The global sneaker industry is at a crossroads, revenues are wobbling for the biggest names, even as the long-term story still looks strong. Nike, for instance, reported revenues of US $ 11.3 billion in Q3 of FY ’25, down by 9% year-on-year, with sales slipping across all regions. Adidas, though, on a recovery path, managed a 7.3% revenue growth in H1 of FY ’25 to € 12.1 billion (US $ 14.17 billion), but continues to warn of risks from US tariffs and global uncertainty. Puma, meanwhile, posted flat sales of € 2.08 billion (US $ 2.44 billion) in Q1 of FY ’25 and saw its margins shrink, forcing a leadership change after multiple profit warnings. Skechers stood out as an exception, clocking record Q2 FY ’25 sales of US $ 2.44 billion, up by 13% Y-o-Y, showing that demand hasn’t vanished, but is shifting unevenly.

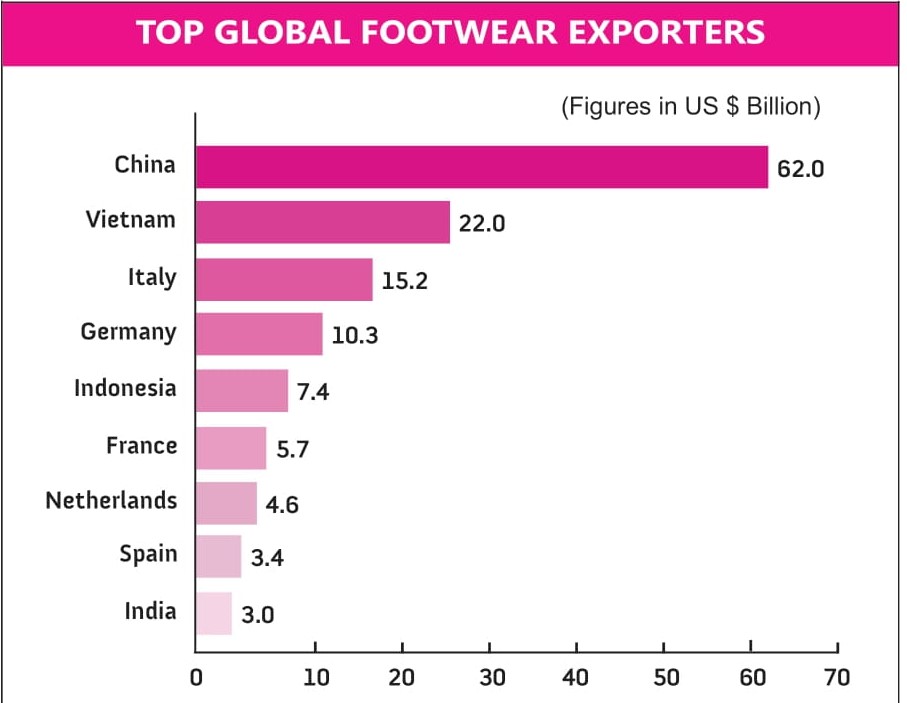

The ripple effects of tariffs are being felt in India too, where footwear exports had risen nearly 25% last year to touch US $ 5.7 billion, but the additional US duties have already begun squeezing margins, with some orders getting redirected towards competitors like Vietnam and Indonesia.

Yet, despite these export headwinds, India’s domestic market has shown greater resilience.

Bata India’s revenue in Q1 of FY ’26 stood at Rs. 942 crore (US $ 107 million), nearly flat Y-o-Y, even as profits plunged due to costs and weak consumption. Relaxo reported Rs. 654.5 crore (US $ 74.87 million) in Q1 of FY ’26 revenue, down by 12.6%, but with improved margins and profits, signalling tighter cost control. Metro Brands, in contrast, saw 10% revenue growth in Q4 of FY ’25 to Rs. 643 crore (US $ 73.55 million), though net profit fell sharply. Campus Activewear clocked Rs. 515 crore (US $ 58.91 million) in Q3 of FY ’25 revenue, up by 9% Y-o-Y, with profits rising by 86%. Liberty Shoes too reported Rs. 172 crore (US $ 19.67 million) in Q1 of FY ’26 revenue, up by 10% Y-o-Y, though bottom line pressures remain.

India is becoming a big opportunity for sneakers. Rising incomes are helping consumers in both cities and towns spend more and the growing middle-class is driving demand for premium and international brands. India also remains one of the fastest-growing major markets.

