Fashion retail isn’t just changing, it’s being redefined. From the gullies of Gwalior to the feeds of Gen Z, the way Indians discover, buy and bond with fashion is evolving faster than ever.

Today, every brand needs to speak Bharat fluently—not just in language, but in emotion, aspiration and culture. Relatable, regional content and nano-influencers are outpacing big-budget campaigns in smaller towns.

And while that connection matters, convenience is king. Buy Now Pay Later (BNPL) is powering the next big spending surge, especially in non-metro India.

In parallel, athleisure is more than a wardrobe—it’s a lifestyle. It reflects a generation that may not hit the gym daily but still wants comfort that signals movement, ambition and self-care.

Meanwhile, an unexpected powerhouse is rising: the Silver Generation.

Ethnicwear is also shedding its ‘festive-only’ tag. And not to forget Q-commerce, which is putting fashion at consumers’ doorstep in under 30 minutes.

The store of the future? Compact, local and smart. Scalable formats with lean teams are winning in Tier-2 and Tier-3 towns.

Finally, discovery and service are being reimagined—where Reels, Pinterest boards and visual storytelling on social media lead the customer journey.

To kick this off, we’re launching an 8-part series that highlights each of these powerful trends shaping fashion retail in 2025.

2025 Trend 1: Grey Economy: Silver generation Set To Rule Fashion

As India’s fashion industry chases the attention of Gen Z and millennials with social media-driven trends, a less publicised but no less powerful demographic is remaking consumption habits: the Silver Generation. Made up of those over the age of 50, this demographic may shop less frequently than young consumers, but their decisions are intentional, their loyalty absolute and their impact on markets rapidly growing.

With longer life spans, improved access to healthcare and greater financial autonomy, this cohort is not only living longer—but well. They are engaged consumers of lifestyle activities such as travelling and eating out and increasingly insist on clothing that is able to keep up with their active lifestyles.

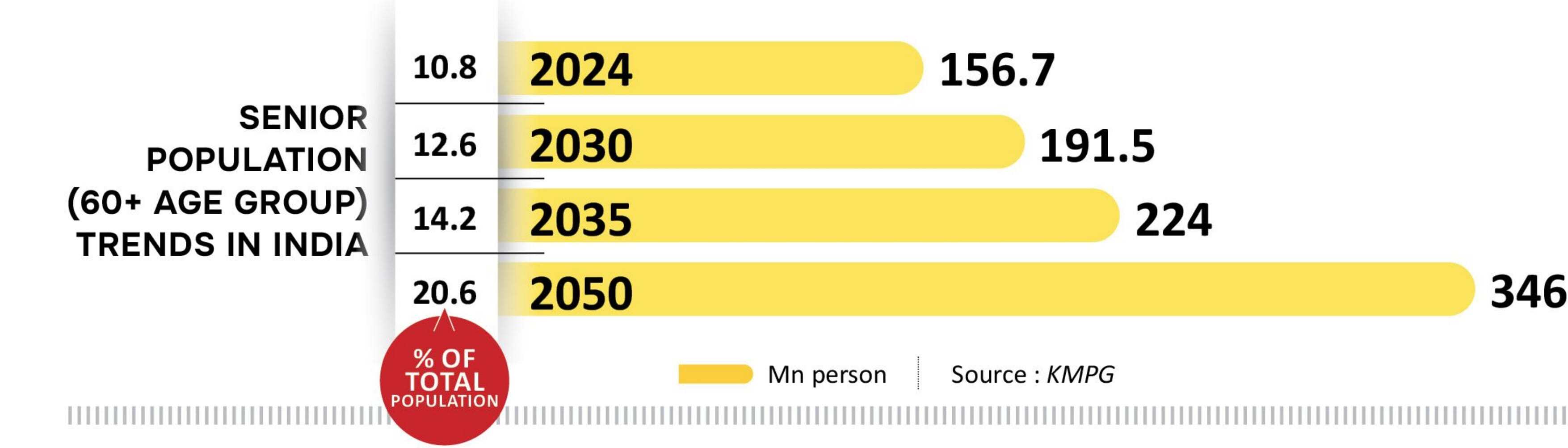

As per the UNFPA India Ageing Report 2023, India is ageing fast. The elderly population (60 and above) in the country is projected to increase to 347 million by 2050, accounting for more than 20.8% of the overall population. This is a significant increase from 10.5% of the population aged above 60 in 2022.

WHAT ARE THEIR FASHION TASTES?

