If the retail industry was hoping for more GST rationalisation or tax relief for salaried workers, it was left disappointed, as these measures could have directly boosted consumer spending.

Instead, the Budget focused on improving the overall business environment for India’s fashion retail market, valued at over US $ 120 billion. It emphasised infrastructure spending, support for MSMEs, skill development, and balanced growth across regions.

“For the retail sector, the impact of the Budget will be gradual and uneven, driven more by improvements in supply chains, workforce readiness and rural and non-metro demand than by direct policy support,” said Kumar Rajagopalan, CEO, Retailers Association of India (RAI).

For example, the creation of a Rs. 10,000 crore (US $ 1.1 billion) MSME growth fund and the expansion of Mega Textile Parks are seen as crucial in modernising the retail supply base.

Likewise, stronger design education and AI-led innovation can help fashion retailers respond faster to trends, improve demand forecasting, and build visual storytelling and digital skills that are increasingly critical for product development and consumer engagement.

This is reinforced by the government’s plan to support the Indian Institute of Creative Technologies (IICT), Mumbai, in setting up animation, visual effects, gaming, comics (AVGC) and content creator labs across 15,000 secondary schools and 500 colleges.

Similarly, SAMARTH 2.0 focuses on improving skills by working more closely with industry and academic institutions, helping ensure a steady supply of job-ready workers across the textile value chain.

The National Fibre Scheme strengthens fibre self-reliance and encourages the use of man-made and technical textiles, reducing dependence on imports. This helps domestic brands manage costs better, shorten sourcing and production timelines, and react more quickly to seasonal demand shifts.

At the same time, the Tex-Eco Initiative pushes sustainability across the value chain. As consumer awareness rises in urban and semi-urban markets, this allows local fashion brands to stand out through responsible sourcing, traceability, and circular practices rather than competing only on price.

“The Budget makes it clear that India’s next phase of growth will be driven by the convergence of design, technology and sustainability. The strong emphasis on sustainable textiles, MSME scale-up and AI-led innovation reflects a long-term vision to move Indian manufacturing up the global value chain. For consumer and fashion brands, this creates a more enabling ecosystem, one that supports responsible production, data-driven decision-making and global competitiveness,” said Amar Nagaram, Co-Founder, VIRGIO, a D2C women’s fashion brand.

Reiterating this view, Siddharth Dungarwal, Founder of the Bengaluru-based menswear brand Snitch, added, “The focus on export enablement, duty rationalisation for leather and synthetic goods and the removal of the courier export value cap will significantly benefit brands and manufacturers looking to scale internationally.”

Faster, Smarter Infrastructure for Retail and Logistics

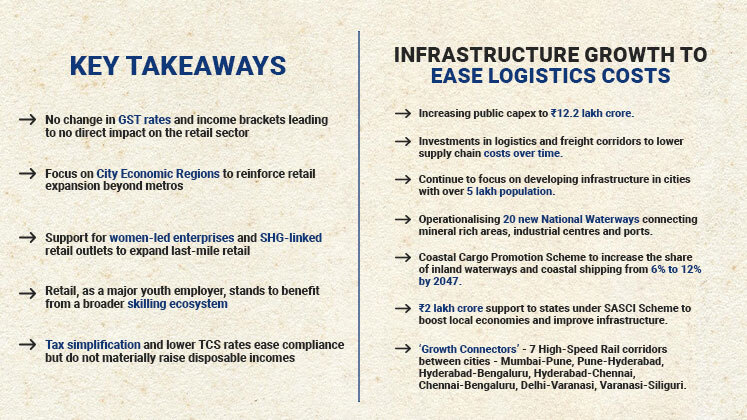

The Budget has increased capital spending to Rs. 12.2 lakh crore (US $ 134.2 billion). Infrastructure development will also focus on Tier II and Tier III cities with populations over 5 lakh. This investment is expected to lower logistics costs for retailers and the wider industry.

India’s logistics performance is already improving, with the country ranking 22nd globally for International Shipments and 38th overall in the Logistics Performance Index in 2023.

Over the next five years, 20 new national waterways will be made operational, and a Rs. 10,000-crore scheme for container manufacturing has been announced. Dedicated Freight Corridors will connect Dankuni in the East to Surat in the West. A ship repair ecosystem will be set up for inland waterways, and a Coastal Cargo Promotion Scheme aims to double the share of inland waterways and coastal shipping from 6% to 12% by 2047.

These measures will improve efficiency at Indian ports, which currently have an average turnaround time of 0.9 days, faster than many major countries including the United States, Australia, Belgium, Canada, Germany, the UAE, Singapore, Russia, Malaysia, Ireland, Indonesia, New Zealand, and South Africa.

With the rise in central capital expenditure this year, the government is reinforcing predictability and execution momentum. Railways have received increased budgetary support, from around Rs. 2.52 lakh crore (US $ 27.72 billion) to Rs. 2.78 lakh crore (US $ 30.58 billion), with more funding for line doubling, new routes, rolling stock, and signalling. These investments will directly improve the reliability and efficiency of goods movement,” said Dr. Ashvini Jakhar, Founder and CEO of Prozo, an AI-powered, tech-enabled supply chain solutions provider.

North-East Retail Set for a Big Growth Spurt

The Budget’s stronger focus on the North-East opens up a clear growth opportunity for retailers looking to expand into an under-served market. With the North-East’s GSDP growing at a healthy 8.17% CAGR between FY2015 and FY2022 to reach Rs. 5.75 lakh crore (US $ 63.25 billion), the region is emerging as a promising next frontier for organised retail.

Several established brands have expanded their presence in Northeast India, including Cantabi, FabIndia, Van Heusen, Biba, Allen Solly and Peter England. Additionally, international brands like US Polo Assn., Nike, Marks & Spencer, Calvin Klein and Levi’s have also entered the region.

At the moment, northeast India is dominated by value fashion players such as V Mart, Baazar Kolkata, City Kart, M Baazar, Style Baazar, and Vishal Mega Mart. These retailers have opened more than 120 stores in the last four years or so.

As such, the provisions like the development of integrated East Coast Industrial Corridor with a node at Durgapur in West Bengal and a scheme for Development of Buddhist Circuits in Arunachal Pradesh, Sikkim, Assam, Manipur, Mizoram and Tripura will further boost the retail landscape in the region.