In the last few months, there have been many negative as well as some positive developments which have had significant impact on Bangladesh’s RMG trade. Going forward, BGMEA elections will be held in the next four months, so it would not be wrong to say that the industry is going through a series of developments, many of which will have short-term as well as long term impact. There are various reports that the industry faced loss of US $ 400 million and saw order shift of US $ 2 billion amidst the recent unrest. As per official reports, around 400 factories experienced about 15 days of production loss due to the turmoil, with annual exports from these factories valuing at around US $ 7.5 billion.

In this light, Apparel Resources (AR)’s survey is an effort to figure out how all these developments have impacted the industry and how things will take shape in the future.

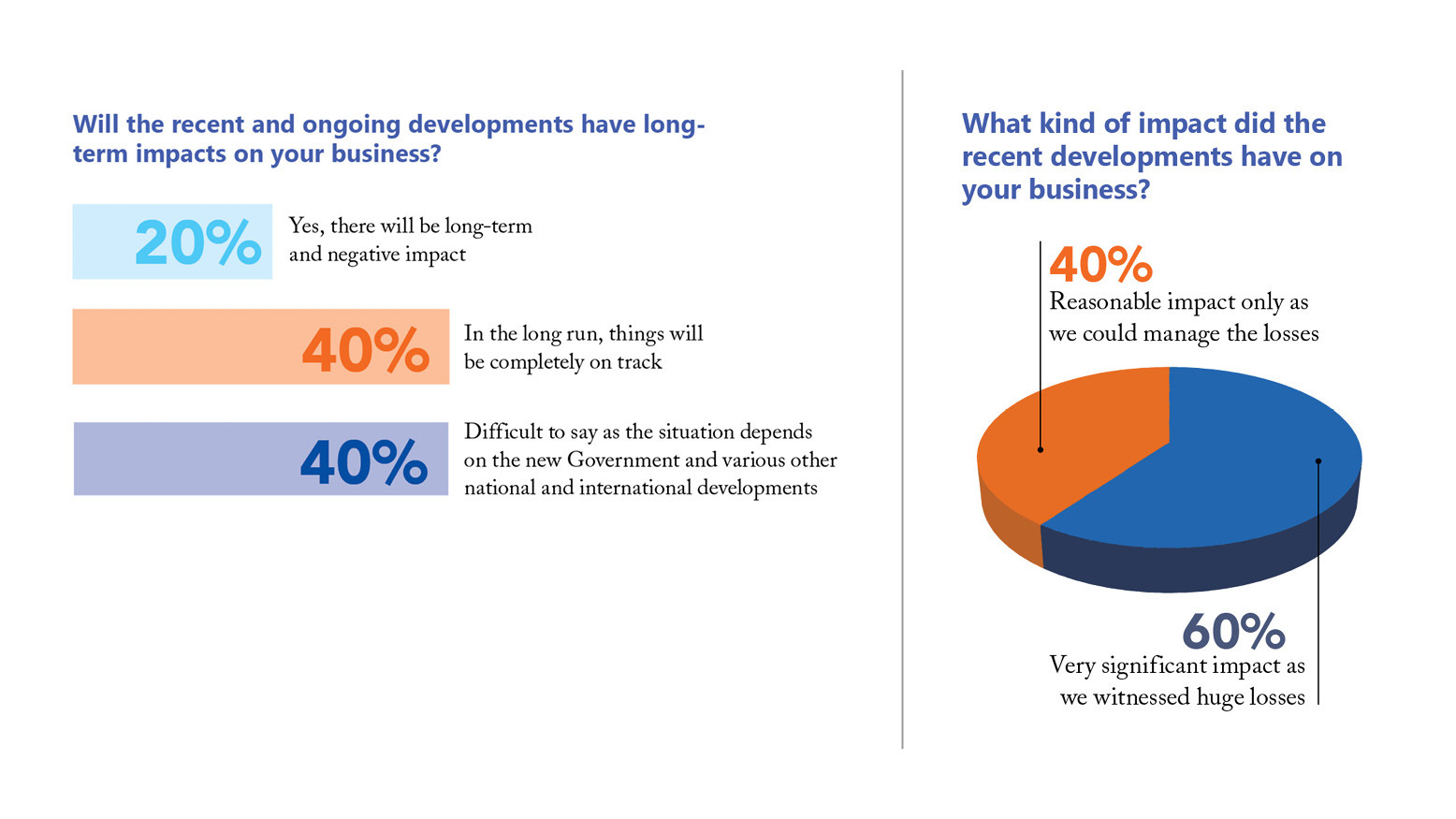

About 20 per cent of the industry believe that the recent developments will have long-term impact which shows how deeply the industry is affected because of all this while 40 per cent of the stakeholders are of the view that the recent developments will decide the future of the industry. Similarly, 40 per cent of the respondents in the survey are quite hopeful that in the long run, things will be completely back on track.