|

Other Trends

1. Product discovery and customer service to power growth

2. 2025 Trends: Ethnicwear Set To Shine,

3. 2025 Trends: Bharat Retail To Go Compact, Lean

4. 2025 Trends: Q-Commerce To Fuel Fashion In Small Cities

5. 2025 Trends: Brands Must Speak Bharat

6. 2025 Trends: Buy Now, Pay Later To Ignite Shopping Boom

7. 2025 Trends: Athleisure To Go Full Throttle

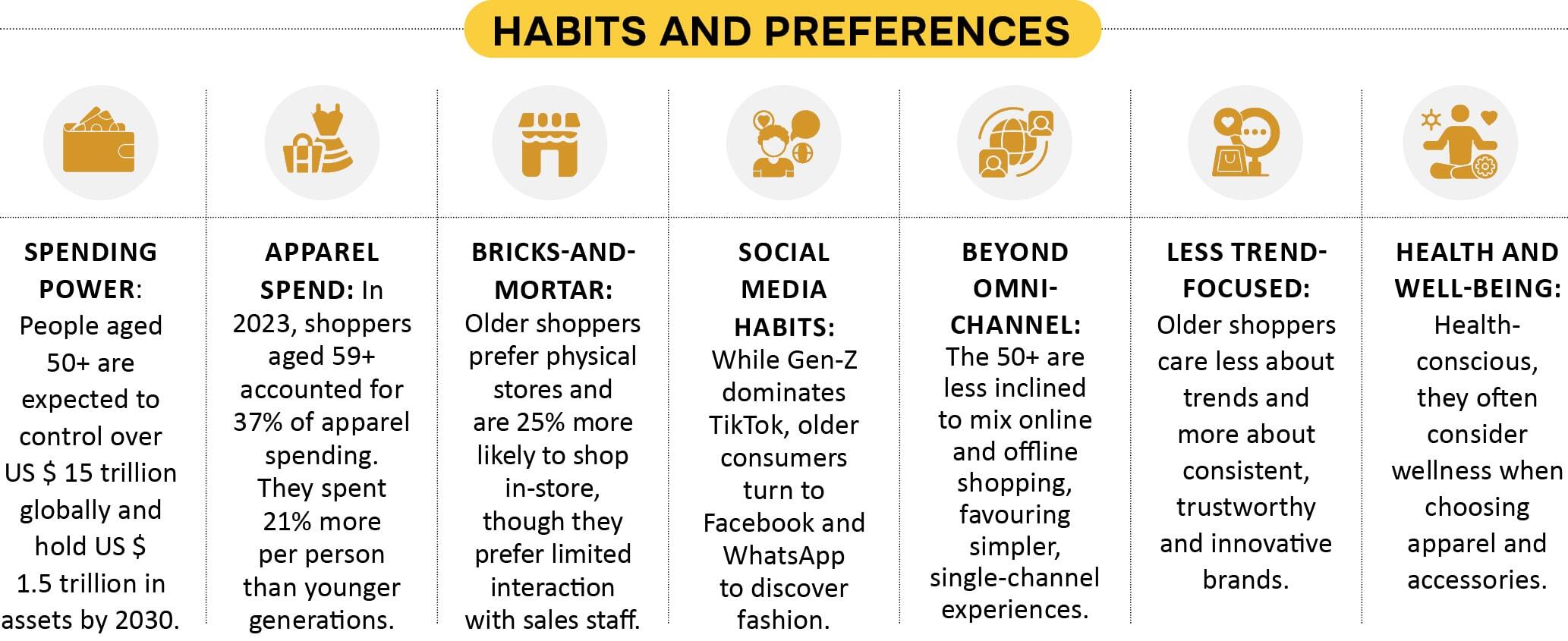

With senior citizens’ expenditure expected to increase from US $ 100 billion in 2020 to almost US $ 1 trillion by 2030, according to a Deloitte report, this group is now off the fashion sidelines. Of the 120 million elderly Indians in 2021, more than 40 million reside in cities such as Mumbai, Delhi and Bengaluru, many with a significant disposable income. Over half of them can easily spend Rs. 40,000 to Rs. 50,000 a month and those above 50 typically possess ten times as much wealth in cumulative terms as those below 35. On an average, Indians spend around Rs. 1,000 to Rs. 2,500 per month on clothing. In contrast to younger consumers pursuing fast fashion, older shoppers value comfort, quality and practicality. They tend to remain loyal to a smaller repertoire of trusted brands, rewarding those that deliver consistently with their loyalty over the long term. This is a consumer base that isn’t impressed with every seasonal fad.

While the e-commerce industry in India continues to expand, this generation also likes multi-brand retail spaces and hence it becomes important for fashion brands to review their distribution models and increase their presence across retailers.

When it comes to advertising, conventional print media continues to work, particularly newspapers and lifestyle magazines. Store interactions also become a crucial factor— individualised customer care, carefully crafted experiences and friendly store interiors help in generating confidence.

Online, this audience is most active on Facebook and WhatsApp, but less so on Instagram or TikTok. Marketing campaigns that intersect around nostalgia and familiarity—i.e., retro visuals, iconic older models or cultural touchpoints—are most likely to work.

Importantly, representation is getting better. Older models are more frequently being featured in marketing campaigns, which means the industry is recognising the Silver Generation not only as consumers, but also as aspirational individuals unto themselves.

Even though the Silver Generation can exert considerable influence, they are less likely to use alternative fashion channels such as resale or rental and are less motivated by sustainability narratives. The best candidates for retention strategies, therefore, are this group; brand efforts should be on loyalty indicators rather than new customer acquisition.

Fashion players are starting to wake up. Retailers like Raymond, Fabindia, Global Desi and Biba, W for Women, Pantaloons, Westside, Soch and Manyavar are adding comfort-driven lines for older consumers to their portfolios. Adaptive clothing labels like Cocoon Senior Clothing and Zyenika also cater to the elderly population with comfortable designs that balance utility and fashion.