How many companies over 250 years old do you know and how many of them have managed to thrive through World Wars, the Great Depression, the rise and fall of empires, the formation of new nations, technological revolutions and countless other seismic shifts in the political, economic and social landscapes? Not many, right? That’s why we reached out to the leaders at Coats, the world’s largest thread and sewing materials company, to uncover the secrets behind its ability to stay ahead of the curve in a constantly changing environment.

Even in tough economic times, Coats continues to thrive. The company registered a 7 per cent revenue growth from US $ 695 million in H1 2023 to US $ 741 million in H1 2024, fuelled by strong growth in footwear and sustained momentum in apparel. Despite softer order book activity in personal protection and composites, particularly in the Americas, the Performance Materials division remains resilient while the company’s overall sales growth continues to keep it on track. EBIT margins have also increased from US $ 108 million to US $ 133 million. In 2023, the company posted US $ 1.4 billion in revenue and US $ 184 million in operating profit.

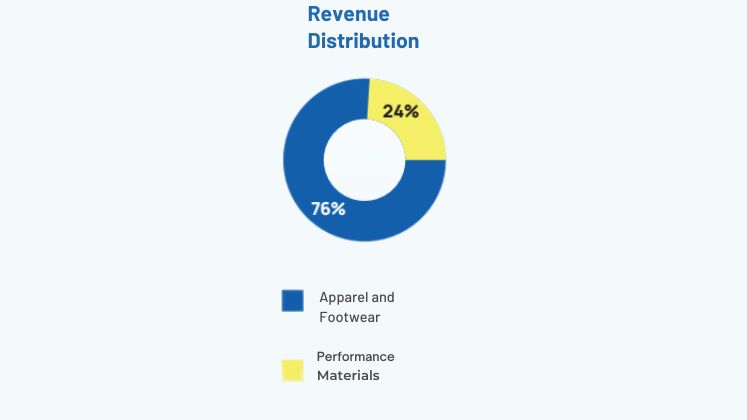

Apparel and Footwear make up 76 per cent of Coats’ total revenue, while Performance Materials contribute 24 per cent. When it comes to revenue by region, Asia leads with 59 per cent share, followed by the Americas at 18 per cent and EMEA at 23 per cent. Today, the company is led by Group Chief Executive Officer – David Paja, who brings over 30 years of leadership experience in automotive, aerospace, defence, fire and security industries. Alongside him is Chief Executive Officer – Apparel and Group Chief Commercial Officer, Adrian Elliott, a Coats veteran with nearly four decades of industry expertise. When asked about navigating the unpredictable future, their response was refreshingly candid: “Over the past 10 years, we’ve all learned not to try to predict the future. The only certainty is that we operate in a volatile and uncertain context and that’s not going to change.”

In an exclusive interview with Apparel Resources, the duo spilled the beans on their strategies, the cutting edge solutions they’re delivering to customers, their insights on evolving market trends, growing appetite for tech investment, sustainability priorities and all the key issues shaping the industry today. Here are the edited excerpts.

AR: Congratulations on your appointment as Group Chief Executive Officer. With your diverse experience across aerospace, automotive and technology, what leadership principles or ‘mantras’ guide you across industries?

David: If you look at my career journey, although I’ve worked across multiple sectors, the common thread has been the B2B space. Whether it’s global businesses, manufacturing or engineering, the core nature of the challenges remains similar. At the end of the day, it’s about addressing fundamental questions: How do we improve operations? How do we better serve customers? How do we drive innovation? These are universal challenges, regardless of the specific industry. Having gone through similar transitions in other industries, I’ve developed a bit of a pattern for getting up to speed quickly. I believe there’s no substitute to travelling and experiencing things firsthand— whether it’s visiting the teams, meeting customers or understanding the markets. In my first three months here, I’ve travelled to 10 countries and visited close to 20 manufacturing sites. That’s roughly 75 per cent of our global operations and it’s been an incredible way to learn.

Travelling allows me to really dive into what makes us successful in each market, identify growth opportunities and understand the unique characteristics of every region. For example, the dynamics in India are quite different from those in Indonesia, Vietnam or Mexico. It’s about recognising those differences in customer needs and evaluating our local capabilities to address them effectively.

Speaking of leadership principles, I’ve always believed that the hallmark of a successful business is its customer centricity. Everything starts with the customer. No matter the market, your success hinges on how well you understand and serve your customers. For me, this means delivering excellent service every single day.

| “Our main focus is on how Coats Digital (the software business of Coats Group) can help manufacturers and brands improve productivity, deliver higher quality and ensure better transparency in their operations. That’s where we’re investing a lot of resources. Adrian Elliott Chief Executive Officer – Apparel & Group Chief Commercial Officer |

AR: What new trends have emerged in the Indian market recently? Has there been a significant shift towards Minimum Order Quantities (MOQ ) and how has this affected your strategy moving forward?

