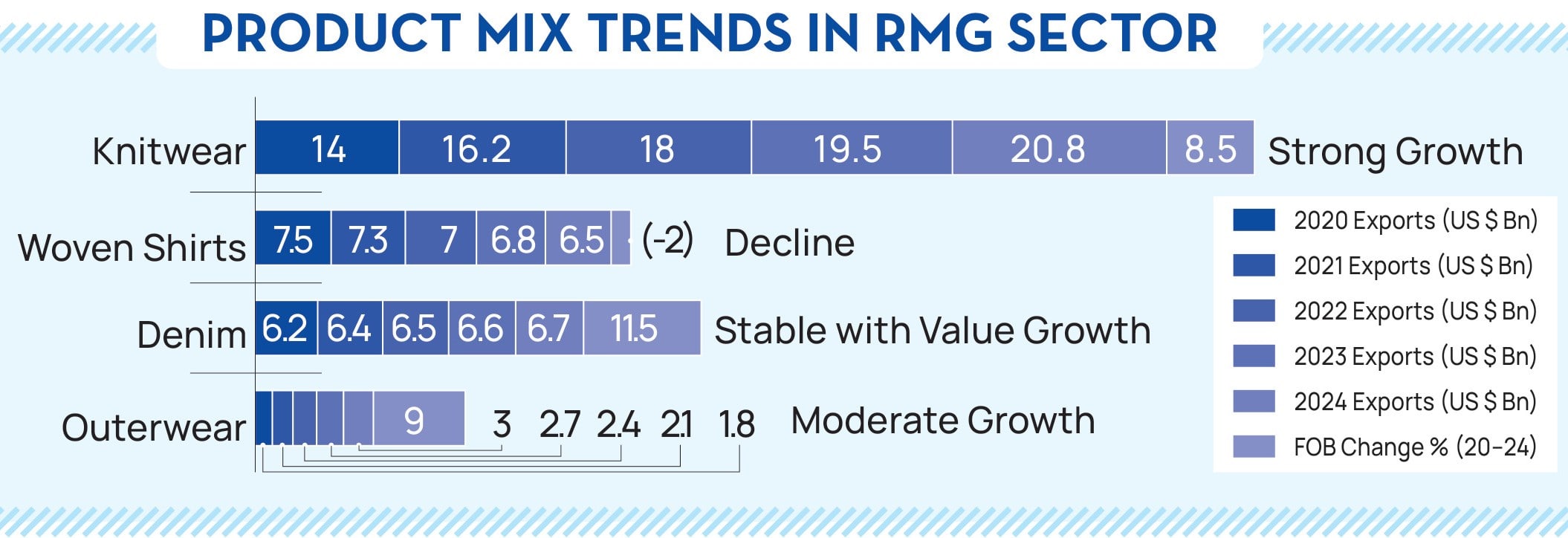

Bangladesh’s RMG industry is going through a rapid change and so is the composition of its product mix. For instance, between 2020 and 2024, global sourcing trends have been reshaped by stringent sustainability laws, changing consumer tastes, faster turnaround time and the supply chain shake-up after President Trump assumed office. One clear sign of change is the dip in woven shirt and blouse exports, which fell 8% in FY 2023–24. This points to a drop in demand or increased competition in that category. Looking at the overall picture, Bangladesh earned US $ 38.48 billion from garment exports in 2023, which was a 7.23% increase from 2022. However, in FY ’24, the earnings fell to US $ 36.13 billion, showing that the industry is now facing tougher conditions and weaker global demand.

Meanwhile, FOB prices are shifting in telling ways across key apparel categories and the trends speak volumes about where the industry is headed. Knitwear, once a consistent growth driver, has dipped by 5.4%, a sign that the market for basic styles is nearing saturation. To stay competitive, manufacturers must pivot toward higher-value knit options such as sustainable fabrics and performance-driven designs.

In the woven segment, the picture is equally clear: shirts and blouses have seen an 8% decline, reflecting the ongoing fade in formalwear demand.

The future lies in smart casuals and stretch wovens that cater to today’s hybrid lifestyles. On a more positive note, outerwear is showing promise with an estimated 8% growth driven by demand for functional, seasonless styles. This is an area ripe for innovation, where upgrading technical capabilities could unlock better margins.

But zooming out, the larger story is sobering: a US $ 2 billion+ dip in exports underscores a sector-wide slowdown. The path forward is clear – brands and manufacturers must shift from chasing volumes to delivering value through shorter lead times, sharper design and constant innovation.