The domestic sneaker market valued at US $ 3.88 billion in FY ’24 and is projected to hit US $ 6 billion by FY ’32, growing at about 5.6% annually. On an average, each person in India will spend about US $ 2.16 on sneakers in 2025, and by 2030, sales could touch 73 million pairs. Sneakers now make up 20-25% of India’s footwear industry and the momentum is being fuelled by Gen Z, a cohort of over 420 million young Indians under 25 who see sneakers not just as footwear, but as cultural markers.

Much of this cultural appeal comes from celebrity influence worldwide. Sneakers today are symbols of status, style and personality. Global stars like Kanye West, Virgil Abloh, Travis Scott, Rihanna, Drake, Pharrell Williams, Serena Williams, LeBron James, Michael Jordan and Beyoncé have shaped trends with collaborations that mix sports, streetwear and luxury fashion.

US $ 6 BillionIndia is becoming a big opportunity for sneakers. The domestic sneaker market valued at US $ 3.88 billion in FY ’24 and is projected to hit US $ 6 billion by FY ’32, growing at about 5.6% annually. |

This explains why global players like Adidas, Puma and Skechers are doubling down on India. But it’s not just the global heavyweights. A wave of homegrown Indian sneaker brands is also rising, adding new energy to the market.

Brands like Gully Labs, Comet, CHNKS, 7-10 (Seven-Ten), Doc Sneakers, Neeman’s, Arks, Nicron India, Banjaaran, RapidBox, The Quirky Naari and Bacca Bucci are building their own niches and winning attention.

Meanwhile, the introduction of BIS (Bureau of Indian Standards) guidelines is pushing local manufacturers to step up quality and design.

Sneakers Powered by Innovation

As the sneaker market evolves, brands are increasingly looking at innovation to cater to changing consumer expectations and preferences. While price and brand recognition remain important, functionality, design and convenience are becoming key differentiators.

| “One of the notable advancements in our Eeken brand is dual-density sole technology, which combines two layers to improve both comfort and durability. The outer sole is made from a tough polymer for long-lasting wear and grip, while the inner layer uses a softer compound for cushioning and shock absorption.” Sachin Joseph EVP – Marketing and IT, Paragon Footwear |

“Unlike previous generations, Gen Z exhibits low brand loyalty, prioritising relevance and trend alignment over legacy labels. While price remains a critical factor, today’s consumers expect more, be it enhanced performance, elevated design or a stronger emotional connect, for the same value,” pointed out Shirish Srivastava, a sourcing leader with over 24 years of experience in companies such as Myntra, PUMA Group, Adidas.

He added that the current sneaker market in India remains fragmented, with entry and mid-price points accounting for more than 80% of the market, largely driven by the unorganised retail sector. However, the premium segment has been recording the fastest growth.

“We launched Blinc that features our proprietary SpringEase™ technology, an innovative hands-free mechanism that truly redefines ease of wear. Combined with elastic quick-wear laces, this system allows users to effortlessly slip in and out of the shoes without bending down or using their hands,” said Ahmad Hushsham, Co-founder, Yoho Footwear. Founded in 2021, Yoho is a D2C footwear brand, offering a diverse range of products from casualwear to formal shoes for both men and women between 28-40 years of age.

US $ 2.16On an average, each person in India will spend about US $ 2.16 on sneakers in 2025, and by 2030, sales could touch 73 million pairs. |

The brand is available in around 500 multi-brand outlets (MBOs) and aims to reach Rs. 1,000 crore in revenue by 2030. “We’ve also taken early steps in exclusive brand retail, with two EBOs in Bathinda and Barnala and are planning to expand across key Tier-1 and Tier-2 cities. Internationally, our focus is on the Middle East,” added Ahmad.

Ahmad also mentioned that from being present in major marketplaces, they have now entered Q-commerce.

Similarly, Ludic, an Ahmedabad-based footwear-first lifestyle brand, is carving its space in the mid-premium segment by blending style with functionality.

| “Our brand partners, bugatti and TT.BAGATT, already leverage AI and 3D printing to streamline development cycles, reduce lead times and elevate product performance. On the retail front, we’re looking at Augmented Reality and Virtual Try-ons to create more immersive, frictionless experiences for our online customers.” Sandip Baksi, CEO, nuvora Retail Pvt. Ltd. |

“A significant innovation came last year when we identified a gap in the canvas footwear market. We took a modern approach to the nostalgic canvas shoes, infusing them with fresh design elements while maintaining the comfort and durability our customers expect. Earlier this year, we introduced Ludic Sliders, which marked a new milestone for us,” said Ishit Jethwa, Founder, Ludic.