Adrian: I’ve been coming to India for quite some time and there’s a palpable sense of dynamism here. Across the industries we serve—whether it’s apparel, footwear or performance materials—we’re seeing increasing investments and expanding capacities.

The development of retail in smaller cities is another trend that’s hard to miss.

There’s also a strong trend towards speed and personalisation, which is driving a shift in the supply chain, including smaller and more fragmented orders. This market is becoming faster, more professional and significantly more tech-savvy, with growing investments in technology across sectors.

For instance, in the Apparel Division, we have increased the penetration of premium products and successfully launched new products to capture untapped markets in tailoring. In the readymade garment sector, we conducted over 300 customer technical clinics to secure market share gains.

| “More global vendors are looking at India as a potential export base, with increased investments and capacity-building. What once was a potential is now becoming a reality, with companies starting to deploy capital into India for exports. Globally, there are several key markets, but India remains important on our list for expansion. David Paja Group Chief Executive Officer |

From a brand perspective, the changes in cycle times are particularly striking. Earlier, for example, brands used to work on 160-day cycles, which then shortened to 90, 60 and even 30 days. For some domestic markets, it’s now down to seven-day cycles. These trends toward shorter cycles, or ‘speed lanes’, reflect a shift in how the industry operates.

For us, it’s all about being faster, more agile and responsive to customer demands.

AR: How do you view the current global environment? Do you think the worst is behind us?

Adrian: Well, I think over the past 10 years, we’ve all learned not to try to predict the future. The only certainty is that we operate in a very volatile and uncertain environment and that doesn’t seem likely to change. Every year brings in new challenges and we’ve had to adapt accordingly. Looking at the apparel and footwear industry, there was certainly a buildup of inventory during the stocking cycle. At a global level, we feel like demand is starting to normalise and we believe we’re almost there across key markets. But of course, the future is always uncertain.

AR: Coats has a rich history spanning over 250 years and has achieved a 7 per cent revenue growth in H1 2024, despite challenges like the industry destocking cycle. As someone with fresh eyes, what strategies do you have in place to sustain this positive momentum?

David: Coats has a really unique and strong culture, one that’s both deeply rooted and forward thinking. The fact that Coats has survived for over 250 years speaks volumes about its ability to adapt, evolve and stay resilient. The culture here is very much focused on execution and efficiency, which has contributed to our success. At the same time, there’s a strong openness to new ideas and innovations.

If I look at the last decade in particular, Coats has made significant strides in optimising its portfolio. We’ve exited certain product lines like our EMEA zips business and strategically focused on investing in new markets while stepping back from others.

Another significant factor in our growth is our global footprint. We have strategically positioned factories in regions where demand is strongest. For instance, our substantial presence in markets like Vietnam and Indonesia ensures that we are where our customers need us most.

Here in India, for example, we’ve reshaped our entire distribution centre network, making it more future-ready and better positioned to meet customer needs.

Our commercial strategy also plays a critical role. We’ve built deep relationships with global brands— serving 800 brands and 27,000 customers worldwide—and have equally strong connections with Tier-1 suppliers at the local level. This dual focus enables us to deliver comprehensive solutions and maintain strong growth momentum.

If you look at the markets we operate in, they tend to grow at around the GDP rate. However, we’ve been outperforming that by gaining market share in both apparel and footwear over the past few years and we aim to continue doing so.

Additionally, we are exploring adjacent growth areas beyond our core business. Coats Digital, for instance, provides software solutions that boost customer productivity, building on our existing relationships to offer more advanced solutions. In 2024, we saw double-digit growth in bookings, reflecting strong customer confidence in our solutions.

In Apparel, we’ve seen a lot of product innovation around soft seams and stretchable fabrics. For instance, our Hi-P high bulk sewing thread stands out for delivering soft, durable seams that enhance both comfort and production efficiency—key factors in today’s competitive apparel industry. This innovation has opened new doors in athleisure and innerwear markets, where comfort is king.

In our Performance Materials division, we’ve been focusing on personal protection solutions—taking yarns and developing protective fabrics that enhance safety.

Similarly, in our Footwear division, we acquired, as part of the Rhenoflex acquisition, the proprietary ‘Rhenoprint’ 3D printing IP, which offers leading brands a zero-waste, print-to-order solution with enhanced footwear performance. There’s a lot of exciting innovation happening across all these areas.

