Today’s shoppers are navigating value and convenience in new ways by cutting back in some areas while splurging on others. These trade-offs don’t always follow past patterns, making behaviour harder to predict. This does not in any way imply that consumers are acting irrationally, but more that the old rules no longer apply – what once felt like temporary reaction has turned into lasting and defining shift. For brands and retailers, the real challenge now lies in keeping up with a constantly shifting consumer landscape. As the decade progresses, staying relevant will depend on how well they understand the motivations behind today’s unpredictable shopper.

Based on data collected from McKinsey’s ConsumerWise Sentiment Survey and State of the Consumer 2025 Market Survey, five key behavioural forces have emerged to help businesses navigate the road ahead. We have discussed them below.

ALONE, ONLINE AND REDEFINING ENGAGEMENT

In contrast to pre-2020 patterns, consumers are increasingly placing importance on immediate gratification, personal convenience and self-focused activities. Surveyed consumers of the US report over three additional hours of free time per week compared to 2019, but nearly 90% of this time is now dedicated to solitary pursuits. The most notable growth areas include independent hobbies, fitness, online shopping, social media use and solo relaxation. Conversely, time allocated to group interactions, whether they be with family, friends or cultural settings such as cinemas and concerts has remained stagnant, making up a smaller overall share of weekly free time. While this shift doesn’t present itself as a deliberate retreat from social experiences, it is largely enabled by the expanded flexibility of remote work and digital services. E-commerce acceleration and the ease of home-based connectivity have given consumers greater autonomy over how they structure their days. In China, however, a different trajectory emerges – one where consumers report dedicating more of their free time to family, friends and personal enrichment, in addition to leisure-driven shopping – indicating regional variations in post-pandemic behavioural evolution. No matter the market, one trend stands out as undebatable: consumers are increasingly expecting convenience as a given. The surge in e-commerce and delivery services reflects a growing ‘bring-it-to-me’ mindset – one that is transforming not just retail, but the service economy at large. For fashion brands, frictionless, on-demand experience is no longer a competitive edge but something that is expected as a given baseline.

| The challenge for brands is to maintain authentic yet personalised messaging across platforms. Companies must consider multiple sources, including social media, influential voices, product reviews and ratings, to shape their messaging. |

Speed in delivery will be accompanied by rising demands for affordability, reliability and seamless returns. The implications for fashion stakeholders are clear – to remain relevant, businesses must realign their strategies and processes to meet consumers where they are – digitally connected, time-sensitive and increasingly focused on self-driven consumption. Operational agility, tech-enabled customer experiences and service innovation will be critical to stay ahead in this recalibrated consumer economy.

THE TRUST PARADOX: HOW CONSUMERS USE— BUT DON’T TRUST— SOCIAL MEDIA

Even though consumers are spending more time on digital and social media platforms, report data suggests that their trust in these channels is rapidly declining. Social media is now considered to be the least trusted source for making purchase decisions.

At the same time, people continue to use these platforms to connect with family and friends who remain their most trusted sources of product recommendations.

Even though trust in media and institutions is low, digital platforms are still moulding how consumers view brands. Consumers say they are influenced most by family and friends, followed by online reviews while social media ranks lowest. Still, digital influence is growing. In 2025, 32% of global consumers research products on social media – a figure that has gone up from 27% in 2023. In India, around half of consumers use social platforms for research before buying. In markets like Germany, the UK and the US, 29% say they’ve purchased a brand they discovered through social media.

The message for brands is clear: social media matters for visibility and research, even if it isn’t fully trusted.

