If mobile phones ruled India’s first e-commerce wave, fashion is the face of the second. Post pandemic, millions of new shoppers—many from Tier-2 and Tier-3 cities—have gone online not just for convenience, but for style. And what’s making those carts heavier? BNPL.

With the BNPL market already touching US $ 30.88 billion in 2025 and set to cross US $ 78.50 billion by 2030, it’s clear this isn’t just a payment trend, it’s becoming the backbone of how India shops. UPI-enabled approvals, zero dependence on credit cards and a flood of new users from smaller cities are driving the shift. As fintechs and banks hustle to make BNPL easier and more accessible, it’s quietly becoming the fuel behind India’s growing appetite for fashion that’s fast, flexible and within reach.

According to a report from Mordor Intelligence, online transactions led with an 83.3% revenue share in 2024 in the India BNPL market, while point-of-sale BNPL is forecasted to grow at 24.5% CAGR through 2030. Generation Z alone commanded a 39.7% share of the India BNPL market size in 2024 and is projected to expand at 23.6% CAGR between 2025 and 2030. Fintechs retained a 64.8% share in the 2024 India BNPL market, but banks are catching up fast and are expected to grow at 25.3% CAGR through 2030.

According to LatentView Analytics, enabling Shop Now, Pay Later can increase average order value (AOV) by up to 30%. When customers know they can split their payments, they’re more likely to choose premium products or add more to their carts—directly boosting revenue per transaction.

According to Varun Vaid, Business Director, Wazir Advisors, informal credit or udhaar has always been common in India, especially in smaller cities. “People have long bought sarees, suits and bedsheets on delayed payments. Since clothes are bought occasionally and often for special events, BNPL suits the category well.” He adds that fashion is aspirational, so shoppers are open to credit if it helps them upgrade their lifestyle.