AR: You mentioned serving 800 brands and 27,000 customers worldwide. What, in your view, is the best way to build strong and lasting relationships with customers?

David: We follow one simple but powerful mantra – customercentricity! It’s about delivering excellence every day. This means consistently delivering quality, on time and with the right speed. That’s the mindset that truly

makes a difference throughout the organisation. We follow the SPIQRS model (pronounced like ‘speakers’), which focuses on Speed, Productivity, Innovation, Quality, Reliability and Sustainability.

Each customer may prioritise different aspects—some value Speed, others Innovation or Reliability. But at the core, everyone is looking for a holistic value proposition. Our approach is to ensure we provide solutions that enhance these areas, helping our customers drive success through improved speed, increased productivity, better quality and greater reliability. That’s what truly adds value to our partnerships.

In today’s uncertain environment, there is a growing focus on stability and reliability and Coats delivers just that. We’ve observed a clear shift towards partnerships built on trust and consistency.

AR: Coats has ambitious plans to reduce in-house emissions by 46 per cent and wider supply chain emissions by 33 per cent by 2030 and achieve net-zero by 2050. Can you share the progress so far and what’s next on this journey?

Adrian: We’re pleased with the progress we’ve made so far, particularly in areas like energy, water, waste, energy intensity and Scope 1 and 2 emissions. We’re ahead of where we initially set out to be.

I’d say one of the major achievements, which has exceeded even our own expectations, is the launch of our recycled product range, particularly under the EcoVerde brand with 100 per cent recycled core spun and textured sewing threads. This has increased the percentage of sustainable materials in our products, primarily driven by the greater use of recycled polyester fibres and filaments in our thread products.

Our recent sustainable sewing thread offerings – Eco Regen and Eco Cycle – have been awarded the prestigious PLATINUM certificate – the highest rated Material Health Certificate from the Cradle-to-Cradle Institute.

Our absolute Scope 1 and 2 emissions dropped during 2023 due to lower production levels caused by continued destocking in the textile supply chain. However, beyond that volume impact, we have made considerable progress in decarbonising our Scope 2 energy and hence our Scope 1 and 2 emissions intensity on a like-for-like basis when compared to 2022 has dropped by 29 per cent.

We remain committed to reducing absolute Scope 1 and 2 GHG emissions by 46.2 per cent by 2030, from a 2019 base year, and increasing renewable electricity sourcing from 5 per cent in 2019 to 100 per cent by 2030. Additionally, we aim to reduce absolute Scope 3 emissions by 33 per cent by 2030.

In 2023, 71 per cent of the fuel consumed were natural gas, with the remainder made up of biomass (21 per cent), oil (7.5 per cent), diesel and petrol (1 per cent).

Between 2019 and 2022, we achieved a 38 per cent reduction in water intensity, and in 2023, we further reduced it by 5.5 per cent, bringing it to 35.6 litre/kg.

We’ve set a target to reduce waste to landfill by 30 per cent from 2022 levels, aiming for zero waste to landfill by 2026. We’ve made upgrades to our Sustainability App, allowing sites to track up to 36 waste types in line with the EU Waste Framework Directive and assign disposal destinations to each type. In 2023, we sent 1,449 tonnes of waste to landfill, representing a 37 per cent reduction from the 2,296 tonnes sent in 2022.

| PLATINUM C E R T I F I C A T E

Coats’ recent sustainable sewing thread offerings – Eco Regen and Eco Cycle – have been awarded the prestigious PLATINUM certificate, the highestrated Material Health Certificate from the Cradle-to-Cradle Institute. |

We are also working on our longterm net-zero targets for 2050 which have now been approved by SBTi. I firmly believe true sustainability is incomplete without ensuring the mental and overall well-being of employees. That’s why, we are dedicated to building a conducive work environment and our efforts have been recognised by Great Place to Work and Fortune magazine as one of the World’s Best Workplaces in November 2023, placing us in the top 25 companies globally.

Sustainability can be viewed as a cost, but we’ve chosen to see it as a competitive advantage—a way to stand out and differentiate ourselves. As leaders in threads and structural components globally, we believe it’s our responsibility to lead by example. After all, if we don’t step up and pave the way, who else will?

AR: Have you noticed any specific trends around sustainability lately?

David: Looking ahead, there are two key areas that will drive our journey forward. First, in the area of material transition, the shift from recycling to more circular models is gaining significant momentum. Instead of recycling plastic bottles, we’re now focusing on more advanced methods like recycling industrial waste. This is a major focus and we aim to maintain a leadership position here as new technologies and private investments continue to accelerate.

