Originally built for groceries, quick commerce is now powering the future of fashion. From agile D2C start-ups to seasoned retail giants, everyone’s jumping on the rapid delivery bandwagon to satisfy consumers who want fashion at lightning speed and unlock new growth avenues.

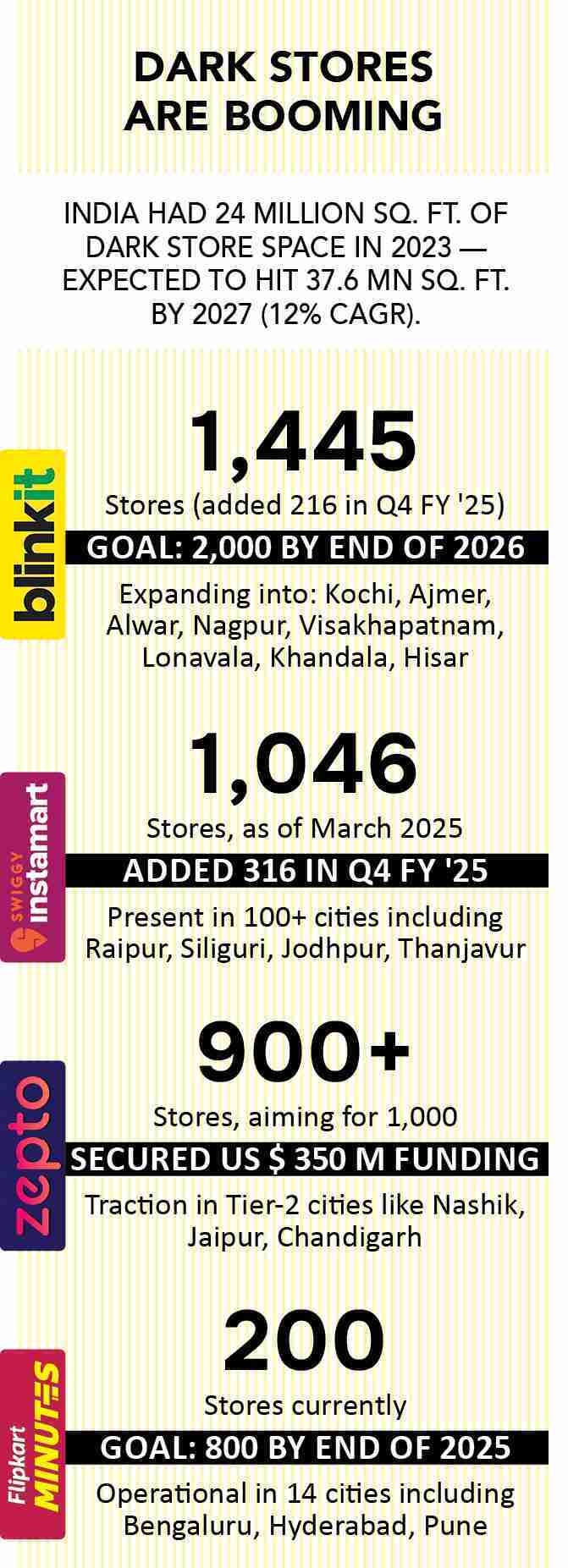

With heavyweights like Blinkit (Zomato), Swiggy Instamart, Zepto and Dunzo leading the charge, the market hit US $ 3.34 billion in 2024 and is set to triple to US $ 9.95 billion by 2029. India already boasts 26.2 million q-commerce users across platforms, and with a CAGR above 4.5%, the growth is only accelerating.

