A decade ago, India’s start-up dream was just taking root. A few founders with big ideas and a lot of courage were trying to build something new. Today, that dream has turned into a movement.

Even with the ups and downs, India’s start-up scene continues to mature and new sectors are starting to stand out. One that’s making a strong impression is fashion and apparel. The country’s apparel market, valued at around US $ 120 billion, is expected to grow at 10% to 12% annually from 2024 to 2030, making it one of the fastest-growing large markets in the world.

Since 2019, more than 800 homegrown digital-first brands have been launched and global players are also scaling up to meet India’s growing appetite for fashion. Consumers across cities are seeking better design, quality and price. Online platforms, exclusive brand stores and organised multi-brand outlets are expected to account for over 60% of apparel sales by 2030, according to Redseer Strategy Consultants.

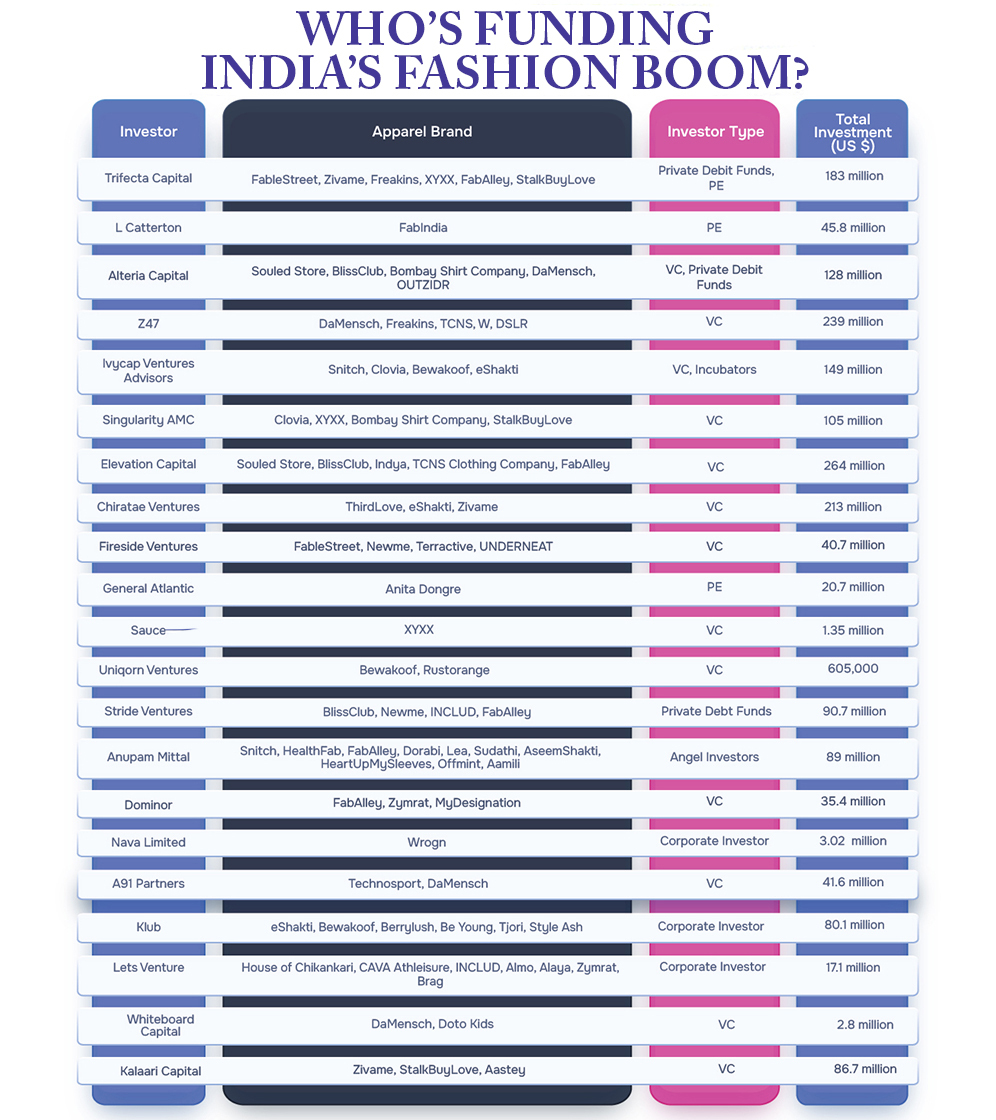

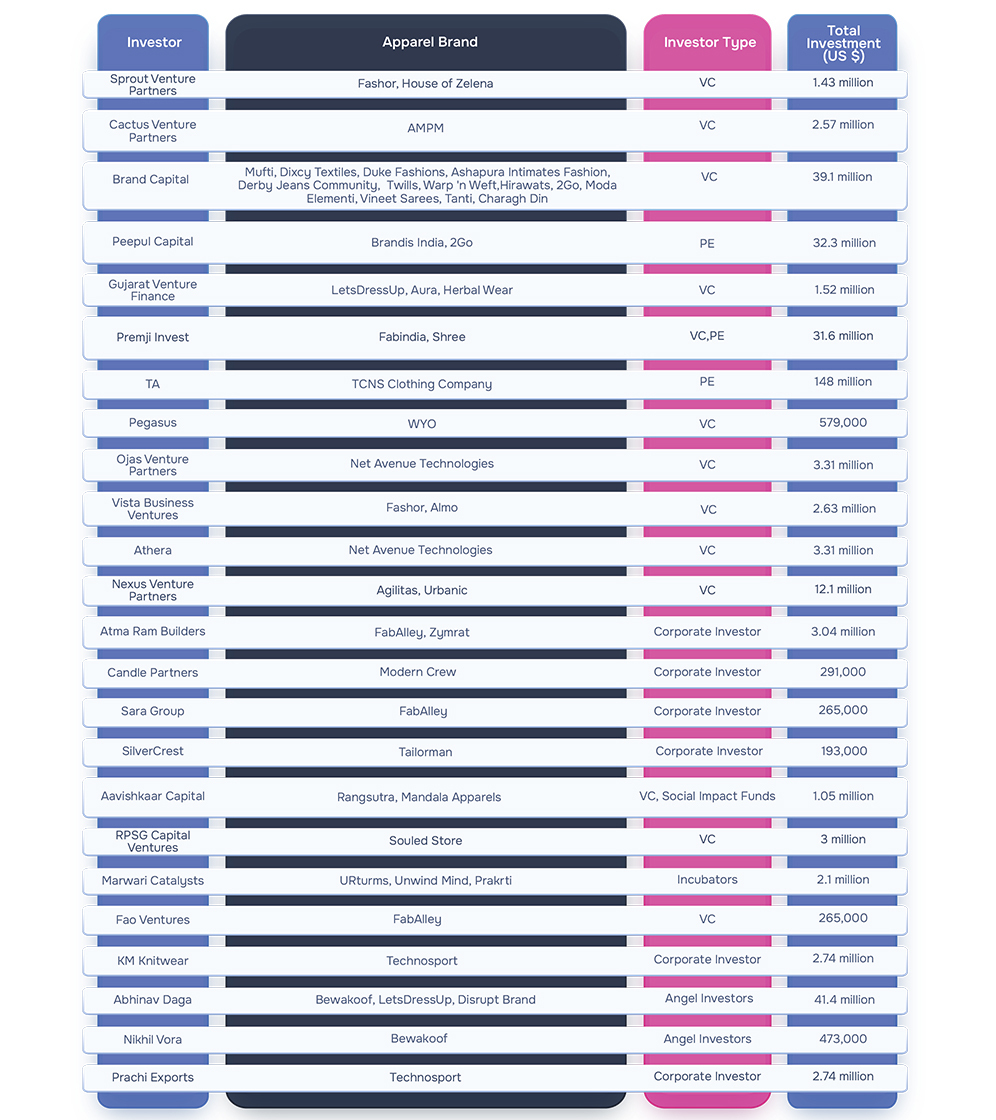

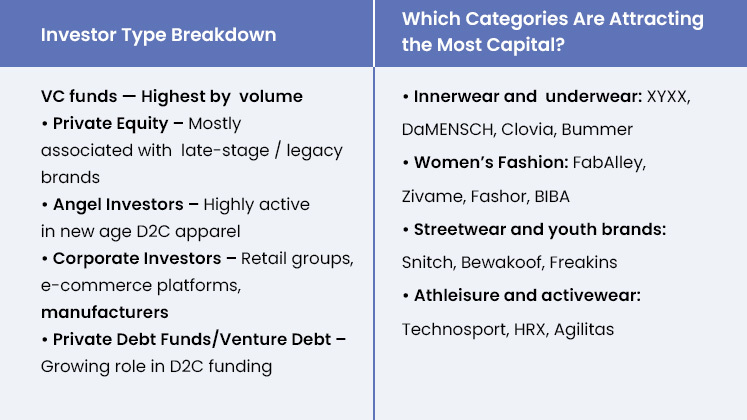

| “Apparel Resources reviewed data on 95 investors funding about 100 apparel brands, totalling US $ 3.34 billion in disclosed funding with an average of US $ 35.5 million. The top 10 investors hold over half of all funding.” |

It’s no surprise then that investors are turning their attention to fashion and apparel.