The second key area is the application of digital technology. Consumer demand, along with increasing regulations, is pushing for greater transparency – things like digital product passports and tracking CO2 footprints will become crucial.

There’s a lot we can do to prepare from a digital standpoint. We’re working to ensure our systems are ready to aggregate this information globally. For a global company like ours, this requires significant effort to get our systems architected in a way that allows data to flow automatically and efficiently.

We’ve already invested considerable time and resources in understanding the changes needed for our systems to be fully prepared.

However, there are some issues that need to be ironed out. For instance, on the legislative front, the European Union’s regulations are already creating uncertainty. No one knows exactly how these will impact manufacturers in India and other regions. It’s clear that the legislation is coming, but the details remain unclear.

Similarly, on the technology side, circularity is a key concept, but there’s still a lot of work to be done on developing scalable solutions. Companies are beginning to explore these areas, but no one has fully cracked the approach yet.

AR: Can you share the digital solutions you’ve implemented so far and what exciting next steps you’re planning?

Adrian: Exciting things are happening! Our main focus is on how Coats Digital (the software business of Coats Group) can help manufacturers and brands improve productivity, deliver higher quality and ensure better transparency in their operations. That’s where we’re investing a lot of resources and we’re excited to see even more customer focused technology innovations, especially around AI for customer service and streamlining processes.

Let me give you a few examples. One is Tech Connect, which is a digital platform connecting with factories to deliver technical services. It allows our customers to place sewing thread enquiries, raise production line issues or simply allow you to speak to someone about productivity improvements within your factory.

Another key initiative is our Shop Coats portal, which is the one-stop destination from requesting a sample to placing a complex bulk order across multiple product lines.

In our Footwear division we acquired, as part of the Rhenoflex acquisition, the proprietary ‘Rhenoprint’ 3D printing IP, which offers leading brands a zero waste, print-to-order solution with enhanced footwear performance. That gives us the ability to add real value to shoes in ways that weren’t possible before.

We operate in very fragmented industries and we’ve seen firsthand how technology can simplify operations and make life easier for our customers. In fact, our India team is leading the way in rolling out these digital solutions globally.

AR: What are the key obstacles slowing down the digitisation journey?

David: There’s no shortage of hurdles holding back digitisation. For one, costs are rising, but consumers still want to pay less. This puts a lot of pressure on businesses.

| “Looking at previous instances, like during the Trump administration and the tariffs on China, we’ve seen some shifts in production. These shifts often result in production moving from regions like China to other countries— Vietnam, Indonesia and now more recently to India. From our perspective at Coats, we’re relatively insulated from some of these tariff risks due to our strong presence in all of these regions. David Paja Group Chief Executive Officer |

The over-reliance on email and Excel creates a major bottleneck, hindering optimal system setups, supplier interfaces and data quality. Even in companies with more advanced tools, the lack of integration across businesses keeps them from reaching their full potential.

Businesses must take a deep dive into their own operations and understand specific buyer expectations to pinpoint a digital adoption strategy that delivers maximum value.

According to a McKinsey report, two thirds of apparel Chief Purchasing Officers, responsible for sourcing US $ 137 billion, rated their digitisation maturity (and their suppliers’ too) as low or very low. This approach just isn’t sustainable anymore!

To truly succeed in digitising sourcing, businesses must expand their focus beyond just sourcing departments and core sourcing processes. They need to drive endto-end process efficiency, foster cross-functional and cross-company collaboration and gain deeper insights into the manufacturing process.

Also, not everyone is quick to adopt change, but the new generation is more tech-savvy. As long as the benefits are clear, the productivity gains are real and the payback is reasonable, businesses are more open to adopting these solutions. This shift is also linked to generational changes in how people approach technology and innovation.

AR: We’re seeing Coats’ growing focus on the footwear sector, especially with the acquisitions of Texon and Rhenoflex, which are leading structural material solutions providers for the footwear industry. How do you see these developments shaping Coats’ plans for the footwear market?

Adrian: I think footwear is definitely an interesting space for a few key reasons. First, there’s been a lot of innovation happening in the footwear industry over the past 15 years—materials, design and overall construction have changed significantly. At Coats, we’ve been focusing a lot on the premium side of footwear, especially in areas like athleisure and sports shoes, which are growing rapidly.

As I mentioned earlier, we’re aiming to grow above GDP and the footwear segment has consistently been growing at around 4 per cent per year. It’s a space that’s ripe for innovation and offers great opportunities for new technologies to emerge.

Also, the value that customers see in Coats owning those businesses has been incredible. In footwear, effective crossselling of threads and Texon components secured over 30 new business wins.