GEN Z: HIGH SPEND, HIGH STAKES

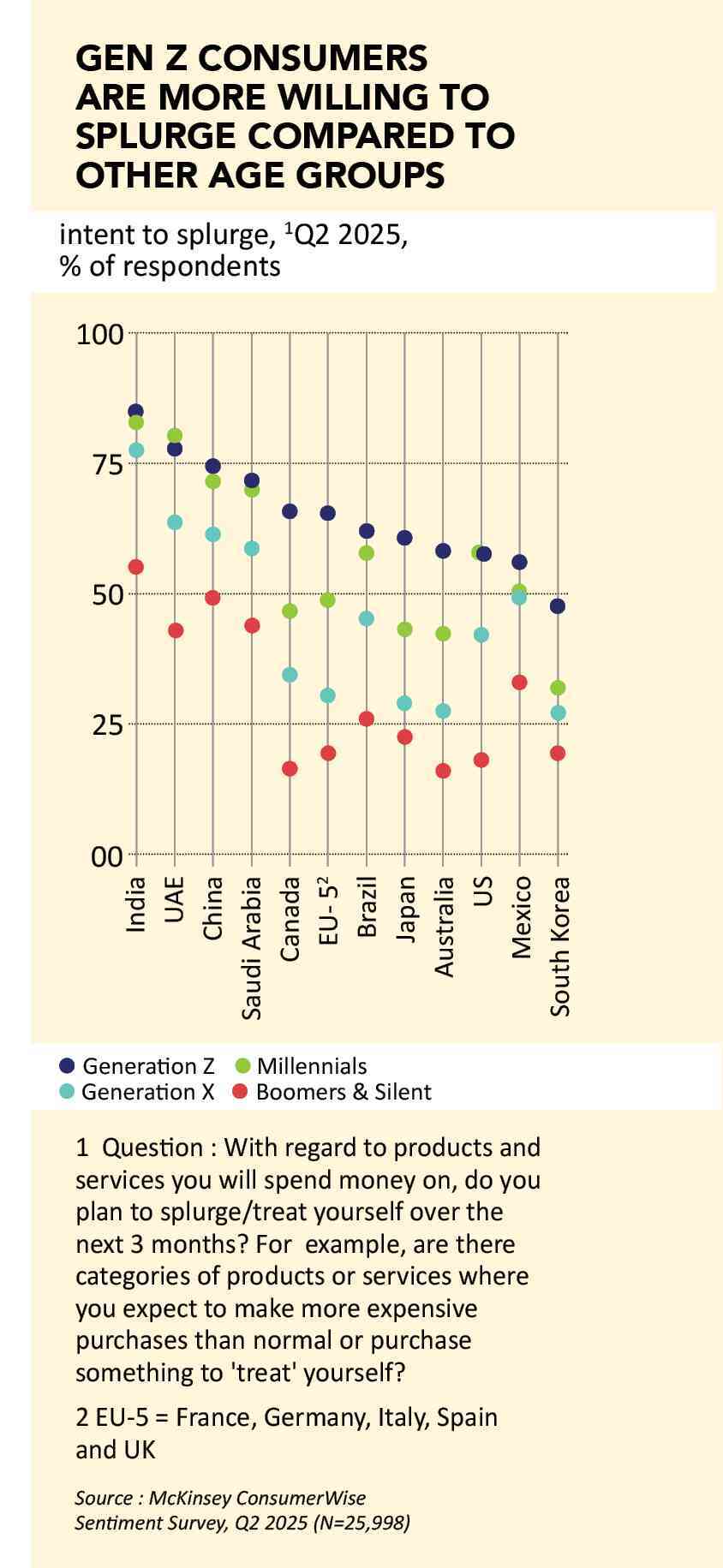

One of the biggest growth opportunities for brands today lies in understanding the Gen Z consumer base – those born between 1996 and 2010. Set to become the largest and wealthiest generation yet, their spending is growing at twice the rate of previous generations and is expected to overtake baby boomers globally by 2029. By 2035, Gen Z could inject an estimated US $ 8.9 trillion into the global economy. What sets Gen Z apart is how they define success. Unlike preceding generations, who often viewed milestones like marriage or parenthood as markers of progress, Gen Z places greater emphasis on career advancement and financial independence. This shift in priorities is largely influenced by the realities of rising living costs and the burden of student debt. This consumer cohort is more hopeful about social issues than older generations but less confident about inflation and price stability. That being said, these financial concerns barely deter them from spending. In the US, 50% of Gen Zers say they couldn’t support their lifestyle for more than a month with current savings, yet they continue to prioritise purchases.

Buy-now-pay-later services are popular with this generation, especially in China (40%), India (38%), UAE (36%) and Australia (35%). Interestingly, despite limited savings, Gen Z is the most willing generation to splurge and take on debt.

Brands must take note: Gen Z spend when they feel it’s worth it. Their top splurge categories are apparel (34%) followed by beauty (29%). To engage them, brands need to deliver products and experiences that feel relevant, trend-driven and worth the spend.

CHOOSING LOCAL OVER GLOBAL

2025 marks a pivotal moment in the shift towards local consumption. While disruptor brands once challenged global giants, consumers are now placing increased value on buying from locally owned businesses. Globally, 47% of consumers say that whether a company is locally owned influences their purchase decisions. The top reason, cited by 36%, is a desire to support domestic brands. Another 20% of surveyed consumers are of the opinion that local brands are better when it comes to meeting their needs, while only 13% cite affordability as a key factor.

As global trade dynamics shift and consumer preferences adjust to be more localised, multinational brands are under increasing pressure to adapt. Their ability to succeed beyond core markets will largely depend on how effectively they tailor offerings to local tastes, to what extent they localise sourcing and make sharp, strategic decisions about where – and how – to compete.