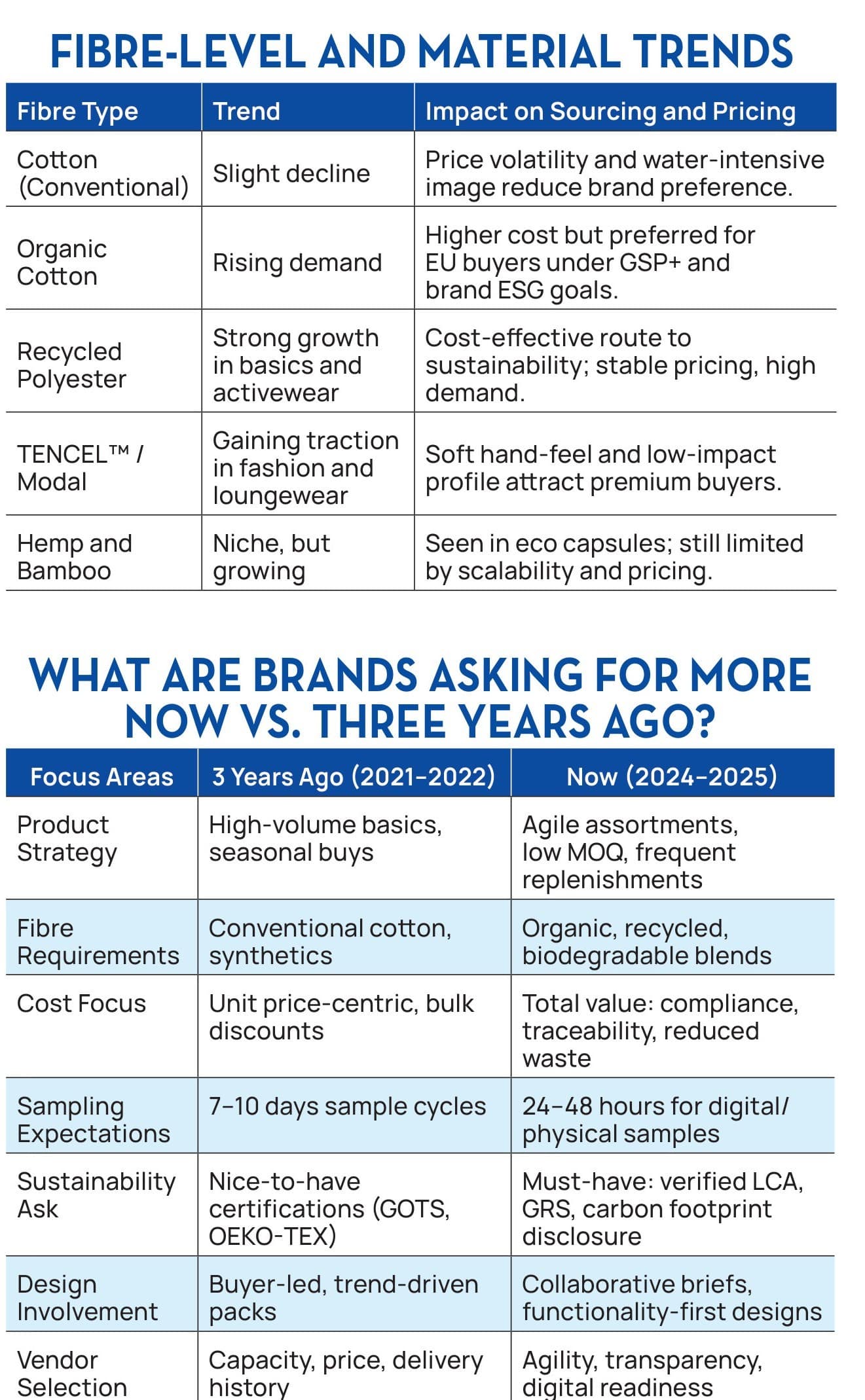

Today, the type of fibre used plays a bigger role than ever in how sourcing and pricing decisions are made. Buyers are now willing to pay higher prices for materials that come with traceability and sustainability certifications. Because of this shift, factories need to diversify their yarn sources and build flexible material plans to handle RFQs that ask for different fibre blends. It’s no longer just about finding the lowest cost per kg, pricing strategies must now reflect the added value of sustainable and certified materials. Lead times have become much shorter across most product categories, reduced by 15–25% since 2021.

At the same time, buyers now expect quick and agile sampling, with tech pack reviews, digital samples or photo approvals to be done within 24 to 72 hours. To meet these demands, top-performing factories are setting up fast-track sample lines and using in-house CAD or 3D sampling tools to speed up the process.