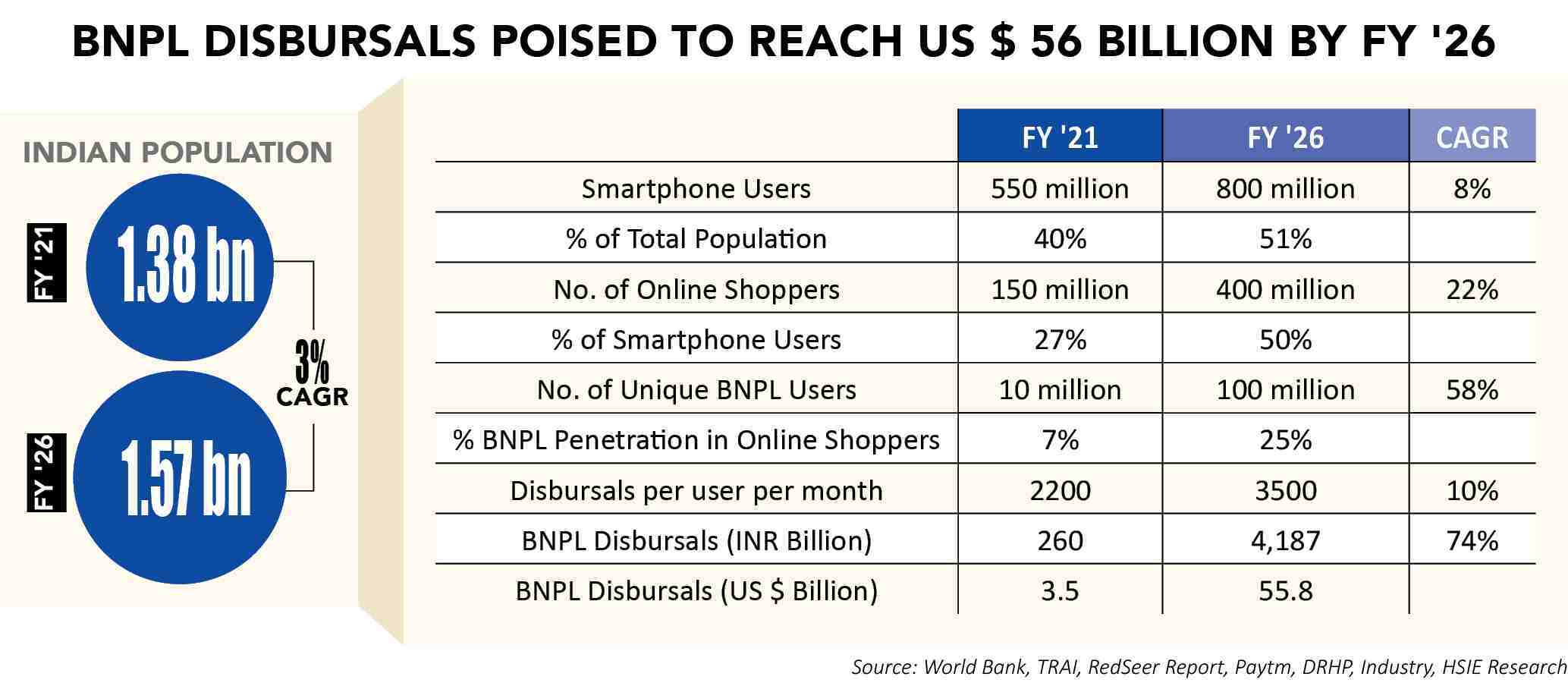

Many studies show that India has a large creditworthy population. For example, as per a BCG publication on India’s spending patterns, one-third of households earn more than Rs. 41,000 per month, while 78% of households earn more than Rs 12,500 per month. With the average BNPL spends per month in Rs. 2,000–3,000 range, the addressable market is disproportionately large.

A report by BNPL platform ZestMoney found that Gen Z and Millennials are the main users of BNPL. While men in Tier-1 and Tier-2 cities mostly spent on fashion and lifestyle, women use BNPL to buy electronics and invest in EdTech courses to upgrade their skills.

Bengaluru, Mumbai, New Delhi, Pune, Hyderabad, Chennai, Ahmedabad, Thane, Kolkata and Jaipur emerged as the top cities witnessing demand for BNPL. Among Tier-2 and Tier-3 cities, Lucknow, Kanchipuram, Vijayawada, Visakhapatnam, Guntur, Surat, Indore, Bhopal, Tiruvallur and Coimbatore are showing strong interest.

“Young shoppers, especially those just starting their careers, are leading the BNPL wave,” pointed Varun Vaid, adding, “Many of them don’t have credit cards, but they’re comfortable with digital payments. Aadhaar-based KYC and UPI payment history help fintech companies approve them without needing traditional credit scores. ”

Retailers are taking note of the shift. A leading value retail chain shared, “We’re seeing growing interest in BNPL, especially amongst young shoppers in smaller towns. Fashion is now more aspirational than ever and flexible payment options help shoppers buy festive or seasonal outfits without feeling the financial pinch. Cities like Patna, Lucknow, Kanpur and Ranchi are seeing a strong response, especially during wedding or festival seasons.”

Other Trends

1. 2025 Trends: Silver Generation Set To Rule Fashion

2. Product discovery and customer service to power growth

3. 2025 Trends: Ethnicwear Set To Shine,

4. 2025 Trends: Bharat Retail To Go Compact, Lean

5. 2025 Trends: Q-Commerce To Fuel Fashion In Small Cities

6. 2025 Trends: Brands Must Speak Bharat

To meet this demand, retailers are looking at simple, no-fuss financing options that don’t need too much paperwork, especially for shoppers new to credit. They want to keep the process smooth, using tools like QR code checkouts or app-based approvals that take under a minute. The goal is to empower the customers— not confuse or burden them—when they choose to shop. Experts say simple and seamless onboarding and checkout processes are key—BNPL should feel like a natural part of the shopping experience, not an added layer. Smart repayment nudges such as UPI reminders or auto-debit opt-ins, along with soft penalties like temporary restrictions on future usage, can help encourage timely repayments without turning away users. To make BNPL truly sustainable, brands and fintechs must also segment users by risk profiles and offer tailored credit limits that balance access with responsibility. Moreover, the rules around BNPL are becoming clearer, which could encourage more companies to join the market.

For instance, in May 2025, PayU got the green light from the Reserve Bank of India (RBI) to officially work as an Online Payment Aggregator. This means it can now grow its BNPL services.