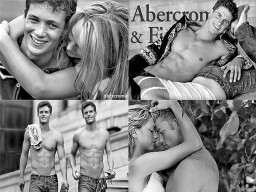

Once an iconic aspiration for teens and young adults, Abercrombie & Fitch, the New Albany, Ohio-based company, is losing score off its ‘sexy and flirty’ image showing a rapid downward curve in both profits and fashion merchandise. With profits plunging more than half in the second quarter as key sales figure fell by 10 per cent, not only in Europe but even in the US the brand that once delighted American teenagers has recorded a fall in figures for the first time since 2009. Blaming it all on a repeated uninspiring product line, the company admits that in a failing economy, coolness and sex both do not sell anymore, and prim and proper is the new dress code, it also plans to move some of its manufacturing back to the United States to respond quicker to change…

Once an iconic aspiration for teens and young adults, Abercrombie & Fitch, the New Albany, Ohio-based company, is losing score off its ‘sexy and flirty’ image showing a rapid downward curve in both profits and fashion merchandise. With profits plunging more than half in the second quarter as key sales figure fell by 10 per cent, not only in Europe but even in the US the brand that once delighted American teenagers has recorded a fall in figures for the first time since 2009. Blaming it all on a repeated uninspiring product line, the company admits that in a failing economy, coolness and sex both do not sell anymore, and prim and proper is the new dress code, it also plans to move some of its manufacturing back to the United States to respond quicker to change…

[bleft]The Making of A&F

• The place to go for hunters, the company was started in 1898 by David T. Abercrombie as a small waterfront shop in Manhattan.

• In 1910, it became the first company to sell clothing to both women and men, with a logo “The Greatest Sporting Store in the World”.

• After going bankrupt in 1975, the store reopened under the A&F name and tried to revive it by selling more modern sportswear like clothing for tennis and golf but sales were still low.

• Chief Executive Officer Mike Jeffries took over in 1992 and turned the company a teen emporium where sex meets the Ivy League.

• In the early 2000’s, it was voted the sixth most popular brand by teenagers, and hired sales clerks that were typically young and attractive to appeal to teen customers.

• Today Abercrombie & Fitch has 1055 stores in 17 countires, offering denim and basic shirts including tees, tanks and sweatshirts for its customers. [/bleft]

Unlike other retail successes and failures that were based on low consumer spending, the loss at A&F is more to do with the change in consumer preferences, as the brands rivals seem to enjoy rising profits with hints of a recovering market. Faced by the company’s disappointing results that were similar across all brands – Abercrombie & Fitch, Abercrombie kids and Hollister Co., Mike Jeffries, CEO and Chairman, admitted, “Did we miss the past two quarters because our assortment was too narrow… because we were late on trends? I believe so.” Portraying the look of beach-tanned bodies with distressed jeans and tight tees since its start, the youth is no longer paying attention to the brands merchandise, as for them today ‘sexy’ is having a job, sporting office wear like blouses and blazers, while the A&F youth looks unemployed.

Considering that today’s teens are radically different from other generations, they have a literal explosion of options, thanks to the boom in fast fashion, moving away from Abercrombie’s American prep aesthetic. While A&F is still selling a US $ 70 jeans when similar styles could be purchased elsewhere for US $ 40 and a old standby items such as US $ 30 T-shirts, compared to its biggest low priced competitor, American Eagle Outfitters, which logged comparable-store and online sales growth of 9 per cent in its second quarter and 17 per cent in its first, the brand is banking on mainstream fashion items such as camisoles with Peter Pan collars and pleated chiffon blouses. Even Gap Inc. announced net revenue increase of 9 per cent rise for August, featuring clothing that is comfortable, classy and hip. Swedish multinational H&M pre-tax profits had jumped nearly a quarter as its newest collections received an enthusiastic response, in spite of the uncertain economy. Amid all the comparison, the fact remains the same that consumers are now underwhelmed by the half-naked models and blaring, dimly lit stores, and have started to prefer apparel and advertising that have a bit of modesty and dignity.

Losing a third of its marketing value in the past year, and with plans to close 180 stores by 2015 with over 70 stores having already been shut down, the brand has literally failed again and again to bring any significant change in its strategy, which has led to serious fashion mishaps and heavy discounting. Critics have commented that even though Abercrombie is positioned well to take advantage of the youths desire to be rebellious and different, because that’s what the brand is about, still, right now the company’s product mix doesn’t communicate that or facilitate it. In an attempt to remedy those missteps, Abercrombie has shortened its product development calendar and is looking to bring some manufacturing back to the United States and Central America from Asia, to be able to deliver the right trends at the right time.

Though becoming unpopular in its home country, the brand still continues to perform well in untapped markets as its first Hong Kong flagship store, which opened in August, and logged more than US $ 1 million in sales in its first five days. It is now considering new locations in China and the Middle East.