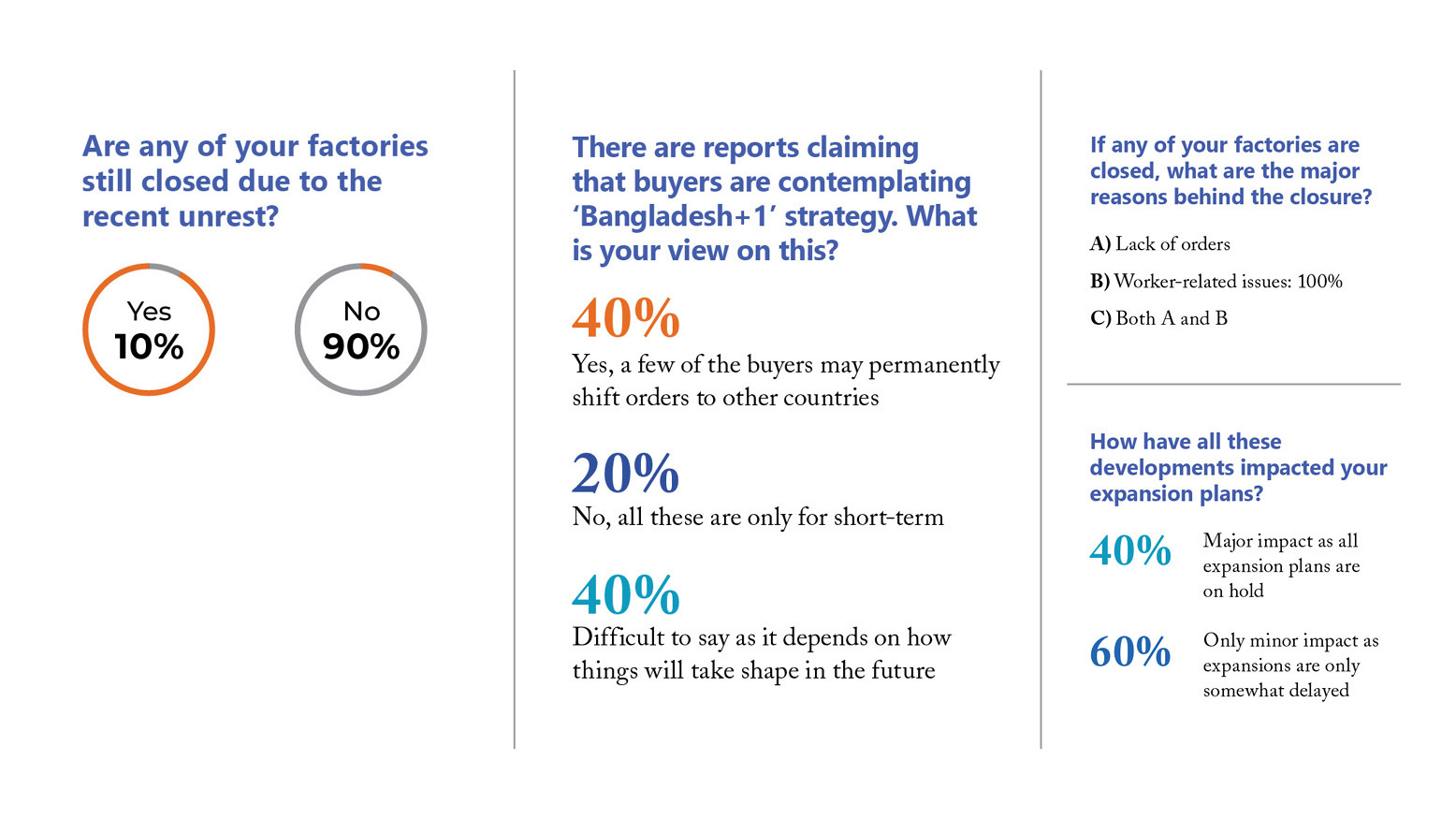

The most satisfactory development is that at the time of writing this piece, 90 per cent factories were operational while rest 10 per cent were also supposed to start working soon.