Fuelling this growth is the ready availability of labour and flexible working models. Currently, the sector employs 2.5-3 lakh outdoor delivery partners and 70,000-75,000 under-the-roof employees, which includes dark stores and warehouses, according to TeamLease Services. Looking ahead, the Q-commerce sector will provide jobs to more than 5-5.5 lakh people in the next year. No wonder, the apparel industry is riding the coattails of q-commerce. From athleisure to innerwear, ethnicwear to denim, apparel brands across price points and categories are present on q-commerce platforms. The list of participants includes who’s who of Indian retail—Fabindia, Puma, Jockey, Adidas, Enamor, Rupa, Libas, Jisora, Ketch, Dennis Lingo, Bewakoof, TIGC, The Bear House, Zivame, Levis, US Polo Assn, Boldfit, VIP, Decathlon, Pepe Jeans, Manyavar, DaMENSCH and playR, to name a few. Even the e-commerce heavyweights like Myntra and Flipkart have joined the q-commerce rush. Myntra, India’s largest online fashion retailer, rolled out its ‘M-Now’ service offering 30-minute delivery, which was initially launched in Bengaluru and is planned to expand to other major cities like Delhi, Mumbai and Pune. Additionally, Flipkart Minutes, Flipkart’s q-commerce wing is all set to expand its business to Tier-2 and Tier-3 cities. The allure of Q-commerce is even attracting the attention of start-ups. One notable example is fashion q-commerce company Slikk, which recently raised US $ 10 million in Series A funding. The brand differentiates itself with offerings like ‘Try & Buy’, one-hour delivery and instant refunds. It is currently available in select areas of Bengaluru and plans to expand its service to other urban centres, including Tier-1 and Tier-2 cities. Another fashion exclusive q-commerce player, Blip that promises 30-minute fashion delivery, is live in Bengaluru and plans to expand to Delhi soon.

Even individual fashion brands are picking up pace. For example, fast fashion brand NEWME recently launched its 60-minute delivery service, Newme Zip, in Bengaluru. The brand earlier launched the service in Delhi with a 90-minute delivery timeline.

Bharat Wants Style…In A Jiffy

As big cities near saturation, India’s fast-growing Tier-2 and Tier-3 cities are stepping into the spotlight. In places like Nashik, Varanasi, Udaipur, Haridwar, Bhathinda, Thrissur, Mangalore, Coimbatore, Jaipur, Lucknow, Surat, Nagpur, Salem, Amritsar, Bhopal, Ludhiana and Warangal, access to trendy fashion is no longer a luxury, it’s a basic expectation. With better infrastructure, growing disposable incomes, deeper internet penetration and a growing appetite for instant style, Q-commerce is fast becoming the preferred fashion fix in these emerging hubs.

According to Yogesh Kabra, Founder, XYXX, a premium innerwear brand with revenue of Rs. 131 crore in FY ’24 and 5 (EBOs), Q-commerce has the potential to become a reliable sales channel for fashion essentials in Tier-2 and Tier-3 markets. “While its current success is more concentrated in Tier-1 cities due to stronger infrastructure, the demand in smaller towns is catching up fast. Consumers in these regions are increasingly looking for quick, hassle-free access to quality basics like innerwear and loungewear,” he noted. Adding to this, Harsh Somaiya, Founder, The Bear House, a menswear brand with a Rs. 140 crore revenue and expansion plan of 6 new stores by end of 2025, noted, “Some of India’s leading Q-commerce portals are delivering to India’s Tier-2 and Tier-3 cities. Fashion has evolved into a ‘daily essential’ for today’s consumers, many of whom are ‘last-minute dressers’—those suddenly in need of a shirt for a Friday night dinner or a casual weekend brunch.”

He added, “The Bear House is on Zepto, Myntra, Flipkart Minutes and we’re also in talk with another leading Q-commerce platform while also targeting promising local start-ups like Zilo, Slikk, Tyro, etc.”

Ravi Kukreja, Co-founder, playR, a sportswear and accessories brand that is aiming a revenue of Rs. 75 crore in FY ’26 and has over 150 stores globally, said, “By fine-tuning our SKUs and customising our offerings to match local tastes, Q-commerce has the potential to become a reliable option for Tier-2 and Tier-3 markets too.”

Other Trends

1. 2025 Trends: Silver Generation Set To Rule Fashion

2. Product discovery and customer service to power growth

3. 2025 Trends: Ethnicwear Set To Shine,

4. 2025 Trends: Bharat Retail To Go Compact, Lean: Anant Tanted, Founder and CEO, The Indian Garage Co.

Rewriting The Inventory Rulebook

To tap into the rise of dark stores in Tier-2 and Tier-3 cities, brands are reworking their inventory strategies. Traditional fashion retail focuses on seasonal planning and large inventories, but Q-commerce is faster and more local, demanding a complete backend overhaul. Experts say fashion brands need to focus on decentralising warehousing by setting up regional fulfilment centres to enable faster last-mile delivery, especially in high-demand zones.