He said the company has developed its own mold using a proprietary EVA compound, CloudFrame, aimed at improving comfort and performance and adopted a monolithic construction to reduce weak points. The brand uses vegan materials as part of its sustainability targets.

Ludic is also exploring offline expansion in metro cities.

Another brand in the premium footwear segment, Louis Stitch, is positioning itself for younger consumers and working professionals in both metropolitan and Tier-2 cities. “Our primary audience likes to look sharp and edgy in formals as well as smart casuals. While demand is strong in larger cities like Delhi, Hyderabad, Mumbai, Kolkata and Bengaluru, Tier-2 cities such as Pune, Chandigarh, Ambala, Lucknow and Indore are also showing growing interest in contemporary styles,” said Amol Goel, CEO and Founder, Louis Stitch.

Louis Stitch has also worked on developing wrinkle-free materials to align with Indian consumer preferences, diverging from European and American markets where natural leather creasing is considered a quality marker. Looking ahead, the company plans to expand to 100 stores over the next five years, while continuing to drive the majority of its sales through online channels.

Even established players are optimistic about the domestic market. Paragon Footwear, which produces around 400,000 pairs daily and 140 million pairs annually, has expanded its portfolio to include lifestyle-driven and performance-oriented products. Its sub-brand Stimulus (launched in 2012) targets a slightly premium audience with functional, comfort-first designs, while Eeken (launched in 2019) focuses on youth-oriented, activewear-inspired styles.

“One of the notable advancements in our Eeken brand is dual-density sole technology, which combines two layers to improve both comfort and durability. The outer sole is made from a tough polymer for long-lasting wear and grip, while the inner layer uses a softer compound for cushioning and shock absorption,” said Sachin Joseph, EVP – Marketing and IT, Paragon Footwear.

He highlighted that this design is achieved through precision injection molding, allowing seamless fusion and ergonomic shaping. The company also uses modern CAD/CAM tools and proprietary ISO-certified polymers to optimise arch support and reduce foot fatigue.

| “Unlike previous generations, Gen Z exhibits low brand loyalty, prioritising relevance and trend alignment over legacy labels. While price remains a critical factor, today’s consumers expect more, be it enhanced performance, elevated design or a stronger emotional connect, for the same value.” Shirish Srivastava, Sourcing Leader |

Paragon products are available across e-commerce and quick-commerce platforms. On the retail side, the company operates 72 EBOs, with presence in Tier-2 and Tier-3 cities. “We plan to open 100 new EBOs by March 2026, focusing on emerging urban centres and Tier-2/Tier-3 cities in line with demand for branded footwear,” added Sachin Joseph.

This appetite for growth and experimentation is echoed by global players expanding into India.

AstorMueller AG, the Switzerland based European footwear major that manages brands like bugatti, TT.BAGATT and Salamander has announced the formation of its Indian joint venture, nuvora in partnership with Gaurik Group, which is into premium retail sector operating exclusive outlets for several international brands across the country.

nuvora intends to open 10–12 bugatti brand stores this fiscal year and use a multi-channel strategy to target the top 20 cities in India through both online and offline channels.

“Our brand partners, bugatti and TT.BAGATT, already leverage AI and 3D printing to streamline development cycles, reduce lead times and elevate product performance. On the retail front, we’re looking at Augmented Reality and Virtual Try-ons to create more immersive, frictionless experiences for our online customers,” said Sandip Baksi, CEO, nuvora Retail Pvt. Ltd.

He mentioned that bugatti continues to introduce features aimed at improving comfort and durability, including Flex City, a flexible and abrasion-resistant sole; Genial Light, a high-grade outsole material that reduces weight; Ultimate Comfort, a soft footbed designed to maintain its shape over time; and the Genial Insole, developed for shock absorption and walking ease.

Looking ahead, Sandip said that the company aims to expand to the top 25-30 cities in India, targeting 20-25 new bugatti stores this fiscal year. It also plans to leverage its manufacturing presence in India for exports to nearby markets. The company recently launched its first store in Bangladesh and is exploring other geographies across South Asia.

| “We launched Blinc that features our proprietary SpringEase™ technology, an innovative hands-free mechanism that truly redefines ease of wear. Combined with elastic quick-wear laces, this system allows users to effortlessly slip in and out of the shoes without bending down or using their hands.” Ahmad Hushsham, Co-founder, Yoho Footwear |

INDIA’S FOOTWEAR STORYLeather rules India: Global rank: Affordable imports: Per capita footwear: |

Footwear Makers Embrace BIS Standards

To strengthen domestic footwear manufacturing, the Indian government now mandates BIS certification for 27 types of shoes, whether made locally or imported.

