Garment buyers are always on the lookout for economically viable sourcing destinations having abundant and cheap labour. Unlike Bangladesh, China, India, Vietnam, Indonesia and Sri Lanka – which are getting costlier due to increasing labour and infrastructure costs, Ethiopia – considered Horn of Africa with 90 million population – is emerging as one of the destinations of choice due to its stable democracy and being the fastest growing economy in Africa with abundant cheap labour. Even the Government of Ethiopia is putting focused and honest efforts in order to encourage investments in textile and garment sector which has resulted into a number of investments from countries such as Turkey, India, South Korea and China in cotton cultivation and other diverse industries. The country provides a promising investment environment to the textile and garment manufacturing sector and is all set to become one of the preferred garment manufacturing hub in the near future.

Manoj Tiwari, Associate Professor, NIFT, Jodhpur, had been in Ethiopia for the entire last year, analysing and observing the Ethiopian garment sector closely and was involved in knowledge and technology sharing with most of the garment manufacturers of Ethiopia. He has been working there as a Team Leader – Garment Technology to ETIDI-NIFT Twinning Arrangement under MOU between National Institute of Fashion Technology (NIFT), India and Ethiopian Textile Industry Development Institute (ETIDI), Ethiopia. Manoj analyses why Ethiopia is an emerging garment manufacturing hub.

Ethiopia (Federal Democratic Republic of Ethiopia – FDRE) is situated in the north-eastern part of Africa and considered as one of the most stable countries of Africa providing a safe and healthy working environment with a low rate of crime and corruption in comparison to its neighbouring countries. The fifth fastest growing economy of Africa, with an average growth rate of 10.7% in last decade, Ethiopia is situated at a strategic geographic location which is connecting Africa to Asian countries as well as a good connectivity to US and Europe and is a link between raw material producing countries of Asia and product consuming markets of US and Europe.

Industrial growth in recent years – On a fast track of development, Ethiopian GDP is projected to grow at an average of 11.4%; also projected to grow is its manufacturing sector which contributed to 13.4% in GDP in the year 2010-11. The Government of Ethiopia is today focusing on implementing ambitious Growth and Transformation Plan (GTP) for 5 years (2010-11 to 2014-15) to boost the Ethiopian economy, resulting in surge in investment to almost 250% to US $ 953 million last year from the year before, according to estimates by the United Nations Conference on Trade and Development.

Industrial investment environment – In textile and garment sector, the entire industry in Ethiopia is at a nascent stage having just started taking baby steps which is obvious from the fact that it has 60 garment factories and 15 textile mills. Though 50% of current textile and garment factories operate at a CMT basis, the country still has a promising environment for investment in garment and textile sector, which is mostly driven by foreign investments. The Ethiopian Government has set ambitious target to achieve US $ 1 billion of exports of textile and apparel under the Growth and Transformation Plan (GTP 2010-11 to 2014-15). However, the performance of the Ethiopian textile and apparel exports during the first three years of Growth and Transformation Plan (GTP) period was only US $ 305 million, against the target of US $ 637 million. For the Financial Year 2012-13, Ethiopian textile and clothing exports fetched US $ 110 million, much lower than the Government target of US $ 357 million.

STRENGTHS – From the business point of view at global level, Ethiopia’s competitiveness lies in the following key factors:

Availability of cheap labour

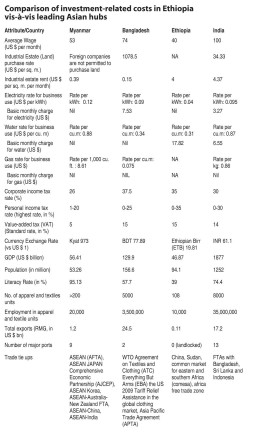

Ethiopia is one young country which has abundant availability of labour at US $ 45 per month for a skilled labour, which presents an ideal opportunity for labour-intensive garment manufacturing. Moreover, the population is expanding annually by 2.9%, at a time when the urban unemployment rate is 17.5%.

Government incentives for industrial growth

1. Bulk interest rate

Investment-friendly policies of Government of Ethiopia is key to the industrial growth of Ethiopia. The minimum capital required for a foreign investment is US $ 200,000 per project; the same is US $ 150,000 per project if the project is in partnership with domestic investor. Up to 70% of the total project cost may be funded by banks @ 8.5% interest rate and balance is expected to be invested by the investor.

a. 100% exemption from the payment of customs duties and other taxes levied on imports of all capital goods.

b. There is an exemption from the payment of customs duties on import of spare parts worth up to 15% of the total value of the imported investment capital goods, provided that the goods are also exempted from the custom duty.

c. An investor granted with a customs duty exemption allowed importing spare parts duty-free for five years from the date of commissioning of a project.

d. An investor can also buy capital goods or construction materials tax free from local manufacturing industries.

e. Investment in capital goods imported without the payment of custom duties and other taxes can be transferred to another investor enjoying similar privileges.

