The Northeast is no longer on the periphery of India’s fashion map, it’s fast becoming the spotlight. A blend of growing infrastructure, rising incomes, expanding connectivity and cultural capital is transforming this region — Assam, Arunachal Pradesh, Sikkim, Tripura, Manipur, Mizoram, Meghalaya and Nagaland — into a dynamic marketplace.

Several established brands have expanded their presence in Northeast India, including Allen Solly, Peter England, Fabindia, Biba, Van Heusen and Cantabil. Additionally, international brands like Levi’s, Nike, Calvin Klein, Marks & Spencer and US Polo Assn. have also entered the region. Local brands such as S-Way, Ngote, Kintem, Ura Maku and EAST are also gaining prominence in the Northeast fashion scene.

The region’s Gross State Domestic Product (GSDP) is also growing at a rock solid pace. It grew at a CAGR of 8.17% from FY 2015 to FY 2022, reaching Rs. 5.75 lakh core in FY 2021-22.

Similarly, the per capita income is rising. As such, it crossed Rs. 1,11,757 (around US $ 1,490) in the financial year 2019-20. Sikkim topped amongst the northeastern states in per capita income with Rs. 3.17 lakh followed by Tripura with Rs. 1.54 lakh, Mizoram with Rs. 1.41 lakh, Arunachal Pradesh with Rs. 1.27 lakh, Nagaland with Rs. 1.02 lakh, Meghalaya with Rs. 81,000, Assam with Rs. 74,000 and Manipur with Rs. 65,000. The average monthly salary also grew to around Rs. 15,500 to Rs. 16,500.

Even rural areas of Sikkim and urban regions of Meghalaya have emerged as the leading drivers of growth in Monthly Per Capita Consumption Expenditure (MPCE) for the period between August 2023 and July 2024, according to the latest data from the Household Consumption Expenditure Survey (HCES).

120Over the last four years, more than 120 stores have been opened in the region by prominent Indian retailers. Out of these, 100 have been opened by leading value retailers. |

Rural Sikkim recorded a 21.3% increase in MPCE, reaching Rs. 9,377 during the period, marking the highest growth among rural areas across India.

The states of Tripura, Nagaland and Mizoram followed suit with substantial growth in their rural MPCE, with increase of 20.2%, 17.4% and 14.2% respectively. This increase reflects a broader trend of rising consumer expenditure in the northeastern states, indicative of economic development and upliftment of communities.

In the urban sectors, Meghalaya led with a 21.9% rise in MPCE, reaching Rs. 7,839. This was closely followed by urban areas in Manipur (21.8%) and Sikkim (15.1%). The robust growth in these urban regions signals an increase in disposable incomes in North east India.

Despite rising disposable incomes, the region’s per capita income remains lower than the national average of Rs. 1,85,854 (US $ 2,388). Hence, the major focus of the region is on value fashion. This is reflected in the huge number of stores being opened by value fashion retailers.