BIS certification is part of India’s Quality Control Orders (QCO), and having the ISI mark is legally required. The process involves submitting an application, getting the factory audited, testing the products in recognised labs and then receiving the license.

The Ministry of Commerce and Industry first notified this rule in 2020. After a few extensions, it became mandatory for large and medium-sized companies from July 2023, while smaller businesses had until August 2024 to comply.

For foreign brands, this is done through the Foreign Manufacturers Certification Scheme (FMCS). They must appoint an Authorised Indian Representative (AIR) to liaise with BIS locally. The process includes a factory visit by BIS officials, product testing in India and giving the AIR a power of attorney to act on behalf of the brand. Applications are submitted through the ManakOnline portal under the foreign manufacturer category.

The whole process usually takes 6 to 10 weeks, depending on the product and responsiveness.

Initially, overseas brands struggled to get approvals. The government’s focus on boosting local manufacturing slowed the certification process, which caused shortages in the premium footwear segment.

Executives said the government finally moved because of two main reasons: US criticism of India’s import barriers on American brands and falling premium sales due to supply shortages.

Nike, which relies heavily on imports for India, had repeatedly requested BIS approval for its global suppliers without success. The matter was eventually raised with the US government ahead of Prime Minister Modi’s meeting with President Trump in February, which helped push the approvals through.

| BIS certification is part of India’s Quality Control Orders (QCO), and having the ISI mark is legally required. The process involves submitting an application, getting the factory audited, testing the products in recognised labs and then receiving the license. |

So, how has been the overall impact of BIS on the industry? Industry reactions have largely been positive. Experts acknowledge that BIS compliance adds time and cost, from lab testing to working with certified partners. There’s also the added layer of coordination across geographies, which can sometimes impact timelines and flexibility in sourcing. But they say, in the long run, it helps formalise the industry and improves product quality and brand trust.

| “Our primary audience likes to look sharp and edgy in formals as well as smart casuals. While demand is strong in larger cities like Delhi, Hyderabad, Mumbai, Kolkata and Bengaluru, Tier-2 cities such as Pune, Chandigarh, Ambala, Lucknow and Indore are also showing growing interest in contemporary styles.” Amol Goel, CEO and Founder, Louis Stitch |

Sandip Baksi pointed out that the transition to BIS certification has been smoother.

AstorMueller group produces nearly 7 million pairs annually and retails them in over 40 countries. Majority of this production takes place in India.

“In fact, over the past two decades, our model has largely been ‘Make in India, Sell in Europe’. And since the implementation of the BIS norms, the share of footwear sourced from India has increased and is set to go up further. Our long-standing relationships with local vendors, many of whom were already operating at high standards allowed us to stay compliant without major disruption,” said Sandeep.

Echoing the sentiments, Sachin Joseph mentioned, “At Paragon, we have always been quality-conscious. Many standards later prescribed under BIS were already part of our processes. The certification simply helped formalise what we were already doing and strengthened our commitment to delivering reliable, high-quality footwear.”

| “We took a modern approach to the nostalgic canvas shoes, infusing them with fresh design elements while maintaining the comfort and durability our customers expect. Earlier this year, we introduced Ludic Sliders, which marked a new milestone for us.” Ishit Jethwa, Founder, Ludic |

Likewise, Gautam Mehra, MD, Lenier Shoes, which manufactures 1.5 million pairs annually, described BIS as a positive push for Indian manufacturing. “I think the introduction of BIS is positive for the Indian manufacturing sector and also pushes us to ensure we meet the quality standards requested,” he said. Lenier makes a wide range of footwear including shoes, boots, sandals, slippers, wedges and sneakers for women. With factories in Noida and Agra, its products are exported to premium brands and retailers across Australia, Europe, Asia and the US, while also selling under its own brand, Vanilla Moon.

“India was highly dependent on imports, especially from China, but now domestic manufacturing, particularly in EVA and PVC footwear, has grown tremendously,” said Vaibhav Dalmiya, Director, Palya Footwear. The company has an annual capacity of 9.6 million pairs, serving mainly the domestic market with some exports to the Middle East.