3. Income tax exemptions

a. All the investments in textiles and textile products sector are exempted from income tax for a period of 6 years depending on the geographical region of the setup.

b. Investment in designated regions attract special exemption of 30% in income tax for three consecutive years even after the expiry of the income tax exemption period as mentioned above.

c. Income tax exemption of 50% is also given in case of factory expansion in volume or adding new product or introducing a new service provided that it is 100% of an existing enterprise.

d. An investor who exports 60% of his products, or services, or supplies to an exporter, is exempted from income tax for additional 2 years.

4. Export incentives

a. No export tax is levied on textile and garment export products of Ethiopia.

b. To safeguard the domestic textiles industry, the Government has imposed 35% duties on imported fabric used for domestic consumption.

c. Duty drawback schemes offer 100% exemption (drawn back at the time of exports) from the payment of customs duties and other taxes levied on imported and locally purchased raw materials used in the production of export goods.

d. There are provisions for Bonded Warehouses, whereby exporters are licensed to operate such warehouse in importing of raw materials duty-free.

e. For the exporters who don’t enjoy facility of bonded warehouse, they are given vouchers with monetary value. Such vouchers can be used in lieu of dutiesand taxes payable on imported raw materials.

5. Land availability

Land is available on a leasehold basis of up to 99 years depending on the geographical region, type of investment and class of land. In order to expedite the foreign investments, regional Governments are putting efforts and are able to allocate land to investors within 60 days of receiving their applications. In Tigray, which is one of fastest growing industrial areas in Ethiopia, the initial land lease price varies from US $ 0.015 to 0.042 per sq. metre/year.

6. Trade agreements

Ethiopia is one of the few countries which is utilizing the duty-free and quota-free exports’ benefits under AGOA at fullest, and where 95% of the garment imports are open to the ‘third country’ fabric rule of origin, which allows garment manufacturers to utilize raw materials from any origin for export purpose. In addition to this, preferential tariff rates have provided Ethiopia to export to the Common Market for Eastern and Southern Africa (COMESA) agreement, indicating that majority of ‘Made in Ethiopia’ products are eligible to enter into these markets quota and duty-free. Further to this, a number of ‘Made in Ethiopia’ goods are entitled to preferential access under the Generalized System of Preference (GSP) in USA and Europe.

7. Fast paced on education front

Every year more than 10,000 students with specialization in business, accounting, engineering, management, economics and law from universities are making Ethiopia a young and educated country. Availability of significant number of educated youth works as backbone to the economic development to this country.

8. Electricity availability at lower cost

Electricity rates in Ethiopia are US $ 0.04 per kWh, while the same is US $ 0.11 to US $ 0.12 per kWh in China and India respectively, 3 times cheaper than that of electricity cost in India. But the electricity supply is erratic, however Ethiopia is on the way of completion of the Grand Ethiopian Renaissance Dam andon completion, which is due in 2017, the country will be able to export electricity to the neighbouring countries.

WEAKNESSES – Despite all its strengths the country has some weaknesses:

1. Logistics

Being landlocked, the country is dependent on its neighbouring country Djibouti for its sea imports and exports. This results in an increased lead time as well as additional cost. It takes 2-3 days for a container to arrive from Djibouti to Addis Ababa by road (770 km.). In addition, 7 days are required for custom clearance and other formalities at Djibouti port. However, Government of Ethiopia is taking necessary measures to expedite the process. Government of Ethiopia has signed treaty with Djibouti and has setup a depot at the border of Ethiopia and Djibouti. It’s expected that clearance time will soon be reduced to 2-3 days and the transit time to Addis Ababa from Djibouti will be less than a week. In addition to this Government of Ethiopia is working on developing railway network (in collaboration with China). The first railway track connecting the capital city of country, Addis Ababa to Djibouti is expected to be functional by the end of next year.

2. Missing raw material suppliers

Ethiopia is a cotton producing nation traditionally but as of now only 3% of its cotton cultivation potential is utilized. Thus it has a huge untapped potential to become the leading cotton producing nation in the world. Ethiopia has a strong base for handloom and hand-woven fabric (cottage industry) but again the same is not true for powerloom fabric weaving creating a mismatch between fabric production and its demand. The key reasons for this scenario are under-utilization of available resources, lack of technical skills, and lack of quality awareness. Due to the unavailability of quality raw material (such asyarns, fabrics, etc.), many of the garment manufacturers arejust involved in CMT business.Many companies from around the world are now investing in cotton cultivation in Ethiopia.

3. Lack of technical knowhow limiting the expansions and productivity

The global best practices of manufacturing are yet to be adopted and practiced in Ethiopia since the industry is not even aware of such practices. At present it seems difficult to meet the challenges (in terms of productivity and quality) at global level unless lot of efforts are made to train workforce and towards the development of management. To achieve the objectives, a number of collaborations have taken place in recent years and one such collaboration is ETIDI-NIFT Twinning Arrangement, where NIFT India is working towards capacity building of Ethiopian garment sector.