There is no denying that the garment and textile sector in Vietnam has been on an upswing since last decade. While 2017 saw the country record a formidable yearly export turnover of US $ 31.2 billion, the projected export target for 2018 has undergone a revision from US $ 34 billion (at the start of the year) to US $ 35 billion.

The revision in garment export can be attributed to significant increase in the number of orders from foreign buyers. In fact, so many companies, especially in Ho Chi Minh City, have been booked for the third quarter of this year and some even till the first few months of 2019. That’s nothing short of being phenomenal. The apparel and textile industry is definitely booming in Vietnam, but is the story same for denim in particular? The question is critical, as despite of being in Vietnam for some time, denim has not seen the growth that it deserved.

Vietnam exported denim apparels worth US $ 173 million to USA in 2016 and then jumped to US $ 207.29 million in 2017, and 2018 has also been no short of ‘extraordinary’, as till January-May 2018 period, Vietnam exported denim apparels worth US $ 78.16 million to US, marking a growth of massive 42.81 per cent on the yearly note.

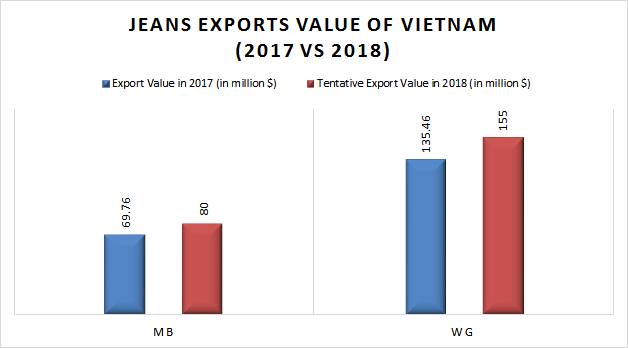

Of all the denim products, jeans are the major products that go to the US market. On one hand, Vietnam is growing in Men and Boy (MB) jeans category, though it is lagging far behind when compared to Mexico, China, Bangladesh, Pakistan, and even Egypt. While, on other hand, Vietnam is continuously climbing as far as Women and Girls (WG) jeans category is concerned and stands at third rank in the tally behind China and Bangladesh – yet again establishing the fact that when it comes to high-end products, Vietnam has its own standing.

Vietnam’s MB jeans exports to the US stood at US $ 21.10 million (up 41.75 per cent on Y-o-Y basis), whereas WG jeans shipment valued at US $ 54.51 million, marking a solid growth of 39.57 per cent during January-May 2018 period.

But then, it is still far away from the reigning status of Bangladesh – the denim hub of Asia which has already exported denim apparels to the USA worth US $ 172 million in the review period, which is almost US $ 94 million more than that of Vietnam.

So, why the struggle…

It is a widely known notion that Bangladesh produces low-priced basic garments whereas Vietnam has been traditionally known for making high-end garments – and when a country does only high-end garments, the volume is always less; Vietnam too is passing through the same dilemma. But the real question that arises is, ‘Does Vietnam even have the capacity to handle big volumes?’

The answer to this question is that even if the brands want to do more volumes of denim, Vietnam does not have the capacity. One of the denim exporters recently told Team Apparel Resources that while two factories in Bangladesh can produce 4 to 5 million pieces per month, all factories in Vietnam together may even struggle to achieve this target.

A good denim is not just about stitching; it is also about washing and nothing is more relevant than having a good washing sense. A company like Saitex has gone 100 per cent into the reuse of water thereby making its laundry more efficient and there are some companies like Le & Le Garment and Washing JSC, Phong Phu Corporation, Prosperity Textile (HK) Ltd., and some others who have invested significantly in washing but then, their number is too less. “The unfortunate part is that very few have invested in laundry in Vietnam and most of them still use outside laundry,” said SM Junaid Javed, Executive Chairman, SM Group. SM Group has been one of the leading denim manufacturers of Pakistan since last four decades.