“Around 40% of our total orders are for sneakers, a segment that has nearly doubled in volume over the past two to three years. BIS has helped raise quality benchmarks for Indian footwear manufacturers. While it brings operational challenges, especially for smaller suppliers, it also differentiates organised players like us who already follow strict quality protocols,” mentioned Varun Budhiraja, Director, Roger Industries. The company currently has an annual production capacity of about 2 million pairs and is setting up a new unit for non-leather footwear with an additional capacity of 1 million pairs per year.

Domestic brands echoed similar views. Ahmad Hushsham of Yoho Footwear, said the mandate has pushed his company almost entirely towards local sourcing. “Earlier, certain components came from abroad, but over the last 12 to 18 months, we’ve built strong vendor relationships locally. It helps reduce lead times and gives better control over quality and compliance. We have more than five factories working exclusively with us and plan to expand further,” he said.

Ahmad noted, “Indian manufacturing has really stepped up, especially for EVA, TPR and fabric-based footwear.”

Manufacturers are also continually looking to stay ahead of the curve and upgrade themselves with new innovations. For instance, footwear major Bata India has modernised its Bata Nagar facility in Kolkata by installing the state-of-the-art DESMA-PUDIP (Polyurethane Direct Injection Process) system to improve production speed, consistency and product quality. Developed by global footwear tech leader DESMA, the new set-up brings robotic automation to the factory floor, including direct soling, spray and roughening arms and automated mould handling.

Stricter rules in foreign markets are also forcing footwear manufacturers to improve their standards, particularly concerning chemical compliance, social and labour compliance and quality management frameworks within the global supply chain.

| “The EU’s REACH regulation and the expanding list of substances of very high concern (SVHCs) are key areas requiring attention. This is prompting a more holistic, digital-first approach to supply chain data collection and management, where brands must ensure traceability and transparency from Tier-1 to Tier-3 and beyond.” Akhil Sivanandan, CEO and Co-founder, Green Story |

For instance, in the European Union, the implementation of the General Product Safety Regulation (GPSR), which has been effective since December 2024, places a legal obligation on brands to carry out detailed product risk assessments before launching products in the market. These assessments must evaluate not only safety and performance but also the presence of restricted substances in finished products.

In addition, the recent adoption of the Digital Product Passport (DPP) under Regulation (EU) 2024/1781, signifies a major shift in regulatory expectations.

| The recent adoption of the Digital Product Passport (DPP) under Regulation (EU) 2024/1781, signifies a major shift in regulatory expectations. |

“The DPP rollout will occur in phases. By February 2027, the first major implementation will involve a battery passport, requiring full disclosure of product information to consumers, regulatory bodies and third parties. By 2030, the DPP will be broadly mandated across various product categories, including textiles and footwear,” said P. Venkatesan, Global PPE and Leather/ Footwear Manager, SGS, a testing, inspection and certification company.

In the United States, California Proposition 65 continues to be a major compliance concern, requiring companies to warn consumers about products that contain chemicals known to cause cancer, birth defects or other reproductive harm. More recently, heightened attention has been placed on PFAS (per- and polyfluoroalkyl substances) and VOCs (volatile organic compounds).

“The EU’s REACH regulation and the expanding list of substances of very high concern (SVHCs) are key areas requiring attention. This is prompting a more holistic, digital-first approach to supply chain data collection and management, where brands must ensure traceability and transparency from Tier-1 to Tier-3 and beyond,” stressed Akhil Sivanandan, CEO and Co-founder, Green Story, a sustainability intelligence platform exclusively for the apparel, accessories and textiles industry.

Export Hubs Sweat as US Tariffs Bite

India’s footwear exporters entered FY ’25 with plenty of optimism. Exports of leather, non-leather footwear and leather products grew by nearly 25% year-on-year, touching US $ 5.7 billion. The US remained the top buyer, accounting for almost US $ 957 million, about one-fifth of all shipments, followed by the UK and Germany. Yet, even as exporters were celebrating this momentum, the US tariff shock has forced the sector back into firefighting mode.

The tremors are being felt most visibly in footwear hubs such as Chennai, Ranipet, Ambur, Mumbai, Kanpur, Jalandhar, Agra, Delhi, Karnal, Ludhiana, Sonepat, Faridabad, Pune, Kolkata, Calicut and Ernakulam. About 1.10 million are engaged in the footwear manufacturing industry.

For instance, Agra alone hosts around 10,000 micro-units, 150 small industries, 30 medium-scale factories and about 15 large exporters. For many of them, the US was the prize they had worked years to crack. Now, with tariffs adding an extra cost burden, thin margins have turned unsustainable overnight. Buyers who had only just started placing larger, more consistent orders are again scouting Vietnam, Indonesia or Cambodia, countries cushioned by more favourable trade agreements.