“There’s a generational shift from unbranded to branded fashion, especially outside metros. Consumers are increasingly quality- and design-conscious. At the same time, infrastructure around D2C enablement, fast supply chains and digital marketing are improving. Quick commerce is one such tailwind for consumer brands,” said Sahil Kukreja, VP, Trifecta Capital.

Trifecta has backed over 20 apparel-focused businesses, including brands like The Bear House, Aramya, Freakins, XYXX, Zivame, GOAT Brand Labs, Daily Objects, Uppercase, FabAlley and FableStreet as well as B2B platforms such as Groyyo, Zyod and Fashinza.

He added, “We’re seeing sharper brand positioning, disciplined growth mindsets and an overall maturing of the ecosystem. The Zudio model has inspired a whole wave of value-driven, agile brands with strong execution muscle.”

Similarly, Aditya Singh, Co-founder and Partner at All In Capital, highlighted, “India is at a turning point where design, affordability and digital discovery are all aligning. Manufacturing quality has improved and the new wave of founders understand both storytelling and scalability. Brands like NEWME, DressFolk and Krvvy show how Indian design-led businesses can be scaled meaningfully.”

A pre-seed fund, All In Capital, has invested in brands like NEWME, DressFolk, Trisu and Krvvy along with tech platforms such as Fantail, Produze and Turnover.

Experts said growth in the apparel space will come from multiple ends of the spectrum. For instance, premium urban consumers seeking quality, differentiation and brand authenticity; Bharat and Tier 2-Tier 4 shoppers looking for value-driven products that still deliver aspiration; Gen Z and young millennials who are purpose-driven, sustainability-conscious and digitally connected.

The real opportunity lies in connecting all three, offering accessible pricing, authentic storytelling and products that feel both aspirational and relatable.

| “First, we look for authentic brand resonance – are customers engaging, returning and advocating? This matters far more than vanity growth. The second focus is on gross margins and inventory discipline. We typically like to see gross margins above 50%, along with strong control on inventory velocity and liquidation. Sahil Kukreja, VP, Trifecta Capital |

“We’ve seen profitability at two ends of the market. Ultra-premium brands can command valuation multiples of 8 to 10 times their annual earnings, driven by strong margins and brand power. On the other hand, mass-market brands are typically valued around 2.5 times earnings, but their strength lies in scale, they move fast, refill inventory every couple of months and keep cash flowing,” mentioned Sunil Goyal, Chairman and MD, Ladderup Finance Ltd., which has invested nearly Rs. 4 crore (US $ 4,51, 000) in brands like Gini&Jony and Zymrat.

According to Sahil, there’s also a large, underserved 30-plus segment that values quality, comfort and fit but is often overlooked by new-age brands. Kidswear is another promising category, particularly amongst urban households with working parents and single-child set-ups, where discretionary spending remains high.

| “India is at a turning point where design, affordability and digital discovery are all aligning. Manufacturing quality has improved and the new wave of founders understand both storytelling and scalability. Brands like NEWME, DressFolk and Krvvy show how Indian design-led businesses can be scaled meaningfully. Aditya Singh Co-founder and Partner, All In Capital |

Inside the Investor’s Checklist

Investors say that fashion start-ups are no longer judged just by growth or hype, they now have to prove they’re real, scalable businesses.

“First, we look for authentic brand resonance – are customers engaging, returning and advocating?”

This matters far more than vanity growth,” stressed Sahil.

The second focus is on gross margins and inventory discipline. Fashion is capital-intensive and mistakes surface quickly in working capital. “We typically like to see gross margins above 50%, along with strong control on inventory velocity and liquidation,” added Sahil. Investors also maintain internal benchmarks to evaluate what qualifies as good inventory discipline.

