2025 is knocking—let’s open the door to what’s next!

After taking insights from industry’s top experts and digging deep into market movements, we’ve uncovered 7 defining trends that will dominate 2025. Bangladesh is facing tough times, battling economic, social and political challenges. Restoring democracy and building trust in the election process will be critical for the interim government.

The RMG sector, vital for national exchequer, would seek diversification into emerging markets like Latin America, Africa and the Middle East while moulding ways to be on the right side of the EU’s sustainability laws.

Fresh leadership in trade bodies and economic authorities is expected to bring renewed energy, focusing on innovation, collaboration and resolving industry-specific issues like lead times and shrinking margins. Simultaneously, logistics infrastructure is set for an overhaul, with initiatives such as the National Logistics Policy 2024 and projects like Matarbari Port promising reduced shipping costs and improved connectivity. Strengthening ties with key allies like Washington, Delhi and Beijing will be critical for trade and strategic collaborations. Dive into more insights!

Bangladesh’s Battle On Multiple Fronts To Intensify

Bangladesh is currently striving for justice—economic, social and criminal— to rebuild the nation in line with its citizens’ aspirations and is facing numerous obstacles for the same.

One major issue for the interim government is to restore genuine democracy, as Bangladesh has not experienced a competitive election in 15 years, partly due to opposition boycotts. This lack of democratic process has mainly contributed to widespread protests.

An immediate priority should be to reinstate the independence of the election commission to build confidence in upcoming polls, which ‘could be fixed by the end of 2025 or the first half of 2026’.

Legal and security reforms are also urgently needed. The interim government should collaborate with a broad range of stakeholders, including established political parties, civil society members, technocrats, and notably, student leaders who have gained public respect. A stable political environment is also crucial for the RMG industry which is the largest source of foreign income for Bangladesh’s economy.

The country’s industries have also been facing a prolonged gas shortage for more than two years now and industry leaders have time and again voiced their concerns. If the crisis is not addressed soon enough, it could potentially turn many hard-working businesses into loan defaulters.

As one of the world’s largest deltas, Bangladesh is believed to have rich natural gas resources.

However, it hasn’t explored them as much as neighbouring countries. For example, India’s Tripura state has drilled over 150 exploratory wells, while Bangladesh has drilled about 100.

Another challenge is the issue of wages. The authorities have sanctioned a 9 per cent yearly pay increment for workers. The pay, effective from 1st December 2024, will be reflected in the wages of workers from January 2025, but the workers are unhappy. If the wage issue gets snowballed into a major issue in 2025, it could cause serious problems for the RMG industry.

The liquidity crisis would also test the resolve of the interim government. Despite rising interest rates on deposits and various efforts by the central bank, the crisis continues. Then on the economy front. the IMF has lowered the economy projection in FY ’25 from 6.6 per cent to 3.8 per cent. The inflation would also remain on the higher side.

In 2025, the effort of the government would be to improve the overall business environment, increase tax collection, boost production and restore confidence in the banking system to resolve these issues.

Emerging Markets And Diversification: Key Drivers For RMG Growth In 2025

The RMG sector is primarily dependent on traditional markets such as the US and the EU, which together account for 70 per cent of its market share. However, these markets are becoming saturated and new regulations are making business operations more challenging. For example, the EU’s upcoming sustainability laws will require local manufacturers to invest in new technologies and infrastructure. The rise of protectionist trade policies and the potential revocation of preferential trade agreements like the Generalised System of Preferences (GSP) in both regions also pose threats to the competitiveness of the country’s industry.

The potential of emerging markets such as Latin America with growing economies and sizeable population can’t be ignored. Other hotspots such as Africa and the Middle East must also be looked into actively. Bangladesh should consider Free Trade Agreements with these countries.

Establishing partnerships with local retailers and investing in brand development initiatives can strengthen market entry strategies. No wonder, various companies are actively participating in sourcing expos to promote their products in these emerging markets and this practice would further embolden in 2025. Moreover, various brands and retailers from Russia, India and Australia have shown interest in sourcing or to increase their existing RMG sourcing from Bangladesh.

Raw material diversification too plays a significant role as the MMF (ManMade Fibre) base continues to grow across the global textile industry. Recently, we reported how companies have placed increased focus on this area. The BGMEA has set an ambitious goal of increasing MMF-based garment production to 40 per cent by 2030.

The jute sector, which is a major strength of Bangladesh and holds significant potential for value added products, offers important opportunities. The Bangladesh Textile Mills Association (BTMA) has emphasised the need to prioritise jute for sustainable development. The issue of product diversification is also expected to gain momentum as T-shirts, trousers and sweaters continue to dominate the country’s exports.