Down south, Tamil Nadu tells a different but equally complicated story. The state has positioned itself as India’s non-leather powerhouse. It’s also the country’s largest exporter of leather, leather goods and footwear, accounting for about 40% of the total exports.

Investors find Tamil Nadu attractive because of factors like available land, skilled workers and steady government policies. What was once an industry concentrated in the north is now spreading across the state, with companies setting up in western and central districts as well. Walkaroo has a unit in Coimbatore, Feng Tay is expanding beyond Cheyyar into Bargur and Tindivanam, and Kothari Evervan is anchoring a footwear park in Perambalur.

According to the Central Footwear Training Institute (CFTI), nearly Rs. 12,100 crore will be invested in Tamil Nadu’s non-leather footwear sector over the next 2-4 years. This is expected to generate 1.35 lakh shopfloor jobs and another 3,000 managerial roles. Much of this is being driven by Taiwanese majors, who have quietly made the state their new home base.

For instance, JR One Footwear, a joint venture between Phoenix Kothari and Taiwan’s Shoetown (Nike’s largest contract manufacturer), has committed Rs. 2,890 crore (US $ 330 million) in Perambalur to manufacture Crocs. Phase-1 is already operational and Phase-2 is under construction. At full scale, the unit will employ 29,000 workers.

Hong Fu Industrial Group is investing Rs. 2,500 crore (US $ 286 million) in Ranipet to produce for Nike, Puma and Converse. Operations are scheduled to start by April 2026, with an eventual workforce of 42,000.

Whereas, High Glory Footwear (a subsidiary of Pou Chen Corporation) is setting up a Rs. 2,300 crore (US $ 263 million) facility at Ulundurpet to manufacture for Nike, Adidas, Asics, New Balance, Timberland and Salomon. This plant is slated to begin production by December 2025 and will employ 20,000 people.

Tata International continues to export for the likes of Clarks, H&M, Zara and M&S from its three facilities.

25%Exports of leather, non-leather footwear and leather products grew by nearly 25% year-on-year, touching US $ 5.7 billion. The US remained the top buyer, accounting for almost US $ 957 million, followed by the UK and Germany. Yet, even as exporters were celebrating this momentum, the US tariff shock has forced the sector back into firefighting mode. |

Indian players are also raising their game. Chennai-based Kothari Industrial Corporation Ltd. (KICL), the main company of the D C Kothari group, has bought the footwear brands Zodiz and Jeetlo for an undisclosed amount. With this move, the company is expanding further into the mass-market footwear segment.

As of now, manufacturers are not rethinking their India plans and will continue to stay invested, at least for now.

Meanwhile, what the industry needs immediately is breathing space. Tamil Nadu’s Chief Minister has already urged the Centre to fix the inverted GST duty structure in the man-made fibre chain, bringing the entire chain under a 5% slab. Exempting import duty on all cotton varieties would also ease input costs. Beyond GST, the industry is pressing for an extension of collateral-free loans under the ECLGS — up to 30% with a 5% interest subvention and a two-year moratorium. Enhancing RoDTEP benefits to 5% and extending pre- and post-shipment credit to all textile and footwear exports would give exporters much-needed working capital relief.

Experts said the government should start a PLI (production-linked incentive) scheme for the materials needed to make high-quality shoes, since India does not produce key items like outsole moulds, glue, EVA (ethylene vinyl acetate) granules and TPU films.

Trade agreements remain the other critical lever. The India-UK FTA is expected to be implemented next year and the long-awaited India-EU FTA is expected to be signed by the year-end. Quick implementation of both could dramatically change the competitiveness equation for exporters, especially in premium segments where European buyers are looking for alternatives to China. Beyond these, India should aggressively pursue new FTAs with Russia, Latin American countries like Chile and Peru, New Zealand and key Middle Eastern markets, all of which represent under-tapped opportunities for diversification.

The bottom line is the overall demand for sneakers will remain strong in the long-term. The global market was worth around US $ 94 billion in 2024 and is expected to grow to about US $ 158 billion by 2033, expanding at roughly 5.3% per year.

At the same time, let’s not lose sight of the domestic market. Despite being the second largest manufacturer of footwear, nearly 95% of India’s footwear output is consumed domestically. Consumers at home are trading up, spending more on quality and branded footwear. For manufacturers, investing in design, comfort engineering and branding for domestic buyers could provide the cushion against volatile export cycles.