Real-time inventory management also becomes critical, ensuring accurate stock visibility across platforms to avoid delays or cancellations. Additionally, packaging must be optimised for quick dispatch and compact enough to suit the hyperlocal delivery model.

“At playR, we’ve embraced a decentralised warehousing approach, using micro-warehouses or dark stores to speed up our deliveries. Our inventory planning is all about real-time data, which helps us keep everything in stock, while running our operations smoothly,” mentioned Ravi Kukreja.

“While entering Q-commerce, we closely monitor current sales data and track the growth rate of dark stores in specific regions. This helps us ensure that our best-performing SKUs are available where the demand is rising, without the need to overhaul our existing supply chain model,” highlighted Yogesh Kabra, while stressing that since entering the Q-commerce space in November 2023 through platforms like Blinkit, Swiggy Instamart and Zepto across 20 cities, XYXX has recorded 20% month-on-month growth.

In a similar vein, DaMENSCH, a men’s apparel brand with Rs. 91.5 crore in revenue for FY ’24 and 25 EBOs, also had to recalibrate its inventory logic and proximity strategy–ensuring fast-movers were stocked closest to high-demand zones. “For Tier-2 and Tier-3, partnering with q-commerce platforms’ dark store networks has been more efficient than building our own infrastructure from scratch,” said Anurag Saboo, Co-founder and Director, DaMENSCH.

“Brands need to design for fast picking and packing, not showroom-style browsing. We’ve optimised pack sizes, introduced Q-comm-exclusive bundles and limited options to reduce decision fatigue and boost sell-through,” he added. Whereas, Sunil Pathare, Chairman and MD, VIP Clothing, an innerwear brand with revenue of Rs. 238.25 crore in FY ’24-25, emphasised, “We adopted a hub-and-spoke model in Tier-2 and Tier-3 cities, with central warehouses supported by local dark stores. This helps maintain a lean inventory while ensuring popular items are always available for quick dispatch.” He added that VIP uses data analytics to understand specific preferences and demand shifts of each locality better, allowing better stocking decisions.

“Looking ahead, we’re excited about combining Q-commerce with geo-targeted offers — imagine getting a limited-edition shirt delivered in two hours, only in Bengaluru,” said Harsh Somaiya.

WHAT’S HOT

Experts say basics like T-shirts, socks and innerwear are currently outperforming trend-led fashion on Q-commerce platforms. “The Basics have simple sizing, universal necessity and perpetual usage. This causes a higher purchase rate and lower returns, which makes them ideal for the rapid delivery model,” claimed Sunil Pathare. Likewise, Harsh Somaiya said, “Our range of easy, go-to styles that don’t take too much thought — like classic polos, solid crewnecks and neutral flannels are perfect for Q-commerce.”

Echoing similar sentiment, Anurag Saboo averred, “Essentials like trunks, tees, socks and vests — where style cycles don’t change often — naturally align with the Q-commerce mindset.”

At the same time, there’s a growing demand for casualwear like shorts, joggers and ethnicwear like kurtas and chudidars. Quick fashion platforms are also seeing a rise in demand for party dresses, co-ords and going-out outfits. Customers are also turning to q-commerce for vacation outfits and travel-friendly styles. Commenting on this trend, Srishti Tanwani shared, “We’ve seen younger customers become more spontaneous, with over 40% of ethnicwear orders placed within 24 hours for urgent needs like office kurtas, last-minute events or same-day Mother’s Day gifts. This behaviour has made quick commerce more active and significantly increased demand for fast services, driving a 30% rise in repeat purchases.”

While essentials lead in volume and frequency, trend-led fashion holds strong potential in specific contexts. For instance, demand for festive clothing such as kurtas and ethnic outfits, spikes during Diwali and Eid, which remain the stronghold of brands like Manyavar.

In addition, the rise of social media-driven fashion discovery is fuelling impulse buying. This shift in behaviour makes Q-commerce a valuable channel for even trend-forward brands looking to expand reach and relevance.