Socks have come a long way! From mere foot-warmers, they have evolved into essential fashion accessories, playing a pivotal role in self-expression and style. Beyond aesthetics, they serve a host of practical purposes, comfortably switching between necessity and lifestyle choices, transcending need, style and functionality with élan.

At a time when demand for products across categories remains soft, the socks market continues to grow world-over (the global socks market is expected to grow at 6 per cent CAGR to reach US $ 56 billion by the end of 2033, up from its current market size of US $ 33.1 billion) and India is not an exception!

An exciting market and promising manufacturing hub!

As per a report of IMARC Group, the Indian socks market size touched US $ 193.2 million in 2022 even if it is expected to reach US $ 271.43 million by 2028, exhibiting a growth rate (CAGR) of 5.70 per cent during 2023-28.

As it would have been, domestic as well as multinational entities are fighting it out for a bigger share of the pie.

“We have been making socks for years and witnessed good growth in this segment and have expanded our capacities accordingly,” underlined Ramesh Agarwal, MD of Rupa & Co Ltd., which is one amongst the burgeoning list of local manufacturers that have floated their own brands to make the most of opportunities in the domestic market while also successfully catering to the overseas export destinations.

| “We have been making socks for years and witnessed good growth in this segment and have expanded our capacities accordingly.” Ramesh Agarwal MD of Rupa & Co Ltd, Kolkata |

Dollar Industries, Lux Industries and Page Industries are a few other prominent names in this direction.

With the brand name of Rupa Footline, innerwear giant Rupa offers premium and regular socks for men, women and kids even if Dollar Industries also offers a wide variety of socks in all the segments under the brand name of Dollar.

Bodycare International Delhi is another home-grown name which is also doing pretty good in the domestic market.

| “Our sock category has experienced substantial growth in recent years. As more individuals recognise the significance of quality socks, our sales have reflected this trend. We are now actively considering capacity enhancement to meet the increasing demand,” underlines Mithun Gupta, Director of Bodcare International, Delhi. |

Amongst the global entities operating in India are names like Jockey, Skechers, Nike, Adidas, Puma, US Polo Assn, Hush Puppies, Gant, Pepe Jeans, Decathlon and so on vying it out with which are home-grown brands like Bonjour and Balenzia (both specialised in socks and having their very own outlets) along with D2C entities and start-ups like Soxytoes, Kues, SockSoho, Bombay Sock Company, Mint & Oak, Dynamocks, Sock Republic, which though emerging names, are promising nonetheless.

What’s more, almost all big names in the domestic fashion retail, including Reliance Trends, Max, Lifestyle, Shoppers Stop, Westside, Pantaloons, V2 Retail and online platforms Myntra, Filpkart, Amazon, Ajio, Tata Click, Nykaa also have a dedicated focus on socks, which only adds to the market vibrancy.

| The Indian socks market size reached US $ 193.2 million in 2022 and it is expected to reach US $ 271.43 million by 2028, exhibiting a growth rate (CAGR) of 5.70 per cent during 2023-28.

India’s diabetic socks market size was valued at US $ 9.36 million in 2022 and is expected to reach US $ 14.47 million by 2030, at a CAGR of 5.6 per cent from 2023 to 20230. |

| “Fashion accessories, especially socks, are significant growth area for us. Along with shoes, sale of socks is also growing.” Himanshu Ratnakar AGM-Sales & Distribution, Woodland |

“Fashion accessories, especially socks, are significant growth areas for us. Along with shoes, sale of socks is also growing,” claims Himanshu Ratnakar, AGM-Sales and Distribution of Woodland.

With the per capita income amongst the Indians on the rise coupled with a fast-growing middle-class population, there’s a particular affinity for branded accessories amongst the consumers, feels Ratnakar.

Growth areas on the domestic front

Amongst the opportunity areas in the Indian market are healthcare categories and that too related to schools.

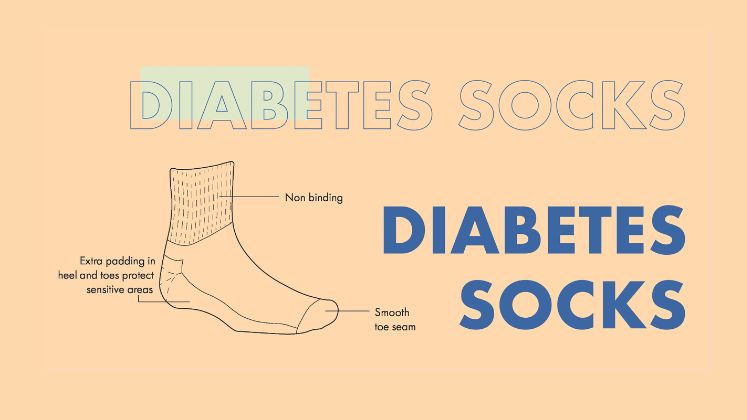

India has the second largest diabetic population in the world, which is expected to grow significantly in the days to come (as per reports, India’s diabetic socks market size was valued at US $ 9.36 million in 2022 and is expected to reach US $ 14.47 million by 2030, at a CAGR of 5.6 per cent from 2023 to 2030), which offers a new area of opportunity for the socks makers.

| “The number of school going students in rural areas of India holds a lot of potential and socks makers should concentrate more on them.” Kamlesh Sheth Founder, Roman Hosiery (Footmate Socks), Ahmedabad |

“Foot care is crucial for diabetics and there are specialised socks needed by such patients, which are designed to keep the feet dry while also enhance blood circulation and minimise risk of foot injury,” says Kamlesh Sheth, Founder, Roman Hosiery (Footmate Socks), Ahmedabad even as Ankit Patel of We Socks (Ahmedabad) anticipates 8 to 10 per cent growth in this segment.

