Athleisure isn’t just a trend anymore, it’s a statement. What began as a fashion-meets function phenomenon is now evolving into something much deeper. For today’s active consumers, exercise isn’t just a health habit—it’s part of their lifestyle DNA and a key expression of identity.

This marks a new chapter in the decade-long athleisure boom, where wellness isn’t a side note, but a central theme of how people live, shop and self-define. For brands, this signals more than just demand for stylish workout gear, it’s an opening to build emotional resonance, deeper engagement and long-term loyalty with consumers who see movement as a way of life.

However, even with all the talk about health and fitness, physical inactivity is actually increasing. Inactive adults made up 26% of the global population in 2010. That number jumped to 31% in 2022 and the World Health Organization warns it could hit 35% by 2030.

This trend is worrying for the sporting goods and athleisure industry—but it’s also a big opportunity. Right now, around 1.8 billion people worldwide aren’t getting enough physical activity. That’s twice the size of India’s adult population. Reaching even a small part of that group could mean huge growth for brands.

Brands have a clear chance to make an impact through inclusive product design, awareness campaigns and youth programs that encourage movement from an early age.

All of this is unfolding at a time when India’s athleisure market is hitting its stride. Valued at US $ 13.5 billion in 2024, it’s projected to grow to US $ 21.25 billion by 2033, driven by rising health awareness, evolving lifestyles and growing demand for comfortable, stylishwear.

A new generation of consumers who expect their clothes to do more are the key drivers of the athleisure movement. This includes urban professionals and Gen Z, followed closely by women and even seniors adopting active lifestyles.

Looking ahead, Sunil Jhunjhunwala, Co-founder and MD, Technosport, an activewear brand, sees athleisure becoming even more embedded in everyday life. “Consumers want clothes they can wear not just at the gym, but throughout the day—at home, during running errands or while meeting friends. Brands that offer this kind of all-day comfort at a good price will grow the most.”

Likewise, Nikhil Aggarwal, CEO, Campus Activewear, a sports and althleisure footwear brand, pointed out, “This move towards a healthy lifestyle isn’t temporary— it’s a fundamental lifestyle transformation. We believe the category will mature in terms of consumer expectations, with a greater focus on performance, versatility and design innovation.”

He added, “Footwear continues to be the anchor within the athleisure category, especially in markets like India where it often serves as the consumer’s entry point into active living.” Adding to this, Ravi Kukreja of playR, a sports merchandise brand, said, “The future of athleisure will be broader, encompassing not just apparel but also equipment and accessories that support a holistic active lifestyle.” According to Allied Market Research report, hoodies are expected to see the highest growth rate in the future, driven by a variety of stylish options available. Other products that are seeing an uptick in sales are leggings, joggers, sports bras, T-shirts and sweatpants. Experts also noted that they are seeing increased interest from Tier-2 and Tier-3 cities.

Heavyweights In Motion

The athleisure market is growing fast, with big brands like Nike, Adidas, Puma and Under Armour leading the way through new ideas, eco-friendly efforts and a wide range of products.

Adidas, for example, has teamed up with fitness brand Cult to improve and promote a strength training workout called adidas Strength+. This program will now be available on Cult’s app, website and in over 150 gyms across India. Adidas has also created shoes like the fully recyclable Futurecraft Loop and products made from ocean plastic. It is also exploring new materials made from plants. Nike has developed Flyknit shoes, Nike Air cushioning, and eco-friendly methods like ColorDry (which dyes fabric without water) and a program that recycles old shoes.

Nike has also launched a collection with Indian brand NorBlack NorWhite, blending traditional Indian tie-dye (bandhani) with sportswear designs. Its first India-based collaboration aims to engage a new generation of female consumers who combine culture, design and active lifestyles. The collection features women’s apparel ranging from shorts and tops to tights and bras. Accessories include sneakers and a crossbody bag, all designed to transition from the sports field to the street. Puma is using AI to design sneakers like the Inverse, offering soft XETIC cushioning and even making compostable shoes. It also connects with young consumers by partnering with stars like Rihanna and Neymar. Under Armour features innovations like UA HeatGear and ColdGear for temperature regulation. Despite their innovations, they are being challenged by emerging players.

Other Trends

1. 2025 Trends: Silver Generation Set To Rule Fashion

2. Product discovery and customer service to power growth

3. 2025 Trends: Ethnicwear Set To Shine,

4. 2025 Trends: Bharat Retail To Go Compact, Lean

5. 2025 Trends: Q-Commerce To Fuel Fashion In Small Cities

6. 2025 Trends: Brands Must Speak Bharat

7. 2025 Trends: Buy Now, Pay Later To Ignite Shopping Boom

1.8 BnRight now, around 1.8 billion people worldwide aren’t getting enough physical activity. That’s twice the size of India’s adult population. Reaching even a small part of that group could mean huge growth for brands. |

According to McKinsey, between 2019 and 2024, globally challenger brands grew more quickly than established companies through sharper positioning and innovation. During this time, the two biggest players–Nika and Adidas– lost 3 per cent of their market share.

