The textile and apparel industry is going through a tough phase, with the lingering effects of US tariffs, weak demand in key markets, and ongoing trade uncertainty. Against this backdrop, the Union Budget 2026 has been broadly welcomed, though industry leaders say several structural challenges remain.

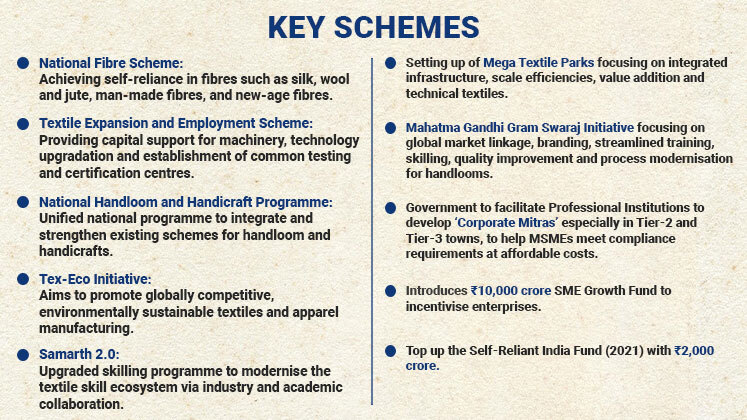

One of the key highlights of the Budget is the National Fibre Scheme, which brings together natural fibres such as cotton, silk, wool, and jute with man-made and new-age materials under a single framework. Industry experts see this as recognition of shifting global demand, where man-made fibres and technical textiles are playing an increasingly important role.

If supported by coordinated procurement, pricing, and research, the scheme could help stabilise the sector and encourage investment in value-added and specialised segments.

The Textile Expansion and Employment Scheme also drew attention. By supporting machinery upgrades, technology adoption, and shared infrastructure such as testing and certification facilities, the scheme is expected to modernise textile clusters and boost overall productivity.

Sustainability continues to be a major focus. The proposed Tex-Eco Initiative aligns with growing global sourcing requirements, particularly in Europe. While short-term costs for sustainability measures can be high, industry participants say policy support could help manufacturers manage these investments and stay competitive.

“The emphasis on the Tex-Eco Initiative further reinforces the industry’s shift towards sustainable and globally competitive textiles, a direction that is closely aligned with Filatex’s ongoing focus on circular recycling, responsible manufacturing and traceability through its Ecosis sustainability platform,” said Madhu Sudhan Bhageria, Chairman and MD, Filatex India Ltd, a leading manufacturer of Polyester Yarn.

Through its Ecosis initiative, Filatex India has come up with a molecular regeneration technology that transforms post-consumer and pre-consumer textile waste into high-quality, regenerated polyester yarn.

India faces workforce challenges due to low research investment and weak collaboration between industry and academia, which limits progress beyond traditional IT-driven growth.

Skilling initiatives under Samarth 2.0 address this gap through deeper collaboration with industry and academic institutions, ensuring availability of industry-ready skilled manpower across the textile value chain.

“To position India in the global employability index, it is essential that there is upskilling of both the existing and new workforce in technology, digital, and AI skills. The Budget’s emphasis on education, employment, and enterprise will definitely help bridge this gap by ensuring that skilling is aligned with the needs of the new manufacturing sector, where automation, digital engineering, and technology-driven services are being increasingly integrated,” stated Priyavrata Mafatlal, Vice-Chairman of Arvind Mafatlal Group and MD of Mafatlal Industries, the textile arm of the Arvind Mafatlal Group.

Furthermore, industry observers say the announcement of Mega Textile Parks in challenge mode, with integrated infrastructure and a focus on technical textiles, could reduce logistics costs, improve compliance readiness, and attract investment into higher-margin segments such as industrial, medical, and defence textiles.

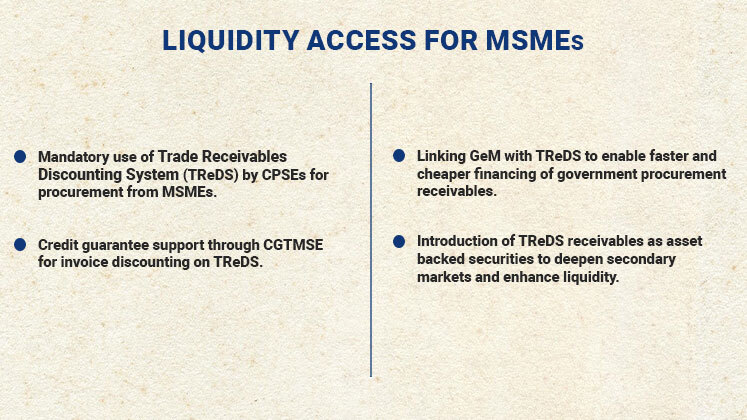

Measures aimed at supporting MSMEs were also welcomed. Strengthening the Trade Receivables Discounting System, mandatory onboarding of CPSEs, credit guarantee support, and the proposed Rs. 10,000 crore (US $ 1.1 billion) SME Growth Fund are expected to ease working capital pressures for smaller textile units.

Extending the export obligation period from six months to twelve months for duty-free imported inputs offers added flexibility amid uncertain order flows.

Cotton, Execution, and Export Concerns

Despite these positive steps, several challenges remain. Raw material costs, particularly cotton, continue to be a concern. The continuation of the 11% import duty on cotton has drawn criticism, as domestic prices remain higher than international benchmarks, affecting export competitiveness.

“Cotton did not attract duty since August 2008 to February 2021 and the imports never affected the farmers and India could export 30 to 100 lakh bales of cotton per year during the season and the industry could import the cotton during off season that enabled win-win strategy for all the stakeholders,” said Durai Palanisamy, Chairman, The Southern India Mills’ Association (SIMA).

Likewise, Ashwin Chandra, Chairman, Confederation of Indian Textile Industry (CITI) pointed out that the industry has consistently sought a dedicated investment incentivisation scheme, particularly to support MSMEs in transitioning towards sustainable production models, which will also help to tap the upcoming India-EU FTA. “While the details of the TexEco initiative are awaited, the absence of a direct investment support mechanism is felt,” he said.

The industry also highlighted execution risks. For instance, previous textile park and cluster programmes have faced delays due to land acquisition, regulatory approvals, and coordination challenges between central and state agencies. Timely execution and monitoring will be key to ensuring that current initiatives create real operational capacity rather than remaining policy announcements.

Finally, exporters said that while the Budget addresses supply-side measures, demand-side challenges persist. Tariffs, inflation, and slow consumer spending in major export markets could continue to affect order flows in the near term.