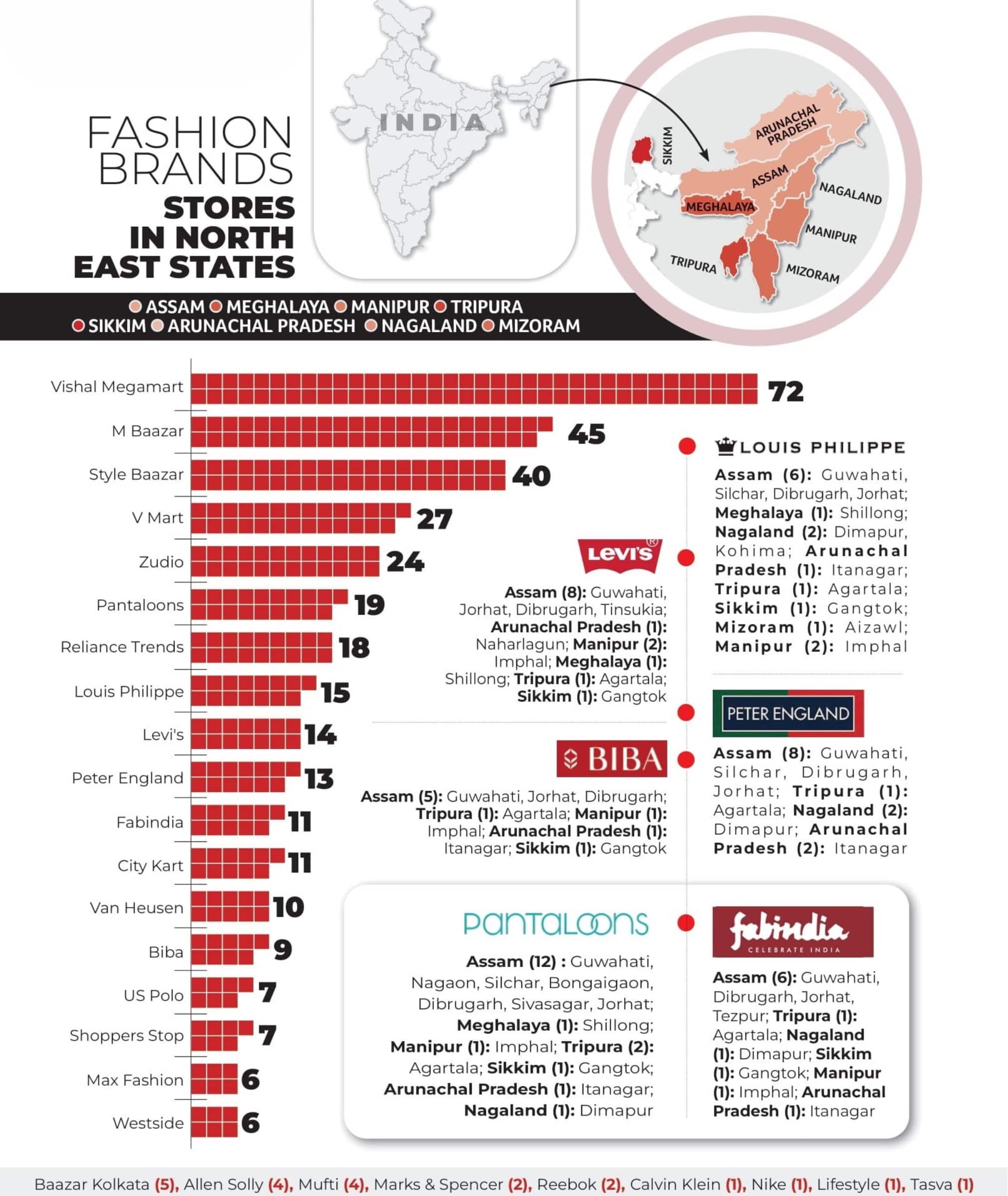

Over the last four years, more than 120 stores have been opened in the region by prominent Indian retailers. Out of these, 100 have been opened by leading value retailers-Style Baazar, Baazar Kolkata, V Mart, M Baazar, City Kart and Vishal Mega Mart, targeting aspirational customers with affordable offerings.

Vishal Mega Mart leads the pack with 72 stores, the majority (44) being located in Assam, which remains the most developed state in the region and a key entry point for brands expanding into the Northeast.

M Bazaar follows with 45 outlets, while Style Baazar operates 40 stores across the Northeast. V Mart has 27 stores and Zudio maintains 24 outlets. Citykart runs 11 locations. Max Fashion has 6 stores and Baazar Kolkata operates 5, most of them in Tripura (4). These value fashion retailers have store sizes ranging from 5,000 to 7,000 sq. ft.

Demographics Also Fuelling Demand

The region’s overall population is 45.7 million, making about 3.78% of India’s total population. The region has a population density of 175 people per sq. km, compared to 492 people per sq. km in India.

According to the 2011 census of India, Assam’s population is 31.2 million, Tripura – 3.6 million, Meghalaya – 2.9 million, Manipur – 2.5 million, Nagaland – 1.9 million, Arunachal Pradesh – 1.38 million, Mizoram – 1.09 million and Sikkim – 610,577.

The region also has a predominantly young population. A significant portion of Northeast’s population is within the 15 to 35 age group, which constitutes about 4% of the country’s youth population, which translates to roughly 20 million individuals, according to VV Giri National Labour Institute.

As such, children aged 0–14 years make up approximately 35% of the region’s population, while adults aged 15–59 years form the largest segment at around 59%. Seniors aged 60 and above account for about 6%, as per the census data.

Northeast India is also rapidly gaining recognition as a major tourist destination. According to data from the Ministry of Tourism, 118.45 lakh domestic tourists visited the northeastern states in 2022, up from 95 lakh in 2019. Tourist footfall increased further in FY 2024–25, with states like Mizoram, Arunachal Pradesh and Sikkim recording growth of over 100%.

A recent report by New York Times ranked Assam as the fourth must-visit destination in the world, while Skyscanner’s Travel Trends Report named Shillong, the capital of Meghalaya, the most popular destination for Indian travellers in 2025.

| 5.75 lakh crore

Northeast region’s Gross State Domestic Product (GSDP) grew at a CAGR of 8.17% from FY 2015 to FY 2022, reaching Rs. 5.75 lakh crore in FY 2021-22. |

Infrastructure Push Opens Up the Northeast

The improving road, rail, water, telecom and air connectivity in the northeastern region are also attracting businesses. As such from 2014 to 2022, 1,350 projects worth Rs. 15,867 crore have been sanctioned under the schemes of the Ministry of Development of North Eastern Region (MDONER) and North East Council (NEC).

In terms of road connectivity, from 8,480 km in 2013-14, the total length of National Highways in the Northeast region increased to 15,735 km in 2022-23, showcasing a growth of 85.55%. The average road density per 100 sq. km. of area is 143.72 km against the national average of 115.30 km.

Since 2014-15, Rs. 19,855 crore has been spent on developing new tracks and doubling the existing lines of the railways in the northeast region. The total railway track length in the northeast is approximately 4200.20 km, with 520 railway stations present in the region. The number of airports and waterways increased from 9 and 1 in 2014 to 17 and 18 respectively.