India’s Homegrown Wave

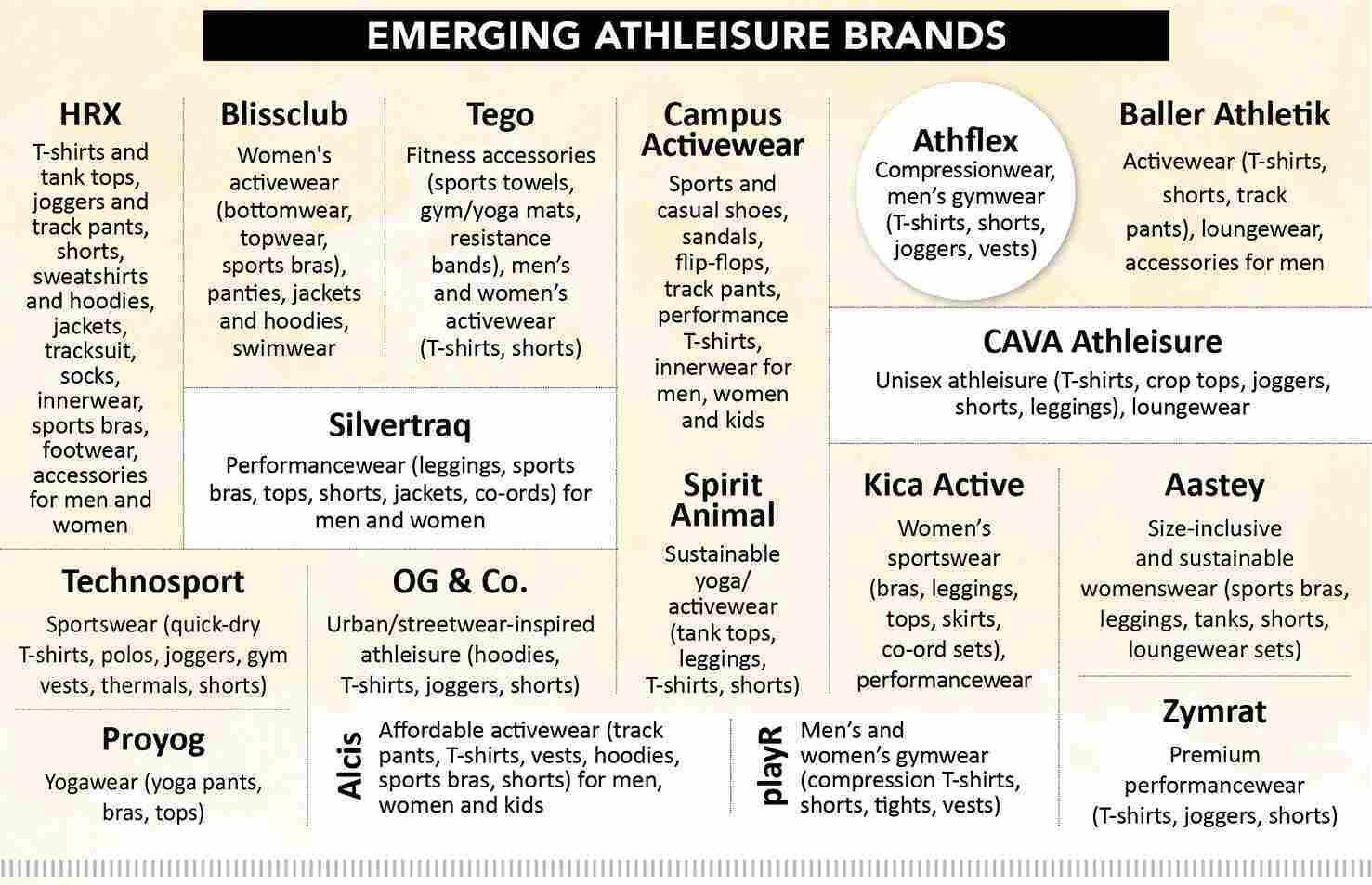

A similar shift is happening in India. Several homegrown athleisure brands are carving out space in the market by focusing on innovation, affordability and deeper customer engagement. This new wave includes names like HRX, Blissclub, Tego, Silvertraq, Athflex, CAVA Athleisure, Spirit Animal, Baller Athletik, Kica Active, Aastey, OG & Co., Campus Activewear, Technosport, playR, Proyog, Zymrat, Satva, Wear Jukebox, Boldfit, Fitkin, SQUATS, Kosha, Alcis and KultApparel.

