- The EU will eliminate tariffs on over 90% of tariff lines and India will eliminate tariffs on 86% of tariff lines. Moreover, both sides will reduce tariffs on a significant additional number of lines, thereby bringing the overall coverage to 96.6% for India and 99.3% for the EU, leading to savings of US $ 4.75 billion for European Companies.

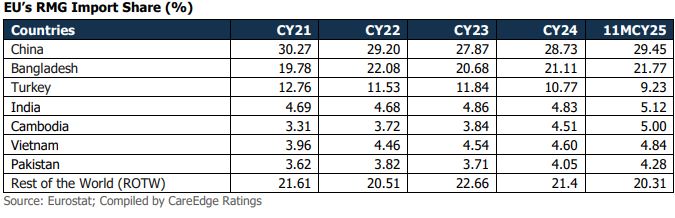

- The European Union (EU) is the world’s largest RMG market, with imports of nearly US $ 84 billion (excluding trade among EU countries) in CY ’24. The EU’s RMG market is already at around US $ 94 billion in the first 11 months of CY ’25.

- China continues to command the largest share of 30% despite a 12% most favoured nation (MFN) tariff, supported by high productivity and scale in man-made fibres (MMF).

- India currently exports US $ 4.55 billion of RMG to the EU, holding ~5% share of the EU’s RMG market.

- The FTA provides zero-duty access for Indian garments and eliminates tariffs on 100% of apparel tariff lines.

- Textile, Apparel and Clothing: 0% tariff vs 12% earlier.

- India is expected to gradually increase its market share from 5% to 8-9% in the EU’s RMG imports, unlocking an incremental annual export opportunity of nearly US $ 4-4.5 billion over the medium term.

- Indian apparel exports to the EU could grow by 20–25% year on year after the FTA becomes operational, compared with the current growth rate of about 3%.

- Key apparel products exported from India to the EU include shirts, T-shirts, trousers & shorts

- The FTA will serve to neutralise the impact of the 50% tariff announced by the US

- Countries such as Bangladesh, Turkey, Vietnam and Pakistan were enjoying duty-free access to the EU market, while Cambodia benefitted from zero tariffs on certain high-value apparel, giving them a 12% tariff advantage over India.

- Upon implementation by 2027, India will gain a 12% duty advantage over China

- China is expected to lose its share in the EU’s RMG market due to the ‘China Plus One’ sourcing strategy adopted by global apparel brands and retailers.

- Socio-political uncertainties in Bangladesh may also lead apparel brands and retailers with a significant presence in the country to diversify their sourcing, thereby benefiting India, among others.

- Lower duties could help Indian suppliers transition from seasonal orders to core programme business (high volume, consistently made products), where volumes are larger and relationships are more stable. This shift is particularly important for apparel manufacturers seeking to move up the value chain from basic cut-make-trim work to full-package supply, where they control fabric sourcing, product development and logistics.

- Indian garment makers now have full access to EU’s US $ 263.5 billion textile market (including apparel).

- Home textiles such as bed linen, towels and other made-ups are a major Indian export category to Europe, supported by strong capabilities in cotton processing and vertical integration.

- Reduced duties on fabrics and intermediates would make it easier for Indian suppliers to offer integrated fabric-and-garment solutions, capturing more value domestically and reducing reliance on imported inputs. This is especially relevant for MMF and blended products, which dominate European apparel demand in many fashion and performance categories.

- There is also potential for increased engagement with European suppliers of textile machinery, finishing equipment and process technologies.

- Leather and Footwear: 0% tariff from 17% earlier

- Due to demand for mid to premium leather goods, the FTA can lift exports across tanning, finishing, and footwear manufacturing.

- The 0% import duty will allow EU’s US $ 100 billion leather and footwear industry to increase sourcing from India—notably from the clusters of Agra-Kanpur in Uttar Pradesh and Vellore-Ambur in Uttar Pradesh.

- India’s increased competitiveness post-duty removal and continued favourable policy regimes in India, such as removal of Quality Control Order (QCO) on polyester yarn, the PM Mega Integrated Textile Region and Apparel (PM MITRA) park and the Production Linked Incentive (PLI) scheme, is expected to aid the sector in becoming more cost competitive and thereby grab these additional export opportunities.