer demand. “These markets were once considered peripheral, but with reduced logistics costs and improved diplomatic ties, they have become important growth areas for us,” Farzad Antor noted.

| We’re leveraging preferential trade access through schemes like GSP+ that make our products more competitive in the EU market compared to non-beneficiary countries. We are also strengthening direct relationships with European brands, expanding our product portfolios to meet seasonal trends. Farzad Islam Antor Director, FTI Group |

Similarly, Shin Shin Group is making strategic investments in Canada, Australia and select Latin American countries. According to Mohammad Sohel Sadat, “We see a growing demand for mid-market quality and compliance capabilities. We’ve established dedicated teams to focus on these markets and build strong relationships with both established retailers and emerging digital-native brands.”

Experience Group is also exploring new markets, having opened new lines with buyers in Europe, Japan, South Korea and the Middle East. Usama Maqsood emphasised, “Diversifying our markets helps us spread risk and unlock more growth opportunities. It’s not just about reacting to tariffs, it’s about building a healthier, more global business.”

Embracing Technology and Automation

Automation, once seen as a luxury, has become a must for staying competitive in today’s market. FTI Group, for example, is investing in smart machinery, AI-driven quality control systems and automated production lines to streamline its processes.

Farzad Antor explained, “We’re moving beyond just cut-and-sew. To remain relevant, we’re focusing on advanced design capabilities, integrating CAD systems and building in-house trend forecasting teams. This allows us to collaborate earlier with global buyers.”

The company is also enhancing communication through B2B e-commerce and API integrations, which help speed up product development.

Similarly, Experience Group is focusing on automating key stages in production and sampling. Usama Maqsood noted, “It’s not just about efficiency. With AI and 3D design tools, we’re aiming to future-proof our operations for the next decade.”

Pacific Jeans is using data-driven systems, ERP tools and 3D sampling to ensure better traceability and transparency throughout its supply chain, adapting to the industry’s evolving needs.

“We’ve introduced advanced 3D design and virtual sampling. Our data analytics investments help refine forecasting and optimise production, boosting competitiveness and enhancing productivity. The aim is to evolve our workforce’s capabilities, not replace them,” highlighted Mohammad Sohel Sadat.

Experts stressed that as the industry embraces a circular economy, energy-efficient technologies are becoming essential.

As the industry gears up for change, it’s crucial for trade bodies and the government to join forces and proactively engage with the Trump administration to address and ease its concerns.

Before the tariffs were put on hold, Bangladesh had offered to lower or remove trade barriers on American goods to help reduce the trade gap, which is currently in Bangladesh’s favour. In 2024, the country exported goods worth US $ 7.6 billion to the US, while it imported US $ 2.5 billion from the US.

To strike a ‘deal’ with the Trump administration, Bangladesh can use the 2025 Foreign Trade Barriers report from the USTR (Office of the United States Trade Representative) as a roadmap. The report lists changes that need to happen to lower the total tariff on goods the US brings in.

The report raised concerns about Bangladesh’s rules on storing data within the country and its strict digital laws. It warned that these policies could hurt digital trade between countries.

| FTI Group is investing in smart machinery, AI-driven quality control systems and automated production lines to streamline its processes. Farzad Antor explained, “We’re moving beyond just cut-and-sew. To remain relevant, we’re focusing on advanced design capabilities, integrating CAD systems and building in-house trend forecasting teams. This allows us to collaborate earlier with global buyers.” |

It also pointed out problems with how customs work in Bangladesh, saying there are rules and procedures that make trade harder. The report also mentioned that Bangladesh hasn’t informed the WTO about how it values goods for customs purposes.

Bangladesh does allow full foreign ownership in most industries. But there are limits in key sectors like petroleum, gas and telecom. In 22 sectors, foreign investors also need no-objection certificates from government ministries.

While companies are legally allowed to send their profits back to their home countries, American investors say the process is slow and unclear. In some cases, it has taken over a year.

On government contracts, the report criticised corruption and a lack of openness, even though Bangladesh supports international bidding.

It also mentioned issues like bid rigging, bribery, unfair competition and frequent delays, which make it harder for American companies to win government projects. The government is already working on some of the issues mentioned in the report.

For instance, as part of its overall plan, Bangladesh has identified 30 American products that face high taxes when entering the country. In a letter to Trump, Muhammad Yunus said that Bangladesh is ready to remove taxes on US farm products and scrap metal. He also proposed cutting tariffs by 50 per cent on major American exports like gas turbines, medical devices and semiconductors.

To offer even more concessions to the US, Muhammad Yunus has also approved a license for Elon Musk’s Starlink to operate in Bangladesh. This makes Bangladesh the second country in South Asia, after Sri Lanka, to welcome the global satellite internet provider. Since 2025, Musk has served as a senior advisor to President Trump and is also the key member of the Department of Government Efficiency (DOGE).

Going forward, Bangladesh also needs to build its own supply chain for fabrics and trims. Right now, the country depends heavily on imports for these materials, which make up around 75 per cent of the total cost of making a garment. The country also needs to fix internal issues by reducing energy and transport costs. This can be done by upgrading infrastructure like improving ports, railways and roads. The clock is ticking. Whether Bangladesh weathers this tariff storm or is swept under by global tides will depend on unity, innovation and bold new strategies.

(With exclusive inputs from Iffat Ara Munia)