Many of these brands are now moving offline. For instance, HRX has its sights on launching 10 offline stores initially, with a long-term vision of reaching 150 stores by 2025. Campus Activewear also began with 35 EBOs in 2017 and now boasts over 250 stores across the country. Similarly, playR was available in over 250 retail locations in 2023 and is on track to reach more than 800 locations globally Boldfit plans to go offline and open over 100 stores across the country in the next four years. Additionally, Blissclub also opened its 16th store in Gurugram recently. These brands are also seeing rapid revenue growth. For instance, HRX has crossed a major milestone, reaching Rs. 1000 crore in revenue, with earnings doubling each quarter. Campus Activewear saw its operating revenue grow 10 per cent year-on-year to Rs. 1593 crore in FY ’25. Technosport crossed Rs. 300 crore revenue in FY ’24 and is eyeing a high double-digit growth of 30-40 per cent over the next few years. Boldfit’s revenue for FY ’24 was reported as close to Rs. 140 crore with a project run rate of Rs. 300 crore for FY ’25. PlayR has seen significant revenue growth with Rs. 55 crore in FY ’25, up from Rs. 36 crore in FY ’24 and is projected to reach Rs. 75 crore in FY ’26. Zymrat claims to have an annual recurring revenue of Rs. 8.6 crore. Tego reported annual revenue of Rs. 5.79 crore in FY ’23, recording triple-digit growth year-on-year. Cava Athleisure reported total sales of Rs. 5 crore in FY ’24 and aims to reach a monthly recurring revenue of Rs. 2.5 crore in FY ’25.

Private equity and venture capital are also betting big on this category. Technosport raised US $ 25 million in its first external fundraising from A91 Partners. Boldfit raised US $ 13 million in its first major funding from venture capital firm Bessemer. Blissclub has raised US $ 15 million in a funding round led by Eight Roads Ventures and Elevation Capital. Meanwhile, Cava Athleisure, a Bengaluru-based brand, has raised a total of US $ 1.14 million in a single round with investors such as Spring Marketing Capital and Lets Venture. Zymrat and Aastey have also attracted early investor venture funding.

Betting Big On Innovations

The younger crop of brands have also reimagined athleisure with innovative technologies that deliver both functionality and style. For instance, Cava Athleisure has introduced ADPT, a moisture-wicking fabric blend of nylon and spandex, available in over 50 styles and colours. All of its products are made with sustainably sourced BCI cotton and recycled polyester and it also uses AR interactive designs in the design process.

On the other hand, Silvertraq incorporates technologies like Swiss Sweat management technology to create fabrics with moisture management, quick drying and anti-odour properties. Similarly, playR utilises materials like DRI-TECH, which is designed to wick away sweat and keep the wearer dry and comfortable. Proyog uses its signature fabric, HYPERBREATH, which blends organic cotton and lycra, designed to be breathable and comfortable for yoga practice. Athflex is also exploring the integration of technology into activewear, including fitness tracking sensors, heart rate monitors and even built-in audio systems. It also offers compression T-shirts designed to provide muscle stabilisation, enhanced blood circulation and accelerated recovery.

Additionally, Sunil Jhunjhunwala noted that one of Technosport’s recent breakthroughs is the development of ‘CotFlex’ technology, which mimics the feel of cotton while offering superior stretch, breathability and moisture management. He said, “This fabric doesn’t cling to the body, dries quickly and remains wrinkle-free, making it ideal for India’s climate and lifestyle.”

As for the eco-conscious consumer, Technosport has developed a proprietary antimicrobial ‘TechnoGuard’ technology that not only enhances hygiene but also extends garment life, contributing to sustainability by reducing the need for frequent replacements. While established brands are used to casting a wide net catering to masses, many emerging players have zeroed in on niche categories, crafting specialised products to attract underserved customer segments. As such, Blissclub has built its business to Rs. 92.16 crore in FY ’24, by targeting women who are not just focused on traditional workouts but who are ‘everyday movers’, including walkers, dancers, yoga enthusiasts and busy mothers. Aastey, another athleisure label, also identified an unmet need for size-inclusive and sustainable activewear in the market, offering apparel up to 4XL. Seizing the opportunity, the brand carved out a niche and has since built a thriving community of 200,000 women. Meanwhile, brands like Blissclub and HRX don’t just sell products– they foster communities via workout challenges, user-generated content and lifestyle storytelling, which resonates deeply with millennials and Gen Z, while Kica Active offers online yoga and wellness classes for its tribe.