You can’t run a marathon in flip-flops and Bangladesh’s RMG sector knows it.

In FY 2024–25, RMG exports reached US $ 39.34 billion, showing 8.84% growth. Knitwear pulled ahead with US $ 21.15 billion in earnings, while woven garments followed closely at US $ 18.18 billion.

There’s a growing awareness that without strong, modern logistics, this momentum could slow down.

That’s why, the country is leaning on better infrastructure. Roads, bridges and ports are helping the industry move faster and grow stronger.

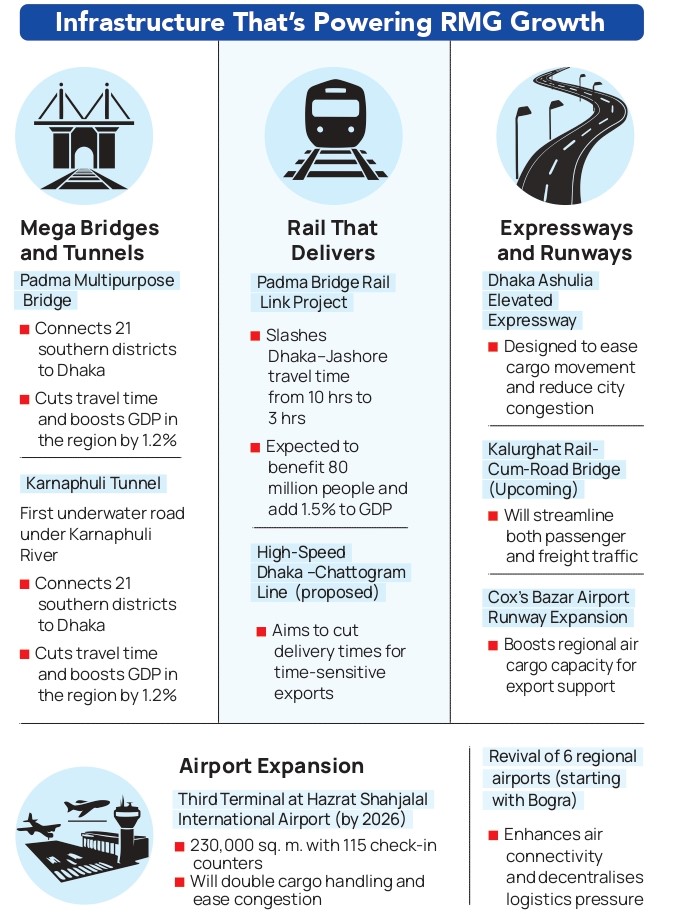

Take the Padma Multipurpose Bridge for instance. It’s one of the country’s most ambitious undertakings so far. This six-kilometre bridge links 21 southern districts with the capital city Dhaka. It’s cutting down travel time, improving access to raw materials and helping finished goods reach buyers faster. According to estimates, it could boost the GDP of the connected regions by about 1.2%.

Then there’s the Karnaphuli Tunnel. This is Bangladesh’s first underwater road, built under the Karnaphuli River. It connects Chattogram Port with Anwara and links two major highways, one going towards Dhaka and the other stretching to Cox’s Bazar. For garment exporters depending on Chattogram Port, which handles over 90% of the country’s sea trade, this tunnel is a game-changer.

Ports are also getting the much-needed attention. For example, Danish shipping giant Maersk has announced a major investment of around US $ 800 million to develop the new Laldia Container Terminal at Chattogram Port. Spread over 32 acres, the terminal will include three container jetties and help ease traffic pressure on existing docks.

In addition, the government has approved a Taka 13,525 crore project to build the Bay Terminal, which will serve as a major ocean-based container hub with a projected capacity of 3.6 million TEUs. This includes building connecting roads, service jetties and support infrastructure to make operations smoother and more efficient.

Mongla Port is also getting a big upgrade. As part of the plan, two new container jetties will be built, each 368 metres long. A modern terminal, a delivery yard, a multi-storey parking space for cars and better roads will also be added. When the project is done, Mongla Port will be able to handle 15 million metric tonnes of cargo every year. Its container capacity will go up from 150,000 to 400,000 TEUs.’

