Cupid Ltd has announced plans to invest Rs. 331 crore (US $ 36.14 million) in Baazar Style Retail Ltd through the subscription of equity warrants, a move that will result in Cupid acquiring an 11.92% stake in the apparel retailer upon full conversion.

The proposed investment was approved by Baazar Style Retail’s board after the company received an expression of interest from Cupid. Under the arrangement, Baazar Style Retail will raise the funds by issuing 1,01,00,000 equity warrants to Cupid on a preferential basis.

Each warrant has been priced at Rs. 328.25, representing a discount of about 2% to Baazar Style Retail’s closing share price on Tuesday, 20th January. The total transaction value amounts to Rs. 331 crore (US $ 36.14 million), with the full consideration to be paid in cash.

The warrants are convertible into an equivalent number of fully paid equity shares with a face value of Rs. 5 each. Conversion may take place in one or more tranches within 18 months from the date of allotment, in accordance with the Securities and Exchange Board of India’s Issue of Capital and Disclosure Requirements (ICDR) Regulations, 2018, and other applicable laws. The preferential allotment will be subject to shareholder approval as well as the receipt of requisite regulatory and statutory clearances. The company stated that 14th January 2026 has been fixed as the relevant date for determining the issue price under Sebi regulations.

If the warrants are not exercised within the stipulated 18-month period, they will lapse and 25% of the consideration paid at the time of subscription will be forfeited. Upon full conversion, Cupid, which currently does not hold any stake in Baazar Style Retail, will own 11.92% of the company.

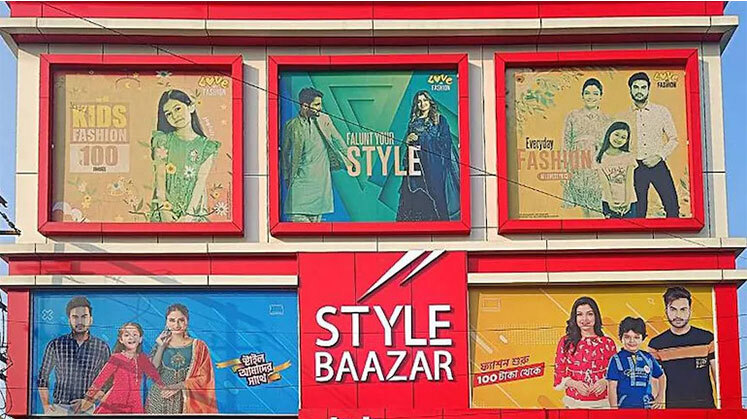

Baazar Style Retail’s shares have rallied around 30% over the past five trading sessions, although the stock continues to trade below its initial public offering price. Market participants view the proposed investment as a strategic move that could support Baazar Style Retail’s growth plans, while also keeping both stocks in focus during the trading session.

Cupid Ltd is primarily engaged in the manufacture and supply of sexual health and personal care products, including condoms, and the proposed investment marks a diversification of its strategic interests.