Getting a dyeing facility in Ho Chi Minh City is today no less than an arduous task. The Government of Vietnam is very strict with regard to starting a dyeing facility in Vietnam – there is no bigger pollutant than this. The industry experts also maintain that a lot of benefits can be gained if the factories start associating themselves with denim consultants. Consultants bring with them lots of experience and knowledge and that is one area Vietnam has been lacking in a big way. Bangladesh has always availed services of many denim experts and consultants from countries like Turkey, Italy and others and the difference can be seen from the growth pace of both countries. What is required today is right machinery and investment at the right pace.

Labour has been another cause of constraint. Despite having skilled and educated labour force, it is no longer cheap. On the contrary, availability of cheap labour helps Bangladesh do big volumes. According to International Labour Organization (ILO), the lowest minimum wage in Bangladesh is US $ 68 whereas it ranges from US $ 70 to US $ 131 in Vietnam. The difference is distinctive. And, now the labour is slowly disappearing – Yes, it is.

While the electronic sector and of late, the tourism industry as well have been luring away the garment workers since last few years, the denim sector in particular has been struggling to get labour. Helen Bui, CEO, K&N Apparel Sourcing, told AR, “Workers in Vietnam generally prefer working in knit and garment factories than in denim factories as the complexities are less in woven and knit. Making denim is more complex.”

According to a study, for an average export garment manufacturer in Vietnam, the proportion of cut, make, and trim (CMT) based on total sales amount is 67 per cent (33 per cent is produced under FOB) and this is yet another concern.

Yet, Vietnam has everything to be the denim leader…

When big players from Taiwan, Korea, and People’s Republic of China are investing – and investing big – in Vietnam, then it has all good reasons to be hopeful of being a denim leader. Prosperity Textile (HK) Ltd. is already elated to see its own fabric mill coming up fast in Vietnam and even the renowned Sasha Denims from Bangladesh has lately expressed its interest in having its denim fabric mill here.

TCE, South Korea’s leading group in the textile & garment industry, also has many projects in Vietnam, with one in the Nam Dinh province being the largest. The company has a joint venture in Vietnam with the Vietnam Textile & Garment Group (Vinatex) and Thien Nam Investment & Development JSC. In fact, there are at least 8 to 9 companies that have their own mills in Vietnam.

Analysts noted that though there are many denim projects in Vietnam, the investment in denim factories still continues. A denim manufacturing project with a capacity of 30 million metres per annum has kicked off in Hoa Xa IZ in Nam Dinh province. The production line which covers all phases of the knitting process is worth US $ 40 million.

It is worth noting that traditional denim laundries consume nearly 37 gallons of water for each pair of jeans; by reducing the number of washes required to treat the garments, Saitex has reduced this volume to just 9 or 10 gallons, with a corresponding reduction in the use of chemicals.

A lot is expected from the upcoming Free Trade Agreement (FTA) between EU and Vietnam (it is in all probability expected to happen later this year). Investments are coming up from different parts of globe and once the treaties will be enforced and more investment incentives will be offered, this country will be amongst the top denim sourcing hubs.

“Denim is improving fast in Vietnam and what is good is that there is now more investment in technology and machinery. So, I am sure Vietnam is slowly heading towards being the denim leader,” chimed Jordi Calucho, Technical Marketing Executive, Archroma. And, this might be true. It is well-known that Vietnam has highly skilled washing technicians (though they may lack experience) “One skilled worker in Vietnam is equivalent to three workers in Bangladesh,” said Kshane Komalsingskul (Tu), Managing Director, JSV Cong TY.

The biggest local denim manufacturers in Vietnam include Phu Cuong, Thien Nam, Viet Hong, Tuong Long, and Phong Phu Corporation among some others.

According to Nguyen Thi Tuyet Mai, Deputy Secretary General, Vietnam Textile & Apparel Association (VITAS), Vietnamese enterprises are now willing to make high investments in production lines to strengthen ODM (original design manufacturer) and FOB production. Outsourcing doesn’t bring high added value. Therefore, both Vietnamese and foreign invested enterprises make denim products within the country. The localisation ratio is 55-60 per cent.

As the denim and jeans industry is growing in Vietnam, exhibitions and trade fairs are also getting organised in the country, and the participation from exhibitors and visitors too is promising. One such important denim show in Vietnam has been the Denimsandjeans.com Vietnam show.