At the same time, the focus is shifting to Payra and the upcoming Matarbari Deep Sea Port. Dredging at Payra has made it possible for larger vessels to dock, which helps cut logistics costs. The port is also getting a big upgrade and is expected to be ready by July 2026. Once finished, the port will be able to handle up to 15 large ships at the same time. A new 650-metre-long jetty will be built where container ships can dock. These ships can carry between 3,000 and 3,500 containers.

The port will also have deep channels that allow big ships called Panamax vessels to enter easily. These ships can be as long as 225 metres and as wide as 32 metres.

Matarbari, which is expected to open by the end of 2026, will go even further. With a depth of 18 metres and space for mother vessels, it could boost GDP by over 1% and bring down import and export costs by as much as 15%.

Not Just the Ports, All Routes Are Getting a Rethink

Better rail connectivity is another piece of the puzzle. The Padma Bridge Rail Link Project, now complete, has cut travel time between Dhaka and Jashore from ten hours to just three. This project is expected to benefit around 80 million people and add 1.5 percentage points to national growth.

Public transport in Dhaka is also seeing a shift. MRT Line 6, the city’s first metro rail, is already saving nearly 35 billion BDT every year in travel time and vehicle operating costs. More lines like MRT 1 and MRT 5 are now in the works. A high-speed train line between Dhaka and Chattogram has also been proposed. If it goes ahead, it could sharply reduce delivery times for export goods, which is something fast fashion buyers care deeply about.

| Taka 13,525 crore

The government has approved a Taka 13,525 crore project to build the Bay Terminal, which will serve as a major ocean-based container hub with a projected capacity of 3.6 million TEUs. |

Energy, of course, is just as critical. Garment factories often run non-stop and a stable power supply is essential. Projects like the Payra Thermal Power Plant, Rooppur Nuclear Power Plant and Rampal Power Station are helping meet that demand.

Meanwhile, roads and runways are being upgraded too. The Dhaka Ashulia Elevated Expressway, the expansion of the Cox’s Bazar airport runway and the upcoming Kalurghat rail-cum-road bridge are all part of this broader effort to ease traffic congestion and speed up cargo movement.

Air connectivity is also getting the much-needed upgrade. The third terminal at Hazrat Shahjalal International Airport is expected to be fully ready by 2026. Once it opens, the airport will be able to handle twice as many passengers and much more cargo. The new terminal will span 230,000 square metres, with 115 check-in counters and expanded immigration areas. This will help ease current congestion and support the country’s growing export demands.

At the same time, the government is working to revive six old airports, starting with Bogra. The aim is to improve regional connectivity, attract new investments and reduce pressure on the busiest airports.

Thanks to these efforts, Bangladesh moved up 12 spots in the World Bank’s Logistics Performance Index, reaching 88th place out of 139 countries in 2023.

But the work is far from over!

How Exporters Are Adapting to Port Delays

Logistics costs are still high, around 15% of GDP. This is much more than the global average of 8 to 10%. For a country aiming to reach US $ 100 billion in garment exports by 2030, improving logistics is essential.

Port delays remain one of the biggest challenges. Chittagong Port handles more than 90% of the country’s trade, especially for the RMG sector. But the port continues to struggle with congestion, slow cargo handling and frequent delays. These issues are making it harder for exporters to meet tight deadlines.

In the World Bank’s 2024 Container Port Performance Index, Chattogram ranked 337 out of 405 ports globally. Colombo, in comparison, ranked much higher with an average turnaround time of less than one day. At Chattogram, the average wait time is more than three days and can stretch to a week or more during peak periods. In 2025, there were several cases where more than 20 container ships had to wait at anchorage for over nine days. These delays increase costs and throw export schedules off track.

Highlighting the logistic inefficiencies, Maashed Rumman Abdullah, Director, Dressmen, one of Bangladesh’s leading apparel exporters with an annual export volume exceeding US $ 100 million, shared that port congestion and slow customs clearance are becoming chronic obstacles. It typically takes 6 to 8 days for a shipment to clear port formalities. On multiple occasions, consignments have missed the vessel cut-off time due to bottlenecks at container freight stations. “Even after sending goods to the depot on time, there are days when containers aren’t loaded because there’s no space or the documentation is delayed. The uncertainty makes planning extremely difficult,” he noted.