Finally, they assess the founding team’s balance between creativity and execution. A strong fashion DNA must be complemented by financial prudence, reporting hygiene and a deep understanding of customer behaviour.

When asked about red flags, experts pointed to weak financial controls or unreliable data as the biggest concerns. These often hide deeper operational issues. Without solid MIS (Management Information System) and SKU-level (Stock Keeping Unit) visibility, it’s difficult to scale profitably or make the right business decisions.

Another warning sign is marketing spend that doesn’t translate into orders or loyalty. Investors track repeat rates, CAC (Customer Acquisition Cost) payback and organic traction to distinguish real brand pull from paid visibility.

Heavy dependence on a single sales channel or hero product also limits resilience. Strong brands diversify early across categories and distribution to build stability.

Another critical area investors watch is slow-moving inventory. Poor sell-through or overstocking ties up capital and quickly eats into margins. Inconsistent cohort behaviour or a lack of clear profitability path also signals weak fundamentals. Investors prefer to see improving unit economics and repeat engagement as brands scale.

| “Sustainability is non-negotiable. We evaluate how a company manages labour welfare, water and energy efficiency and sourcing transparency. Our proprietary PRISM framework quantifies how investments enhance livelihoods and reduce environmental risks. Our first cheque for consumer brands is roughly between US $ 250,000 to US $ 600,000. Siddharth Lulla, Partner, Intellecap |

“Sustainability is non-negotiable. We evaluate how a company manages labour welfare, water and energy efficiency and sourcing transparency. Our proprietary PRISM framework quantifies how investments enhance livelihoods and reduce environmental risks,” said Siddharth Lulla, Partner, Intellecap. They have invested in companies across the apparel value chain. These include Hela Apparel Holdings; Zouk, an India-born D2C lifestyle brand built on vegan materials and local craftsmanship; and earlier investments in Rangsutra and Jaypore, both of which pioneered connecting rural artisans and women’s producer groups to mainstream markets.

He further mentioned that they typically invest between US $ 3 million and US $ 5 million through equity, quasi-equity or structured instruments.

Whereas Aditya said, “Our first cheque for consumer brands is roughly between US $ 250,000 to 600,000. We also keep follow-on capital reserved for high-performing brands from our second fund.”

| “We’ve seen profitability at two ends of the market. Ultra-premium brands can command valuation multiples of 8 to 10 times their annual earnings, driven by strong margins and brand power. On the other hand, mass-market brands are typically valued around 2.5 times earnings, but their strength lies in scale, they move fast, refill inventory every couple of months and keep cash flowing. Sunil Goyal,Chairman and MD, Ladderup Finance Ltd. |

How Investors Pick and Back Fashion Winners

The due diligence process for apparel investments typically runs for 8 to 12 weeks, depending on the complexity of the business. The first phase focuses on screening, early management discussions and alignment on the company’s vision. This is followed by a deeper evaluation that includes financial, legal, governance and ESG audits, often extending to factory visits and worker interviews in the case of apparel companies. The final stage involves investment-committee approval and formal documentation.

“Initially, we connect weekly or biweekly, then move to monthly reviews. We track metrics like revenue growth, repeat rate, acquisition cost and contribution margin. We also support founders in hiring, marketing and connecting with future investors.

The goal is to help them scale faster, not manage their operations,” said Aditya Singh.

However, he mentioned that at the pre-seed and seed stage, overanalysing can often mean missing great founders. What matters most is the founder’s clarity of thought, their understanding of the customer. Numbers are important, but at this stage, it’s really about whether the founder deeply understands the problem they’re solving and shows the hunger to keep learning fast.

When it comes to exits, most investors take a long-term view. Siddharth added, “Our typical holding period ranges from five to eight years, long enough to strengthen governance, embed ESG systems and unlock scale. We pursue three main exit routes:

strategic acquisitions by apparel or retail majors, secondary sales to global private-equity or sustainability-focused funds and IPOs for companies that achieve scale and profitability.”

He pointed to past examples that illustrate this approach. “Our exits from Jaypore, which was acquired by Aditya Birla Fashion & Retail, and Rangsutra, which was acquired by Fabindia, show how purpose-driven, design-led Indian brands can generate strategic value and attract global interest.”

The next chapter for India’s start-up story is about scaling up. The base is strong and the ambition is clear. What’s needed now is more capital, more courage to take risks and more belief in homegrown innovation.