As global buyers increasingly favour vertically integrated supply chains, along with the challenges of sourcing quality, cost-competitive raw materials—particularly fabric—larger RMG exporters look to strengthen their backward linkages or consider becoming vertically integrated.

If the overall business environment in Bangladesh remains stable and positive, some segments of the RMG industry may resume or expand their growth plans in 2025. As per Apparel Online survey, around 40 per cent of the expansion plans were delayed or put on hold due to disruptions in 2024, while 60 per cent of owners had their plans slightly adjusted.

Fresh Leadership To Power RMG Sector Forward

New leaders bring fresh ideas and energy that push the industry forward. Their different perspectives drive growth, improve competitiveness and ensure the industry stays ahead in today’s fast-paced world. At a time when the industry stands at a critical juncture, new faces at the helm of key industries are just what the doctor ordered. A slew of leaders took office last year and the full impact of their policies would be evident beginning this year.

For instance, Anwar Hossain, the Vice Chairman of the Export Promotion Bureau (EPB), recently stepped in as the new Administrator of BGMEA, one of the most active trade bodies in the world following the sudden resignation of SM Mannan Kochi. His task is to hold fresh elections on priority. Similarly, the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) also underwent a leadership change. Mohammad Hatem, a long-serving Executive Member and Vice President, has now taken the reins as the new President.

Moreover, the Bangladesh Textile Mills Association (BTMA) has also seen change at the top. Shawkat Aziz Russell, Chairman of Amber Group and former Senior Vice President of BTMA, has been elected as the new President. Russell’s leadership is anticipated to foster collaboration and innovation within the textile mills sector.

Additionally, in September, Ashik Chowdhury was entrusted with dual roles. He was appointed as the Executive Chairman of the Bangladesh Investment Development Authority (BIDA) and the Bangladesh Economic Zones Authority (BEZA). These leaders would be tasked to navigate the RMG sector amidst challenges like political turmoil, increasing cost, energy crisis, reducing lead time, decreasing order size, highly under pressure margins, dollar crunch and global uncertainty.

Logistics Sector Revamp To Be Prioritised

Bangladesh has big ambitions – to become a fully developed country by 2041 and reach US $ 100 billion in RMG exports by 2030. But to make these dreams a reality, strong infrastructure is a must. The challenge is huge as freight traffic is expected to increase sevenfold by 2040-41 and ports like Chattogram are struggling with outdated equipment and limited capacity. In December, the port entered ‘Three Million Club’ by processing over three million containers in just the first few days.

On the positive side, concrete efforts are being made to spruce up the infrastructure. For instance, the approval of the National Logistics Policy for Bangladesh 2024 is a step in the right direction. This policy aims to improve logistics operations and boost efficiency across the country. Key initiatives under the policy include building logistics hubs, economic zones and upgrading ports – both river and seaports – along with international corridors and airports.

Projects like Padma Multipurpose Bridge besides the expansion of the country’s top airport terminal and the inauguration of the first deep seaport mark significant milestones. These are essential for better connectivity, reducing travel times and encouraging industries to move to less developed areas where operating costs are lower.

The Matarbari Port, expected to be fully operational by 2030, will be Bangladesh’s first deep seaport. It will reduce reliance on foreign ports like Colombo and Singapore, cutting shipping costs and improving supply chain efficiency.

With the establishment of a transshipment facility for Bangladeshi cargo at Delhi airport in March 2023, it rapidly evolved into a crucial hub for transshipment to European destinations.

Approximately 8,000 metric tonnes of RMG from Bangladesh were moved through Delhi Airport to various European countries such as Spain, France and the Netherlands in the past year alone.

| 88 Bangladesh ranks 88th among 139 countries in the 2023 Global Logistics Performance Index (LPI), lagging behind India (38th) and Sri Lanka (73rd). It even has the highest logistics cost at around US $ 1,833.2 per 100 kg |

That said, the progress hasn’t been fast enough. Bangladesh ranks 88th among 139 countries in the 2023 Global Logistics Performance Index (LPI), lagging behind India (38th) and Sri Lanka (73rd). It even has the highest logistics cost at around US $ 1,833.2 per 100 kg, much more than Vietnam (US $ 717), Turkey (US $ 792), China (US $ 980) and India (US $ 1,080).

Direct shipping still poses a significant challenge for the RMG industry. Due to reduced costs and delivery time, direct shipping from the Chattogram port has been a major boon to the RMG industry but efforts in this regard are coming to a halt as shipping lines are discontinuing their operations.