These concerns are echoed by Mohammad Hatem, President, Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), a key trade body representing over 2,000 knitwear exporters. “The association has been receiving increasing complaints from its members regarding inefficiencies at both Chattogram Port and airport facilities in Dhaka,” said Mohammad Hatem. According to Hatem, basic breakdowns in port operations, like the non-availability of trailers, poorly managed yard space and customs backlogs, often lead to missed vessels and order cancellations. At peak times, such as the Eid holidays or during port labour unrest, trucks carrying export cargo are forced to wait 2 to 3 days just to enter terminal gates, further delaying shipments and raising transportation costs.

| “Visibility is everything now, especially for brands that expect precision delivery windows. It’s not just about ETA, it’s about understanding where the risk lies, whether in customs, factory dispatch or freight. Some logistics partners are now offering real-time dashboards and alerts.”Jahangir Alam Sarker, MD and CEO, 3i LOGISTICS Group |

“On July 26, this year, we sent five trucks of goods to the KBS depot, but they haven’t been unloaded yet. As a result, we missed the scheduled vessel and now we are forced to pay demurrage charges. This has significantly increased our costs,” added Hatem.

He pointed out that beyond logistical bottlenecks, other systemic issues are hurting the industry. For instance, a company named Unic Design, located in Board Bazar, Gazipur, recently imported a shipment of Chinese fabric valued at BDT 98,000 under HS code 5408, which typically covers woven fabrics of synthetic filament yarn. Despite this, customs officials claimed the goods fall under Chapter 07. The shipment was imported under a bonded warehouse facility and has remained stuck at customs for over two months. Multiple follow-ups with the National Board of Revenue (NBR) officials have yielded no resolution so far.

Digital Leap in Logistics

To enhance supply chain efficiency, the RMG industry is embracing a multi-pronged logistics strategy. Exporters are increasingly utilising inland container depots (ICDs) and private container freight stations (CFS) near manufacturing clusters like Gazipur, Narayanganj and Savar to reduce dependency on congested seaports. Many factories now also use mobile SCM apps to track raw material arrivals in real time, preventing production delays and improving supplier coordination.

| “Freight volatility has forced us to rethink sourcing and production planning. We’re now building greater flexibility in our shipment planning, choosing FOB vs. CIF strategically based on real-time cost data. Also, we’ve begun allocating production to specific lines based on expected logistics capacity.” Maheer Mannan, Deputy MD, Shangu Tex |

Many large manufacturers are now partnering with third-party logistics (3PL) and fourth-party logistics (4PL) providers to integrate inventory management, customs brokerage and transport scheduling under a single system. Digitisation has also seen a notable push – automated customs clearance, real-time cargo tracking and RFID-based warehouse management systems are being deployed to reduce delays and improve shipment visibility.

Moreover, the sector is investing in GPS-enabled fleet management for better route optimisation, while some factories are piloting electronic data interchange (EDI) with global buyers and freight forwarders to cut documentation turnaround time.

Maashed Rumman Abdullah mentioned that the factory depends heavily on buyers’ selected forwarders for visibility and tracking. “We do get access to dashboards from our forwarders. We can track which container is where, how much time it’s taking, but the system is not ours, it’s theirs,” he said.

Whereas, Maheer Mannan, Deputy MD, Shangu Tex explained, “From the gate-out time to customs clearance status to whether a container is stuck at a yard or depot, we get updated.”

Shangu Tex has built a strong reputation in woven garments, making everything from boxers and shirts to tops, lightweight bottoms and denim. With 21 active production lines and about 1,000 stitching machines, the company is now setting its sights on expanding into more robust categories like jackets and heavier shirts.

“We’ve adapted by improving internal agility and leaning on logistics partners who offer express services. For example, being able to go from design finalisation to shipment in under 45 days is now possible and that has definitely improved our competitiveness in Europe and North America,” mentioned Maheer Mannan.