Players like DHL, Blue Dart, Shiprocket, Ecom Express, Xpressbees, DTDC, India Post and Delhivery have also started offering services here, which has improved deliveries. Delhivery alone has reported an increase of 30% in its northeast business in the last four to five years. Internet connectivity in the region has significantly improved over the past 6 to 7 years, with all major telecom providers now offering high-speed services. An investment of Rs. 3,466 crore has been made under the 10% Gross Budgetary Support (GBS) scheme, facilitating the upgrade to 4G connectivity in 4,525 villages across the region.

The Northeast also has a flourishing start-up scene. The region now has 2,054 start-ups, with Assam leading at 1,487 start-ups, followed by Manipur (179) and Tripura (141).

Textile development has also expanded in the region. There are namely 6 dedicated textile parks in NER including Prag Bosimi Textile Park-Darrang in Assam; Industrial Estate-Short Round Road in Meghalaya; Industrial Estate Rangpo in Sikkim; Integrated Textile Park-Kharuaja, Assam; Samvrudi Handlooms Textile Park, Khensa-Mokokchung in Nagaland; and Handloom and Handicrafts Park-Aizawl, Mizoram.

Big Ticket Projects Underway

Several mega infrastructure projects are planned across the region. Amongst them is the Arunachal Frontier Highway, a 1,748-km route that will run from Bomdila through Nafra, Huri and Monigong. In Assam, the Maa Kamakhya Corridor in Guwahati aims to promote spiritual tourism. Arunachal Pradesh is also home to the under-construction Sela Tunnel, the world’s largest double-lane tunnel, which will connect Tawang with West Kameng.

Assam is set to develop the Guwahati Metro, a 61.4 km line, while the state has also announced the construction of the 890 km Brahmaputra Expressway, stretching from Sadiya in the east to Dhubri in the west, along the river’s length. Another key project in Assam is the Palasbari–Sualkuchi Bridge, estimated to cost Rs. 4,000 crore.

In Manipur, the Noney Bridge, part of the 111 km Jiribam–Imphal railway project, will become the tallest railway bridge in the world at a height of 141 metres. The Sivok–Rangpo Rail Link, spanning 45 km, is also in progress.

Meanwhile, the Tata Group plans to set up a semiconductor processing facility in Assam with an investment of Rs. 40,000 crore. The Airport Authority of India is upgrading Lokpriya Gopinath Bordoloi International Airport in Guwahati with a new terminal building at the cost of Rs. 1,232 crore. Additionally, Assam’s Finance Minister Ajanta Neog has announced the development of ANRIT-GIG City, a 1,000-acre technology and innovation hub in Guwahati.

| 2,054

The Northeast also has a flourishing start-up scene. It now has 2,054 start-ups, with Assam leading at 1,487 start-ups, followed by Manipur (179) and Tripura (141). |

Street Markets, Malls and Influencers Drive Fashion

There are more than a dozen shopping malls in the region. The largest mall is the City Centre Mall in Guwahati, which has a total area of 400,000 sq. ft. Additionally, the Assam government is developing a Unity Mall (Ekta Mall) in Guwahati, costing Rs. 226 crore to promote national integration and the ‘Make in India’ concept.

The region is home to vibrant high streets and markets that reflect the region’s rich cultural identity and craftsmanship. In Assam, there is Guwahati’s Fancy Bazaar and GS Road, while Arunachal Pradesh has Itanagar Crafts Centre and Tawang’s Handicraft Emporium.

Shillong in Meghalaya features Lew Duh Market, alongside the bustling Police Bazaar. In Mizoram, Aizawl’s Bara Bazaar and Thenzawl Handloom Market specialise in locally woven fabrics. Nagaland’s Dimapur hosts Hong Kong Street and Kohima’s Naga Bazaar. Manipur offers the iconic women-run Khwairamband Bazaar in Imphal, complemented by the nearby Paona Bazaar. Tripura has Purbasha Emporium in Agartala and JB Road. In Sikkim, Gangtok features MG Road and Tashi Viewpoint Bazaar. Each of these streets captures the spirit of its state. Perhaps the most potent–and underreported–shift is the rise of a homegrown influencer economy.

The Northeast is home to a vibrant community of fashion influencers who are making their mark on social media with distinct styles and strong personal brands. These include Veronica Awungshi (192K), Merenla Imsong (144K), Nilu Yuleena Thapa (110K), Peden Ongmu Namgyal (96.6K), Juhili Debbarma (69.4K), Angelina Pongener (57.8K), Aien Jamir (52.7K), Gloria Tep Rengma (36.4K), Shivani Boruah (16.5K), Asenla Jamir (10.3K) and Lee Middleton (6.6K). These influencers reflect the diversity and creativity of the region’s fashion scene, shaping trends and representing Northeastern style on a national stage.

Several brands have begun tapping these creators for micro-influencer campaigns, signalling a shift in marketing strategy from Bollywood-led top-down storytelling to grassroots, hyperlocal engagement.