As per reports, the routes that have already ceased operations from the Chattogram port include those to the Netherlands-Spain, China, the UAE and the UK. Currently, shipping routes from the port to Italy, France and Spain are also in uncertainty.

| The Bangladesh-India relations are going through a reset following one-and-a-half decade of close ties under Sheikh Hasina regime. Since New Delhi invested heavily and for a long time in Hasina and her party, it now has limited connections with those in power. |

In 2025, the emphasis of the authorities would also be to automate customs processes to reduce the cost of import and export. According to a time release study (TRS) conducted by the National Board of Revenue (NBR), the average time required for import clearance processes is over 10 days at Benapole land port, 11 days at Chattogram and 7 days at Dhaka. A significant portion, ranging from 72 per cent to 78 per cent of the clearance processing time is consumed by collecting and submitting import documents.

According to the World Bank, efficiency in the logistics sector could offer substantial cost savings, ranging from 7 to 35 per cent depending on the subsector. The government is expected to address this matter on a war footing this year.

Strengthening Ties With Washington, Delhi And Beijing

How well Dhaka deals with Washington, Delhi and Beijing, all critical trading partners of Bangladesh, would define the success of its overall foreign policy.

The Bangladesh-India relations are going through a reset following one-and-a-half decade of close ties under Sheikh Hasina regime. Since New Delhi invested heavily and for a long time in Hasina and her party, it now has limited connections with those in power and lacks the influence to secure its interests effectively.

The effort of the interim government would be to reduce the distrust and concerns some sections in India have about Bangladesh. Restoring close ties is important for both countries and could benefit Bangladesh, especially in light of the current, tough economic environment. Bangladesh is India’s biggest trade partner in South Asia, while India is Bangladesh’s second largest trade partner in Asia. In FY 2023-24, Bangladesh exported goods worth US $ 1.97 billion to India. The total bilateral trade between the two countries in FY 2023-24 stood at US $ 14.01 billion.

Improving logistics and infrastructure also depends on cooperation with India, as both countries have worked together on multiple projects. The RMG sector needs closer collaboration with India to thrive and for that to happen, sensitive issues must be handled with care and more attention must be given to closer trade and economic ties.

The Bangladesh-US relations seem well for the time being. Muhammad Yunus is well respected and admired in political and civil circles in Washington. No wonder, the US administration under Joe Biden offered ‘full support’ to the interim government of Bangladesh.

The present government can certainly push for the restoration of the Generalised System of Preferences (GSP) facility which was suspended post 2013 Rana Plaza tragedy. Bangladesh’s export to the US now is nearly US $ 8 billion a year, and with the GSP facility, the export could easily rise by US $ 4 billion. Also, better political ties could help Bangladesh gain more economic benefits and secure much-needed funds from organisations like the World Bank, IMF and ADB.

However, the Donald Trump presidency could bring new challenges.

Muhammad Yunus is seen as close to prominent Democrats, which might not sit well with Trump. Additionally, past comments made by the head of the interim government about Trump after his 2016 win over Hillary Clinton could come under scrutiny. Trump’s earlier support for Bangladesh’s minorities may also test the foreign office’s negotiation skills. However, the interim government showed maturity by congratulating President-elect Trump and expressing a desire to work with his administration, which is a positive sign.

Bangladesh could also benefit from the ongoing US-China trade war, which is expected to intensify under Trump. If the US imposes new tariffs on Chinese goods, Dhaka could use this opportunity to increase its garment exports to the US.

The year 2025 marks the 50th anniversary of China-Bangladesh diplomatic relations, and without doubt, both countries share a strong bond. According to Bangladesh Bank data, during 2023-24, the FDI inflows into Bangladesh dropped by 8.8 per cent on a Y-o-Y basis to US $ 1.47 billion. However, the FDI from China experienced a threefold increase compared to the previous fiscal year.

Recently, Ding Yu (BD) Enterprise Ltd., a Chinese firm, announced plans to invest US $ 28.92 million in the BEPZA Economic Zone (BEPZA EZ) to establish a garment manufacturing facility. Earlier, a Chinese company, Jidalai, signed an agreement to invest US $ 5.85 million to set up a factory for making zipper pullers in the Adamjee Export Processing Zone (AEPZ). Another Chinese company, Bangladesh BaoRui Textile, signed a deal to invest US $ 19.53 million to build a textile manufacturing factory in the Mongla Export Processing Zone (Mongla EPZ).

Since the interim government was formed, 12 Chinese companies have invested a total of US $ 210 million in Bangladesh.

Due to rising labour costs and environmental challenges in China, the country has shown interest in buying more products from Bangladesh. There is also a strong connection between people from both countries, with 58 flights per week that can carry over 11,000 passengers. This growing partnership between the two nations is expected to strengthen in 2025, helping Bangladesh upgrade its industries and diversify its exports.