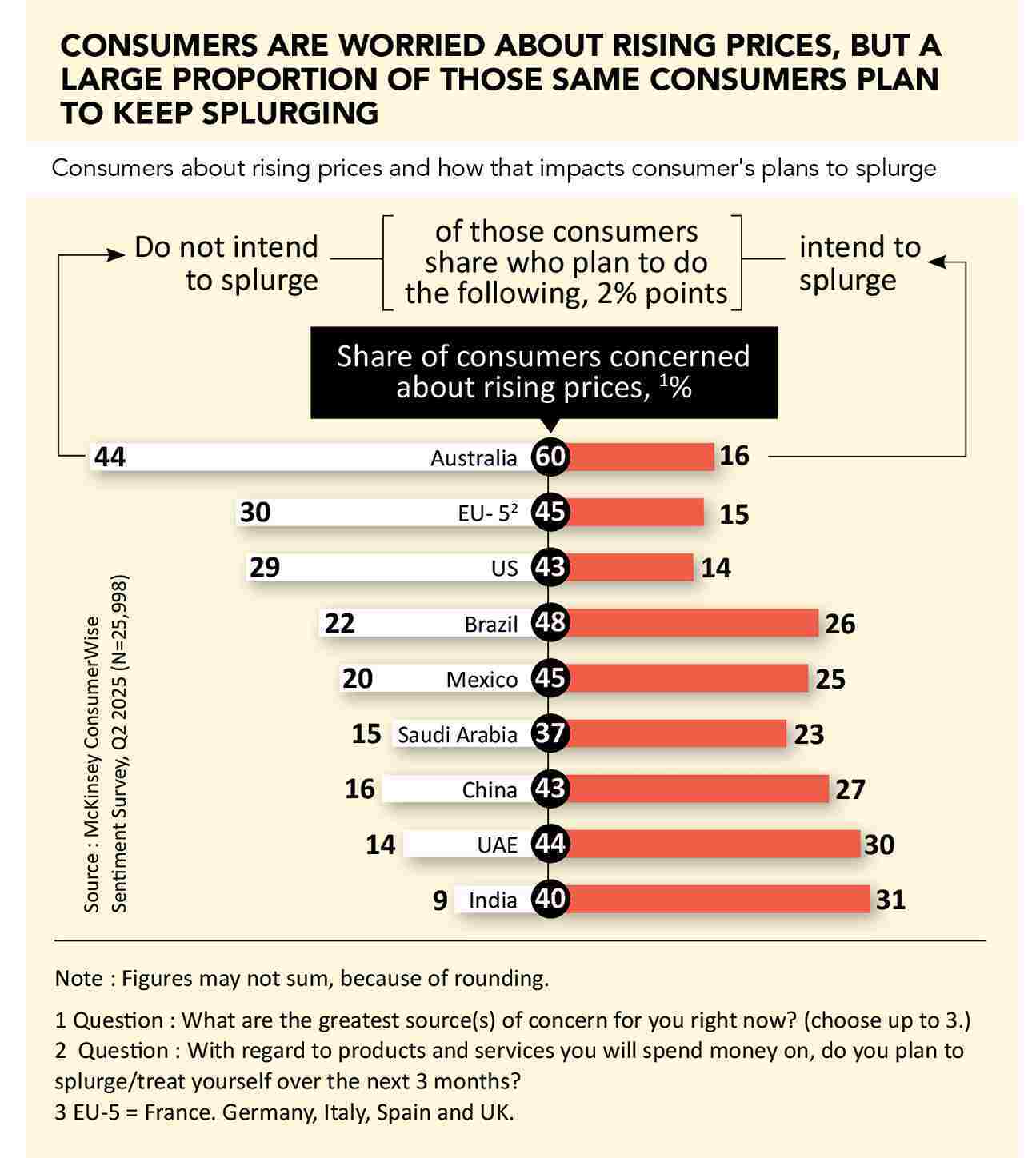

VALUE REIMAGINED: HOW PRICE SENSITIVITY IS RESHAPING CONSUMER BEHAVIOUR

The report finds that rising prices remain the top concern for consumers across all 18 markets surveyed overpowering worries about climate change, global conflict and job security. In response, 79% of consumers are trading down, though not always in conventional ways. Rather than simply buying less or switching to cheaper retailers, over half of global consumers now look for deals on every purchase. Another growing trend is cross-category trade-down where consumers cut spending in one area to afford more in another. Notably, 19% of consumers say they plan to reduce spending on essential categories while still splurging on non-essentials. This pattern reflects a refusal to give up small luxuries, many of which became part of consumers’ routines during the pandemic. Despite inflation concerns, over a third of surveyed consumers still intend to indulge, particularly in markets like Brazil, China and the UAE.

| One thing that brands should keep in mind: Gen Zers often pay a premium for convenience. Looking ahead, Gen Z consumers will set the tone for broader consumer expectations. Businesses that best understand where Gen Z is prioritising spending will be positioned for success. |

As consumers redefine what ‘value’ means, brands must adapt and step up their game. Success will depend on showing up where consumers are searching for value and ensuring that pricing, deals and promotions align with evolving expectations.