He further added, “Global freight volatility has forced us to rethink sourcing and production planning. We’re now building greater flexibility in our shipment planning, choosing FOB vs. CIF strategically based on real-time cost data. Additionally, we’ve begun allocating production to specific lines based on expected logistics capacity, which wasn’t common practice earlier. Congestion at transshipment ports like Colombo has also prompted some buyers to consider alternate routes and ports like Mongla or Payra in Bangladesh.”

| “The association has been receiving increasing complaints from its members regarding inefficiencies at both Chattogram Port and airport facilities in Dhaka. At peak times, such as the Eid holidays or during port labour unrest, trucks carrying export cargo are forced to wait 2 to 3 days just to enter terminal gates.” Mohammad Hatem, President, BKMEA |

At Ha-Meem Group, Sajid Azad, Director too noted that there’s still enormous pressure to hit exact ETDs. “Buyers are more demanding than ever. They track not only production but logistics milestones too. If we miss vessel cut-off, the goods wait a week,” he explained. Ha-Meem often resorts to consolidating shipments or using multiple ports (like Mongla alongside Chittagong) to reduce risk.

Ha-Meem Group is a leading wholesale clothing manufacturer of Bangladesh and also globally. The company has 26 garment factories consisting of 300 production lines and 7 washing plants producing 7 million pieces/month.

Sajid Azad pointed out that although the company has its own C&F unit and manages large volumes independently, customs digitisation remains a bottleneck.

“We are using SAP/ERP in which logistics is one of the important modules. We are using the GSP tracker for our export and import carrying vehicles,” he further added.

As manufacturers grapple with tighter lead times, buyers’ evolving expectations and rising costs, logistics partners are playing an increasingly strategic role. “Buyers now expect shorter lead times and greater transit reliability, especially on routes to the EU and US,” said Jahangir Alam Sarker, MD and CEO, 3i LOGISTICS Group.

His company which works with a broad range of Bangladeshi exporters, has observed a spike in demand for tech-integrated supply chains. “Realtime tracking, predictive ETAs and exception alerts are no longer ‘nice-tohaves’, they’re essential,” he explained.

The company also focuses on bonded and digitally-enabled warehousing, value-added services like labelling and packing and green logistics that align with clients’ ESG targets. “Sustainability, resilience and visibility are becoming baseline expectations,” Jahangir added.

A recent example highlights these improvements in practice. 3i LOGISTICS helped a leading Bangladeshi RMG exporter serving fast-fashion brands in Europe and the UK to reduce lead times by 25% and lower freight costs by 15% during peak seasons. This was achieved through a combination of sea-air and road-air multimodal shipments, optimised container consolidation, real-time tracking alerts for proactive delay management and streamlined customs documentation. The result was a 98% on-time delivery rate and this significantly improved buyer satisfaction. While discussing ETA, Maheer averred, “Visibility is everything now, especially for brands that expect precision delivery windows. It’s not just about ETA, it’s about understanding where the risk lies, whether in customs, factory dispatch or freight. Some logistics partners are now offering real-time dashboards and alerts, which help us pre-empt delays and keep buyers informed proactively. That level of transparency strengthens trust with our customers.”

Logistics Gets a Green Makeover

The industry still focuses on cost and speed, but there’s a quieter shift underway. The way goods are moved is changing, with more attention now on sustainability. ESG goals are no longer a side note. As global buyers get more climate-conscious, they’re asking tougher questions about how products are shipped.

At Shanghu Tex, the team is trying new things like shared warehousing and combining shipments to reduce their carbon footprint. “Sustainability isn’t optional anymore. It’s becoming something buyers expect,” said Maheer Mannan. “When we pick logistics partners, we look at whether they offer carbon offset options, fuel-efficient fleets, or even CO₂ data per shipment. It helps with reporting, and we know this trend is only going to grow.”

Logistics providers are adapting too. 3i Logistics has upgraded its warehouses with solar panels and energy-efficient lighting. They’ve also started planning smarter delivery routes to cut fuel use and reduce emissions.

Some companies are also trying cleaner transport. DHL Express Bangladesh now runs an electric delivery van in Dhaka and plans to switch most of its fleet to electric by 2030.

| “Buyers are more demanding than ever. They track not only production but logistics milestones too. If we miss vessel cut-off, the goods wait a week. We are using SAP/ERP in which logistics is one of the important modules. We are using the GSP tracker for our export and import carrying vehicles.” Sazid Azad, Director, Ha-Meem |

There’s movement on the policy side as well. BGMEA and GIZ are building a digital platform to help factories track and report CO₂ emissions per shipment, something more and more buyers are asking for.

While Bangladesh still has work to do to build a fully green logistics system, the direction is clear. Industry groups like BGMEA and BKMEA are urging members to think about environmental impact when choosing partners.

(With exclusive inputs from Iffat)