Bangladesh’s Efforts To Secure A Smooth LDC Transition Set To Accelerate

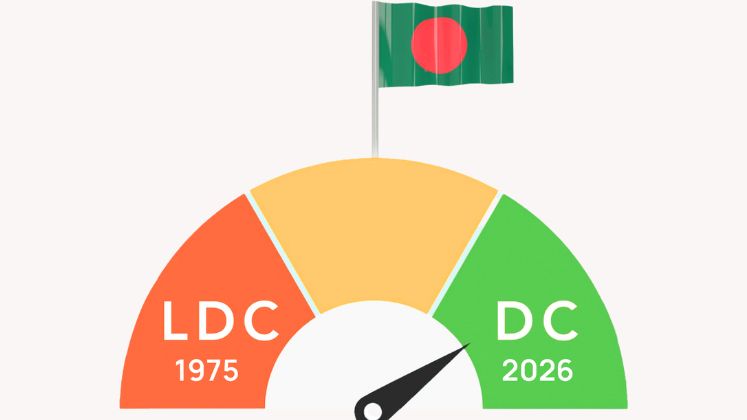

Bangladesh’s shift from LDC status to Developing Country status in 2026 is a moment to celebrate. Who would have thought, when this nation was created amidst turmoil, struggles and sacrifices, that this would be possible?

In 2021, when the UN made this decision, Bangladesh’s GNI per capita, Human Assets Index (HAI) and Economic Vulnerability Index (EVI) were well above the required thresholds, something we should all be proud of.

That being said, concerns remain about the challenges this graduation may bring.

No doubt, this transition will improve Bangladesh’s global image and attract more investments, but it would also mean losing benefits like duty-free, quota-free market access, concessional loans and other advantages. So how much would be the price we have to pay?

According to reports, losing Most Favoured Nation (MFN) tariffs and duty-free, quota-free market facilities could reduce export earnings by 7 per cent to 14 per cent.

A report by the Asian Development Bank further highlights the loss of business. Bangladesh’s exporters could face higher tariffs such as 17 per cent in Canada, 16 per cent in the PRC, 8.7 per cent in Japan and 8.6 per cent in India. For the EU market, garment exports will see tariffs rise from 0 per cent to around 12 per cent.

Though in the UK, Bangladesh will benefit from the newly announced Developing Countries Trading Scheme (DCTS) Enhanced Preferences, which allows most exports to enter duty-free, but the Rules of Origin (ROOs) required will be stricter than those for LDCs.

The government and the private sector must work hand-in-hand and tirelessly to smoothen the process. As discussed, the country must diversify its export base and make structural changes to the RMG sector.

There are 45 LDCs, with 15 on the path to graduation. Twelve are WTO members: Bangladesh, Cambodia, Comoros, Djibouti, Lao PDR, Myanmar, Nepal, Rwanda, Senegal, Solomon Islands, Tanzania and Uganda.

Bangladesh should collaborate with other LDCs to ensure WTO commitments like duty-free market access and favourable rules of origin are fully implemented before graduation.

A Tougher Road Ahead For Sustainability

The RMG industry has earned a feather in its cap with its commitment to sustainability. This is highlighted by the 232 LEED-certified green factories as of 2024, which is commendable given the economic environment and price pressure.

However, the journey to sustainability will get tricky going forward as the new sustainability legislation in the EU and other Western nations takes shape. A report by the Apparel Impact Institute (AII) says that US $ 1 trillion is needed worldwide to make garment supply chains eco-friendly, with a large amount needed for Bangladesh. As Bangladesh transitions to a developing nation, meeting EU due diligence requirements and other trade rules will become challenging.

For Bangladesh’s RMG sector, partnering with countries with advanced recycling systems could bring in much needed new technologies and ideas for managing waste. Steps like tax breaks for using recycled materials, subsidies for adopting sustainable technologies or grants for eco-friendly infrastructure are needed to nudge the industry, particularly small and medium enterprises, for faster adoption of greener practices. For example, Bangladesh’s textile millers have asked for permission to import recyclable plastics and support for using recycled plastic flakes and polyester fibre. Similar demands should get a patient hearing from the government. Financing is crucial for green transition. There are funding options such as those from the Infrastructure Development Company Limited (IDCOL) and the Bangladesh Bank, but many factories struggle to access these funds because of strict rules and complicated processes.

| US $ 1 trillion A report by the Apparel Impact Institute (AII) says that US $ 1 trillion is needed worldwide to make garment supply chains eco-friendly, with a large amount needed for Bangladesh. |

To overcome these challenges, Bangladesh has already received US $ 250 million from the Green Climate Fund (GCF) for renewable energy projects, but more needs to be done. Another focus area for the industry leaders would be on improving the low energy efficiency in factory operations, particularly with steam systems. If these hurdles aren’t addressed, Bangladesh might miss its Nationally Determined Contributions (NDC). The country has pledged to cut greenhouse gas emissions by 6.73 per cent on its own and another 15.12 per cent with international help by 2030. However, if we continue to see sustainability as an opportunity, there’s a big market waiting to be tapped.