Bengaluru-based IPF, a peer-to-peer marketplace for pre-owned children’s products, has raised Rs. 3.2 crore (US $ 375,000) in a seed funding round led by Kunal Bahl’s Titan Capital.

The round also saw participation from Better Capital, along with angel investors including Ranjit Pratap Singh, co-founder and chief executive officer of Pratilipi; Aashish Jindal and Vivek Gulati, co-founders of Grip Invest; and Abhishek Bhayana, co-founder of NearPe Technologies.

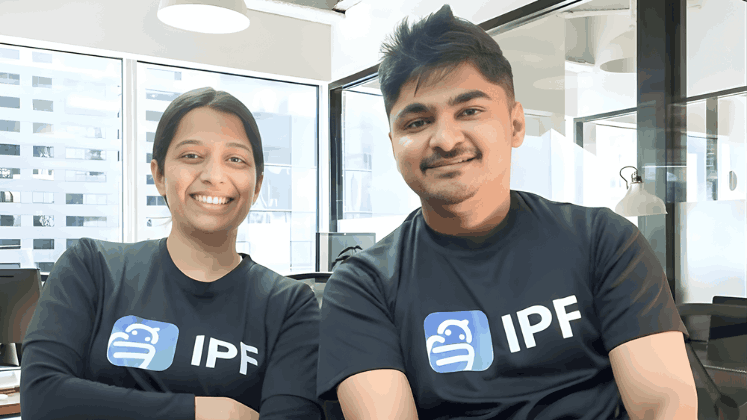

Founded in 2024 by IIT Roorkee graduates Priyadershita Singh and Abhas Mittal, IPF enables parents to buy and sell high-quality items that their children have outgrown, including apparel and other essential products. The platform offers a fully integrated marketplace with in-app payments, doorstep logistics and buyer protection, aimed at ensuring secure and convenient transactions.

Commenting on the development, the founders said that every lightly used stroller, crib or toy represented an opportunity to save families money while reducing waste. They added that what began as a trusted parenting community had grown into a broader movement for more sustainable parenting in India, with over 80,000 parents already using the platform. With Titan Capital’s backing, the founders said the company would focus on strengthening its technology, deepening trust and safety features, and ensuring seamless transactions for parents nationwide.

IPF launched its in-app payments feature in March 2025 and currently serves parents across India, including both metro and non-metro markets.

A spokesperson for Titan Capital said the firm believed consumer-to-consumer commerce was poised for significant growth in India. The spokesperson added that IPF addressed a widespread need among Indian families by bringing trust, transparency and convenience to a category that had long lacked a reliable peer-to-peer solution, and said Titan Capital was pleased to partner with the founders as the company scaled.

The start-up plans to use the funds to strengthen its technology stack and platform scalability, enhance logistics and quality-control operations, and accelerate parent acquisition across key cities. It also intends to invest in product intelligence, stronger verification mechanisms and operational capabilities to support families in the years ahead.