Worrying aspects

One of the most worrying aspects is that 40 per cent of the exporters who participated in this survey believe that a few of the buyers will permanently shift their orders to other countries. There have been several talks about the ‘Bangladesh+1’ strategy being adopted by buyers and India has gained from this of late in its apparel exports which saw a 12 per cent increase in August this year compared to the same month of the last year. And it is being said that India will gain momentum in US apparel market too as crisis in Bangladesh continues.

Another 40 per cent owners informed that they have been majorly impacted as all expansion plans are put on hold due to the negative developments whereas 60 per cent owners’ expansion plans have been delayed. They are not sure about when these expansion projects will start.

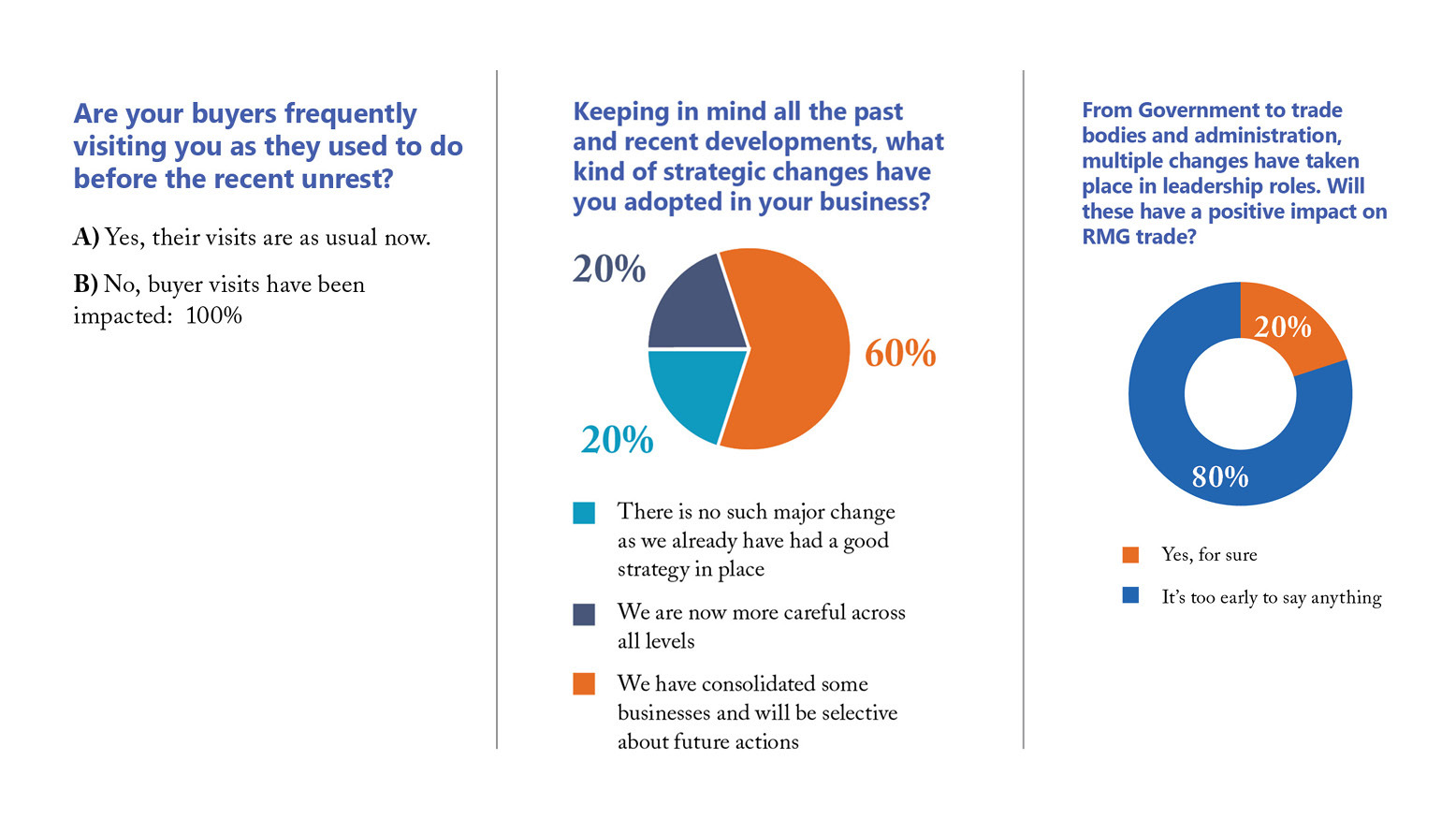

It is also a point of concern that 100 per cent of respondents of the survey are of the view that their buyer visits have been impacted in last few months.