The number of school going students in rural areas of India holds a lot of potential and socks makers should concentrate more on them, feels Kamlesh, going on to add that even if not used to wearing socks currently, these school kids will soon start using socks, thanks to many development programmes that are taking place in the rural areas.

Roman Hosiery has a capacity of 7,000 pairs per day and supplies socks to more than 5000 schools currently.

| Textile-based fashion accessories have some other products also that have reasonable growth like caps, ties, pocket squares, handkerchiefs and so on. Like socks, these categories have leading manufacturers, retailers and niche players focusing upon them.

As per research reports, during 2023, fashion accessories (textile-based only) market size in India will be around US $ 523 million and it is expected to reach US $ 783 million by 2027. Generation Y, millennials – composed of those between the age group of 18 and 35 – are India’s largest demographic segment. Similarly, as per a report, the Indian caps market in 2022 rose by 57 per cent against the previous year. Apparel Resources will soon cover those categories in detail. |

It’s ‘Made in India’ for the glocal market

Boasting a strong manufacturing base, Indian socks manufacturers are slowly but steadily spreading their wings overseas even as they continue to successfully cater to the domestic demands, be it for global brands operating in the country or the home-grown names.

Almost 80 per cent of the socks sold at Decathlon’s India stores are locally made while Jockey India (Page industries) is strongly banking on India as a manufacturing destination for socks not only for the Indian market but its operations in many other countries as well.

The burgeoning demand for ‘Made in India’ socks has now led Page Industries to increase its capacity, for which it has selected Odisha.

The flagship Odisha Project with 576 knitting machines including 215 advanced knitting machines is expected to be ready by the end of FY ’24, which will be one of the largest projects built on 28.5 acres campus, with a built-up area of 6.5 lakhs sq.ft.

SNQS International (a leading apparel exporter which is also supplying socks for global brands and retailers) is another name planning to expand in socks manufacturing as it looks towards adding 200 more machines in next couple of years to take up the machine strength to 500.

| Socks nowadays come in an array of quirky designs with plenty of colours, stripes, polka dots, emojis. For kids, along with these designs, the focus is also on cartoon, 3D socks (socks that have an ear or an eye popping out). Currently, there is also the trend of parents and kids wearing similar socks. Beyond basic comfort, socks today are even odour-free and breathable, some have padded base in-built and are softer than cotton socks. |

“We are witnessing reasonable growth in the socks category and will expand capacity in near future,” claims Elangovan Viswanathan, Founder of SNQS International.

| “We are witnessing reasonable growth in the socks category and will expand capacity in near future.” Elangovan Viswanathan Founder of SNQS International, TIrupur |

Waiting in the wings to expand capacities are many socks specific manufacturers which already have decent capacities even as they continue to build on the quality front to serve better the local and global clientele.

Mustang Socks & Accessories, Infiiloom, Zonac Knitting (Bonjour), Jagmini Micro Knit, Heelium Sports, Vidhaan Socks are some cases in point.

Boasting turnover of around Rs. 500 crore, Infiiloom India, Pune has capacity to churn out with its more than 1800 knitting machines even as this Sedex and Wrap-certified company continues to manufacture socks for almost all leading brands.

With its parent company headquartered in Israel, Delta Galil Textiles (India) is also a leading name in this segment and boasts global sale of socks to the tune of approximately US $ 272 million while Mumbai-based Mustang Socks & Accessories, offering socks for men, women, kids and newborn, has strong presence in India as well as overseas markets.

Along with its interesting designs and health-related socks, the company is also known for its innovative manufacturing strength.

With more than 500 computerised knitting machines Bonjour has approximately turnover of US $ 96 million and is amongst few of those that have a strong control over manufacturing.

Apart from the regular products, the company offers designer socks, yoga socks, diabetic socks and socks for school children using organic cotton as raw material and it boasts of 16 EBOs also with strong distributor network.

Super Knit Industries (Supersox brand) is another leading company in socks manufacturing with more than 300 knitting machines and annual capacity of more than 15 million pairs of socks. It has strong reach in Indian domestic and export market.

Boasting capacity of more than 8.7 million pairs per annum, Virat Industries Limited has clients like John Lewis and Ted Baker, UK, Migros, Switzerland and Shoe Mart, Middle East.

It is also the approved supplier to Puma in the UK.

The massive growth opportunities have attracted manufacturers known for other knitted products like innerwear, leggings, etc., to get into socks manufacturing.

| Then there are antiskid, antimicrobial, waterproof socks (preferred for mountaineering and mega kitchens, field work in rainy areas), socks made with material like bamboo having natural antibacterial strength. Fine-textured fabrics such as wool and bamboo, along with blister-guard yarn, are used to make socks to prevent abrasion against the skin. |

Playing on quality to beat the heat!

Even if China still continues to be a major player in the global market, Indian socks exporters are increasing their share and a case in point is USA.

As per available data, India’s socks export to US increased by 1.43 per cent in volume and 9.42 per cent in value in 2022 and this despite the fact in 2022, US’s overall socks import fell by 6.25 per cent in volume even as leading manufacturing destinations like China, Bangladesh and Vietnam witnessed de-growth in volume in the US market.

“Thrust on quality and using quality cotton yarn apart from using high-end Korean machines give us a definite edge over China,” opines Raj Shankar Chaurasia of Kanpur-based Jagmini Micro Knit (having annual production capacity of more than 15 million pairs, exporting 75 per cent of this to the European brands) to wind up on a positive note.